2014 Gmc Sierra 1500 Base on 2040-cars

6000 S 36th St, Fort Smith, Arkansas, United States

Engine:4.3L V6 12V GDI OHV

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1GTN1TEH1EZ314794

Stock Num: 14522

Make: GMC

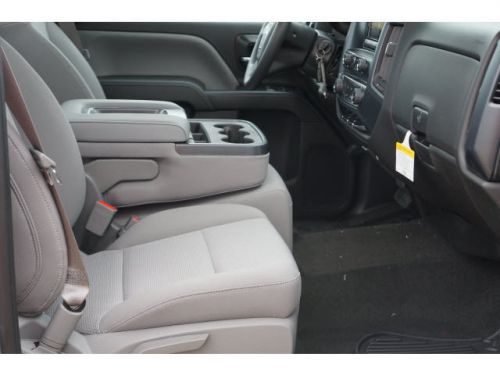

Model: Sierra 1500 Base

Year: 2014

Exterior Color: Quicksilver Metallic

Interior Color: Jet Black

Options: Drive Type: RWD

Number of Doors: 2 Doors

Mileage: 12

Shopping with the VIP department gives you VIP Pricing! Haggle-free pricing means a pleasant experience for all of us. Call/text 888-231-6584 to speak with Jackie, Alyssa, James or Jon. We price low and fair, allowing us to focus on your needs. Shopping with the VIP department gives you VIP Pricing! Haggle-free pricing means a pleasant experience for all of us. Call/text 888-231-6584 to speak with Jackie, Alyssa, James or Jon. We price low and fair, allowing us to focus on your needs. June Rebates: $1500 off Acadia and Enclave, $1000 off 14 Lacrosse and 14 Regal. Huge discounts on all trucks! 2015 Yukons and 2500's in stock.

GMC Sierra 1500 for Sale

2014 gmc sierra 1500 base(US $28,065.00)

2014 gmc sierra 1500 base(US $28,065.00) 2014 gmc sierra 1500 base(US $32,065.00)

2014 gmc sierra 1500 base(US $32,065.00) 2014 gmc sierra 1500 base(US $37,140.00)

2014 gmc sierra 1500 base(US $37,140.00) 2014 gmc sierra 1500 slt(US $48,620.00)

2014 gmc sierra 1500 slt(US $48,620.00) 2014 gmc sierra 1500 slt(US $49,930.00)

2014 gmc sierra 1500 slt(US $49,930.00) 2014 gmc sierra 1500 base(US $27,270.00)

2014 gmc sierra 1500 base(US $27,270.00)

Auto Services in Arkansas

Winchester Tire & Alignment ★★★★★

Texarkana Glass Co ★★★★★

Steve Landers Chrysler Dodge Jeep ★★★★★

Seeburg Muffler & Brake ★★★★★

Precision Tune Auto Care ★★★★★

Jones Tire & Service ★★★★★

Auto blog

Chevy Silverado edges Ram 1500 in Consumer Reports two-truck shootout

Tue, 17 Sep 2013Forget Corvette versus Viper. When it comes to important head-to-head comparisons, fullsize trucks are where domestic automakers really care. And until the redesigned Ford F-150 makes its debut, the Chevrolet Silverado is going to have plenty to brag about thanks to a new Consumer Reports shootout against the Ram 1500.

It was a tight race among these V8-powered titans, but the all-new 2014 Silverado (and its GMC Sierra twin) barely edged out Ram's updated pickup with a score of 81 points - enough to make it the institute's top-rated fullsize truck on the market. Its narrow victory over the Ram, which finished just three points back, was due to its superior fuel economy, better towing and payload capacity and conveniences like a lower step-in height, easy-to-use tailgate and rear bumper steps that make loading and unloading less of a chore.

Importantly, CR notes that buyers with less heavy-duty truck needs might actually prefer the Ram over the Chevrolet, since its high points include a smoother ride thanks to its coil spring rear suspension, dominant infotainment system with Uconnect, and a big thumbs up for the available Hemi engine and eight-speed automatic transmission.

Best car infotainment systems: From UConnect to MBUX, these are our favorites

Sun, Jan 7 2024Declaring one infotainment system the best over any other is an inherently subjective matter. You can look at quantitative testing for things like input response time and various screen load times, but ask a room full of people that have tried all car infotainment systems what their favorite is, and youíre likely to get a lot of different responses. For the most part, the various infotainment systems available all share a similar purpose. They aim to help the driver get where they're going with navigation, play their favorite tunes via all sorts of media playback options and allow folks to stay connected with others via phone connectivity. Of course, most go way beyond the basics these days and offer features like streaming services, in-car performance data and much more. Unique features are aplenty when you start diving through menus, but how they go about their most important tasks vary widely. Some of our editors prefer systems that are exclusively touch-based and chock full of boundary-pushing features. Others may prefer a back-to-basics non-touch system that is navigable via a scroll wheel. You can compare it to the phone operating system wars. Just like some prefer Android phones over iPhones, we all have our own opinions for what makes up the best infotainment interface. All that said, our combined experience tells us that a number of infotainment systems are at least better than the rest. We¬íve narrowed it down to five total systems in their own subcategories that stand out to us. Read on below to see our picks, and feel free to make your own arguments in the comments. Best infotainment overall: UConnect 5, various Stellantis products Ram 1500 Uconnect Infotainment System Review If there¬ís one infotainment system that all of us agree is excellent, it¬ís UConnect. It has numerous qualities that make it great, but above all else, UConnect is simple and straightforward to use. Ease of operation is one of the most (if not the single most) vital parts of any infotainment system interface. If you¬íre expected to be able to tap away on a touchscreen while driving and still pay attention to the road, a complex infotainment system is going to remove your attention from the number one task at hand: driving. UConnect uses a simple interface that puts all of your key functions in a clearly-represented row on the bottom of the screen. Tap any of them, and it instantly pulls up that menu.

GM recalls Chevy Express, GMC Savana over rollaway concern

Mon, 21 Jan 2013The National Highway Traffic Safety Administration has issued a recall notice for a small number of General Motors fullsize vans due to possible rollaway concerns. On certain 2013 Chevrolet Express and 2013 GMC Savana models, it is possible to remove the key from the ignition without the shifter being in park.

Only 980 total units are being affected by this recall, and GM is fixing the issue by replacing the ignition cylinder and associated keys. Affected Chevy vans were built during most of November and December while its GMC counterpart was only built for a week in November. The recall goes into effect on January 23, and to find out if your vehicle applies to the recall, the GM and NHTSA contact numbers can be found on the official recall notice, which is posted below.