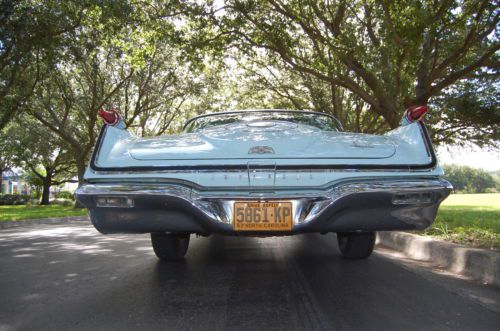

1962 Chrysler Imperial Crown 68k Original Miles Rare Highly Optioned Ac Ps Pb V8 on 2040-cars

Sarasota, Florida, United States

Body Type:Sedan

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Used

Year: 1962

Make: Chrysler

Model: Imperial

Mileage: 68,800

Exterior Color: Blue

Interior Color: Blue

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 8

Chrysler Imperial for Sale

"good driver" original

"good driver" original Low milage - loaded - 1975 chrysler imperial lebaron 2-door - "one family owned"

Low milage - loaded - 1975 chrysler imperial lebaron 2-door - "one family owned" 1958 chrysler imperial mopar parts car 58

1958 chrysler imperial mopar parts car 58 1965 chrysler imperial base convertible 2-door 6.7l(US $32,500.00)

1965 chrysler imperial base convertible 2-door 6.7l(US $32,500.00) 1981 chrysler imperial base hardtop 2-door 5.2l

1981 chrysler imperial base hardtop 2-door 5.2l 1970 chrysler imperial lebaron hardtop 2-door 7.2l

1970 chrysler imperial lebaron hardtop 2-door 7.2l

Auto Services in Florida

Zip Auto Glass Repair ★★★★★

World Of Auto Tinting Inc ★★★★★

Wilson Bimmer Repair ★★★★★

Willy`s Paint And Body Shop Of Miami Inc ★★★★★

William Wade Auto Repair ★★★★★

Wheel Innovations & Wheel Repair ★★★★★

Auto blog

NHTSA preparing to wallop FCA, automaker 'failed to do its job'

Sat, Jul 4 2015As embattled the National Highway Traffic Safety Administration may be, but that certainly doesn't mean it isn't willing or able to put the smack down on automakers that violate its recall procedures. Following a public hearing on Thursday, the government safety arm is preparing what will likely be some very serious punishments for Fiat Chrysler Automobiles. FCA stands accused of mishandling 23 individual recalls covering some 11 million vehicles since 2013, with NHTSA claiming the Italian-American automaker kept it "in the dark," failing to notify the government of safety defects. Uncle Sam also alleges that FCA failed to notify consumers of important safety notices and didn't provide a steady supply of replacement parts. For these charges, the automaker could be fined up to $35 million per recall, which could mean a maximum of $805 million in fines. FCA could also be forced to buy back the unrepaired vehicles. "We have serious concerns with Fiat Chrysler notifications to owners and to NHTSA about its recalls. In every one of the 23 recalls, we have identified ways in which Fiat Chrysler failed to do its job," Jennifer Timian, the head of the Office of Defects Investigation, said during the FCA hearing, The Detroit News reports. The company also "repeatedly failed to provide NHTSA with other critical information about its recalls, including changes to the vehicles impacted by the recalls and its plans for remedying those vehicles." Fiat Chrysler, for its part, didn't really fight back during its hearing, although Scott Kunselman (shown above during the hearing), the senior vice president of vehicle safety and regulatory affairs at FCA, did tell The News that, "We absolutely had no mis-intent." "The plan is to move forward," Kunselman said, adding that the company has "fallen short," and that "some of the things we've done were sloppy." NHTSA administrator Mark Rosekind told The News that the regulator would issue its sanctions by the end of July, adding that he saw no way that FCA could avoid punishment.

