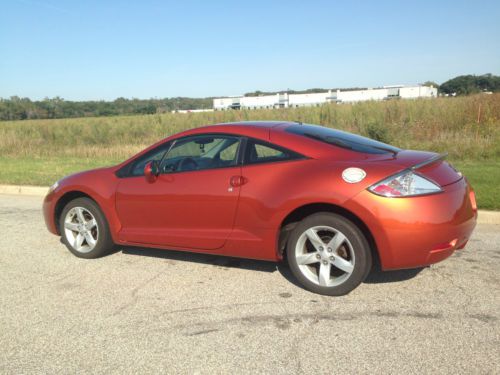

2008 Mitsubishi Eclipse Gs Coupe 2-door 2.4l on 2040-cars

Portage, Indiana, United States

|

A NONSMOKER vehicle. Very clean. The car drives great. It has 169,000 miles on it. It recently had the spark plugs changed, battery replaced, timing belt replaced, 4 new tires bought, and 3 new rims. It has the sun and sound package meaning that there is a automatic moon roof that tilts up as well as slides back. The sound system consists of 6 speakers and a subwoofer in the trunk, SXM ready, and a 6-CD changer--all in great condition. The A/C and heat are in perfect condition. The transmission is automatic with the option of auto-stick shifting. There is a small chip on the passenger side of the front windshield. There is some hail damage on the front hood of the car. There is a crack in the plastic of the passenger side rear view mirror. The Cruise control does not function. 1 of the 4 rims was scratched on a curb.

|

Mitsubishi Eclipse for Sale

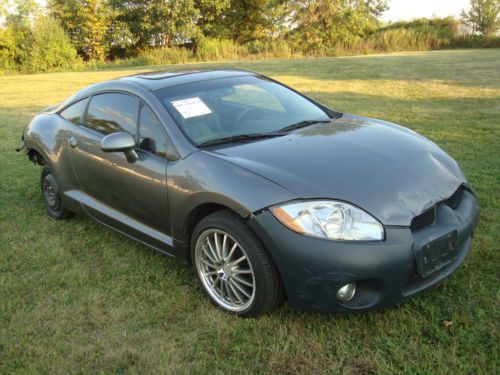

Mitsubishi eclipse salvage rebuildable repairable damaged project wrecked fixer(US $3,495.00)

Mitsubishi eclipse salvage rebuildable repairable damaged project wrecked fixer(US $3,495.00) 2002 mitsubishi eclipse gt coupe 2-door 3.0l(US $3,900.00)

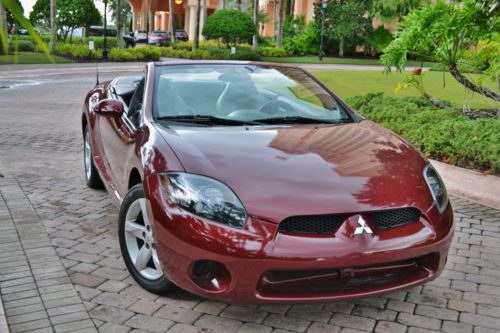

2002 mitsubishi eclipse gt coupe 2-door 3.0l(US $3,900.00) 2007 mitsubishi eclipse spyder only 58k miles! no reserve!!

2007 mitsubishi eclipse spyder only 58k miles! no reserve!! 2009 mitsubishi eclipse gt premium sport leather xenons heated seats sunroof wow(US $14,900.00)

2009 mitsubishi eclipse gt premium sport leather xenons heated seats sunroof wow(US $14,900.00) 2000 mitsubishi eclipse gt hatchback automatic 6 cylinder no reserve

2000 mitsubishi eclipse gt hatchback automatic 6 cylinder no reserve 1994 mitsubishi eclipse 2.4l turbo dsm 1g 6 bolt gst must see(US $6,750.00)

1994 mitsubishi eclipse 2.4l turbo dsm 1g 6 bolt gst must see(US $6,750.00)