Investors want answers about Marchionne’s final days

Mon, Jul 30 2018The mystery of Sergio Marchionne's surprise death last week continues, with investors now questioning the timeliness of disclosures by the company and family. Bloomberg reports that Italy's market regulator is making a routine check into how Fiat Chrysler handled communications regarding his illness. Fiat Chrysler's stock is down 12 percent in both Italy and on the New York Stock Exchange since the announcement of Marchionne's death. University Hospital Zurich last week issued a statement saying that Marchionne, who died July 25 while recovering from an unspecified should surgery, had been treated for more than a year for a serious illness that it didn't define. Marchionne's family told Reuters the companies hadn't been aware of his health conditions. The Italian business website Lettera 43 reported July 5, and FCA later confirmed, that Marchionne had undergone shoulder surgery in a Swiss hospital. But the company later denied a July 20 report by the website that Fiat Chairman John Elkann planned to meet with company leaders to divide Marchionne's responsibilities. Yet the FCA board indeed met on July 21 and chose Mike Manley, who had formerly overseen the Jeep and Ram brands, to succeed Marchionne as CEO. The company on July 25 published a brief statement acknowledging the former CEO's death. "Unfortunately, what we feared has come to pass. Sergio Marchionne, man and friend, is gone," Elkann said in the statement. Marchionne told no one outside his inner circle — reportedly not even Elkann — that he was seriously ill. His partner, Manuela Battezzato, who works in Fiat's press department, told Bloomberg that Marchionne's family didn't tell the company about his health condition. The famously hard-working CEO, who had quit smoking about a year ago, had also reportedly stopped responding to messages and calls from some advisors since the end of June. People close to him told Bloomberg that Marchionne died from complications following the shoulder surgery, including two cardiac arrests. Image Credit: Ferrari flags hang at half-staff at the Hungarian Grand Prix / Getty Chrysler Fiat Sergio Marchionne

An early gas-electric hybrid was developed by...Exxon?

Tue, Oct 25 2016We're not sure which aspect of Exxon's 1970s-era efforts to develop advanced and electrified powertrains is the most ironic. There's Exxon, that of the Valdez oil spill infamy, being on the leading edge of hybrids and electric vehicles. There's a boat-like Chrysler Cordova getting 27 miles per gallon. And there's the central role a Volkswagen diesel engine plays in that hybrid development. It's all outlined in an article (linked above) by Inside Climate News, and it's an amusing read. Flush with cash and fearing what it thought was peak oil production in the 1970s, Exxon funded a host of new ventures divisions geared to find alternatives to gas-powered powertrains. In the early 1970s, Exxon lured chemist M. Stanley Whittingham to develop what would become a prototype of a lithium-ion rechargeable battery. Then, in the late 1970s, Exxon pioneered the concept of using an alternating-current (AC) motor as part of a gas-electric hybrid vehicle. The company retrofitted a Chrysler Cordova (yes, that's the model Ricardo Montalban used to hawk) with a powertrain that combined 10 Sears Die-Hard car batteries, an alternating current synthesizer (ACS), a 100-horsepower AC motor, and, yes, a four-cylinder 50-horsepower Volkswagen diesel engine. The result was a rather large two-door sedan that got an impressive 27 mpg. And while US automakers didn't see the potential in the early concept, in 1980 Exxon and Toyota began collaborating on a project that would involve retrofitting a Toyota Cressida with a hybrid engine. That car was completed in 1981, and may have been one of the seeds that eventually helped sprout the concept of the Toyota Prius. Soon after rebuilding the Cressida, Exxon would get out of the advanced-powertrain-development business, as oil prices began to fall in the early 1980s, spurring cost-cutting measures. Cry no tears for the Exxon, though, as what's now known as ExxonMobil is the largest US oil company. Related Video: News Source: Inside Climate NewsImage Credit: Spencer Platt/Getty Images Green Read This Chrysler Toyota Electric Hybrid battery

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.037 s, 7945 u