Auto Services in Indiana

Westside Auto Parts ★★★★★

Voelkel`s Collision Repair ★★★★★

Tammy`s Towing And Auto Recycling ★★★★★

Superior Auto Center ★★★★★

Sid`s Towing & Recovery ★★★★★

Safeway Auto Repair-Used Tires ★★★★★

Auto blog

Mitsubishi reverses course on European exit with help from partner Renault

Wed, Mar 10 2021Mitsubishi will remain in some European markets after all, a surprise announcement from the company and its alliance partners Renault and Nissan confirmed early Wednesday. This is a reversal of what was expected after several rounds of restructuring were announced in 2020 as the company looked ahead to a $3.4 billion loss. From the announcement, we can gather that Mitsubishi's survival on the continent comes care of its partners, who will supply vehicles that have already been approved for sale in Europe to be offered alongside the Mitsubishi Eclipse Cross plug-in hybrid. The announcement refers to them as "sister models [...] with differentiations," which could mean anything from typical platform-sharing to some old-fashioned badge engineering. Given the company-wide cost-saving efforts, we're inclined to believe it's more along the lines of the latter. "Mitsubishi Motors has decided to procure OEM-model vehicles from Renault, best-sellers on the European market which already meet regulatory requirements, for selected major markets in Europe," the announcement said. "Starting 2023, Mitsubishi Motors will thus sell two 'sister models' produced in Groupe Renault plants, which are based on the same platforms but with differentiations, reflecting the Mitsubishi brand’s DNA." The Alliance has also not yet confirmed which markets will remain open to Mitsubishi, however Automotive News has confirmed that the UK will not be one of them. Mitsubishi has already launched its updated Eclipse Cross lineup, but the forthcoming PHEV has yet to be fully detailed. The company said it has no plans to bring it to the United States, where the Outlander PHEV has moved in only limited volume. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. 2022 Mitsubishi Outlander crossover SUV reveal

Nissan and Carlos Ghosn settle SEC claims over undisclosed compensation

Mon, Sep 23 2019WASHINGTON — Nissan and its former Chief Executive Carlos Ghosn have agreed to settle claims from the U.S. Securities and Exchange Commission over false financial disclosures related to Ghosn's compensation, an SEC statement said on Monday. Nissan will pay $15 million, while Ghosn agreed to a $1 million civil penalty and a 10-year ban from serving as an officer or director of a publicly traded U.S. company, the SEC statement said. Ghosn was arrested in Japan and fired by Nissan last year. He is awaiting trial in Tokyo on financial misconduct charges that he denies. Former Nissan human resources official Gregory Kelly agreed to a $100,000 penalty and a five-year officer and director ban. Nissan, Ghosn, and Kelly settled without admitting or denying the SEC's allegations and findings. The SEC said in total Nissan in its financial disclosures omitted more than $140 million to be paid to Ghosn in retirement — a sum that ultimately was not paid. The SEC also accused Ghosn in a suit filed in New York that he engaged in a scheme to conceal more than $90 million of compensation. That suit is being settled as part of the agreement announced Monday. Nissan confirmed it had settled the allegations and said it "is firmly committed to continuing to further cultivate robust corporate governance." Nissan provided significant cooperation to the SEC, the agency said. The company now has a new governance structure with three statutory committees — audit, compensation and nomination — and has amended its securities reports for all relevant years. The SEC said beginning in 2004 Nissan's board delegated to Ghosn the authority to set individual director and executive compensation levels, including his own. The SEC said "Ghosn and his subordinates, including Kelly, crafted various ways to structure payment of the undisclosed compensation after Ghosn's retirement, such as entering into secret contracts, backdating letters to grant Ghosn interests in Nissan's Long Term Incentive Plan, and changing the calculation of Ghosn's pension allowance to provide more than $50 million in additional benefits." "Investors are entitled to know how, and how much, a company compensates its top executives. Ghosn and Kelly went to great lengths to conceal this information from investors and the market," said Stephanie Avakian, co-director of the SEC's Division of Enforcement.

Renault delays decision on merger with Fiat Chrysler

Wed, Jun 5 2019PARIS — Renault has delayed a decision on whether to merge with Fiat Chrysler Automobiles, a deal that could reshape the global auto industry as carmakers race to make electric and autonomous vehicles for the masses. The deal still looks likely, but faced new criticism Tuesday from Renault's leading union and questions from its Japanese alliance partner Nissan. The French government is also putting conditions on the deal, including job guarantees and an operational headquarters based in France. The French carmaker's board will meet again at the end of the day Wednesday to "continue to study with interest" last week's merger proposal from FCA, Renault said in a statement. A Renault board meeting Tuesday to study the deal was inconclusive. The company didn't explain why, but a French government official said board members don't want to rush into a deal and are seeking agreement on all parts of the potential merger. The official, who spoke on condition of anonymity in line with government policy, told The Associated Press the conditions outlined by France's finance minister still "need to be met." France and Italy are both painting themselves as winners in the deal, which could save both companies 5 billion euros ($5.6 billion) a year. But workers worry a merger could lead to job losses, and analysts warn it could bog down in the challenges of managing such a hulking company across multiple countries. And a possible loser is Japan's Nissan, whose once-mighty alliance with Renault and Mitsubishi is on the rocks since star CEO Carlos Ghosn's arrest in November. Nissan CEO Hiroto Saikawa cast doubt Tuesday on whether his company will be involved in a Renault-Fiat Chrysler merger — and suggested adding Fiat Chrysler to the looser Renault-Nissan-Mitsubishi alliance instead. Saikawa said in a statement that the Renault-Fiat Chrysler deal would "significantly alter" the structure of Nissan's longtime partnership with Renault, and Nissan would analyze its contractual relationships to protect the company's interests. If Renault's board says "yes" to Fiat Chrysler, that would open the way for a non-binding memorandum of understanding to start exclusive merger negotiations. The ensuing process — including consultations with unions, the French government, antitrust authorities and other regulators — would take about a year. A merger would create the world's third-biggest automaker, worth almost $40 billion and producing some 8.7 million vehicles a year.