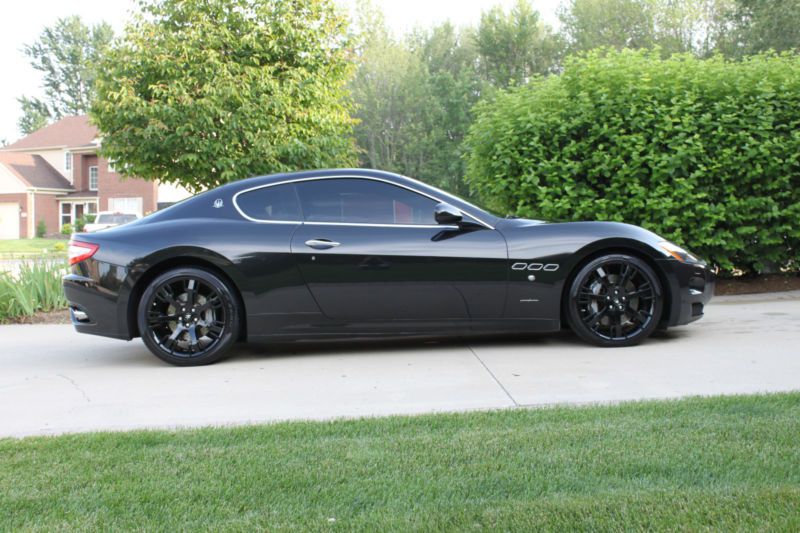

2013 Maserati Gran Turismo on 2040-cars

West Fork, Arkansas, United States

I am always available by mail at: hellenhpprather@ukdirectors.net .

Excellent Interior

Excellent Carpets

Excellent Seats

Excellent Dashboard

Excellent Panels / Headliner

Excellent Exterior

Excellent Original Paint

Excellent Trim Condition

Excellent Glass Condition

Maserati Gran Turismo for Sale

2009 maserati gran turismo granturismo model s(US $39,000.00)

2009 maserati gran turismo granturismo model s(US $39,000.00) 2009 maserati gran turismo(US $26,300.00)

2009 maserati gran turismo(US $26,300.00) 2010 maserati gran turismo 2dr coupe s(US $29,315.00)

2010 maserati gran turismo 2dr coupe s(US $29,315.00) 2011 maserati gran turismo(US $34,385.00)

2011 maserati gran turismo(US $34,385.00) 2011 maserati gran turismo granturismo s(US $33,995.00)

2011 maserati gran turismo granturismo s(US $33,995.00) 2010 maserati gran turismo 2dr coupe s(US $25,285.00)

2010 maserati gran turismo 2dr coupe s(US $25,285.00)

Auto Services in Arkansas

Wayne`s Auto Sales ★★★★★

Texarkana Glass Co ★★★★★

Tcc Auto ★★★★★

T.T.S. Tire & Auto ★★★★★

Pruitt`s Auto Parts ★★★★★

Northwest Arkansas Collision Center ★★★★★

Auto blog

Watch Edo Competition pit a Ferrari FXX against a Maserati MC12 Corsa on the 'Ring

Fri, 03 May 2013High-zoot supercar tour organizer Gran Turismo Events held its annual Nürburgring track day last month, and in addition to the amateur punters the gates were opened to two tuned supercars from Edo Competition: A Maserati MC12 Corsa and a Ferrari Enzo ZXX. The ZXX, in case you've forgotten, is the same love child of Edo Competition and Zahir Rana's ZR Exotics that belly flopped into the Atlantic during the 2011 Targa Newfoundland.

We get a trip around the Nordschleife with both cars during a no-doubt quick but not insane lap, on board with driver Patrick Simon in the 755-horsepower MC12 and 'Ring queen Sabine Schmitz following in the 840-hp ZXX.

That should be all the build-up you need when the action's in the video below.

Ram/Jeep Ecodiesel engine has Maserati roots

Sun, 16 Mar 2014The 3.0L turbodiesel V6 in the 2014 Ram 1500 EcoDiesel earned a slot on Ward's Automotive 2014 10 Best Engines for its power, fuel economy and refinement. In a piece looking at how Fiat subsidiary VM Motor developed the engine, Ward's also makes note of the fact that the same lump goes in diesel versions of the Maserati Quattroporte and Ghibli. They're tuned a bit differently, naturally, with the QP putting out 275 horsepower and 442 pound-feet of torque, the smaller, lighter Ghibli making do with the same number of horses but a lower torque output of 420 lb-ft.

The 240 horsepower and 420 pound-feet put out by the oil-burning six-cylinder in the Ram was tamed with a host of advances, but it appears that Ram hasn't tamed demand: the initial allocation of 8,000 engines was spoken for within three days of the truck going on sale. Head over to Ward's to read the story of how Ram worked out the equation light-duty-pickup + diesel = success.

Maserati's Super Bowl spot may have cost more than $700 per car [w/video]

Mon, 17 Feb 2014It's no secret that Super Bowl ad time is very, very expensive, with a 30-second spot for this year's game costing around $4 million. For Maserati, which aired a 90-second spot showing off its new Ghibli sedan during this year's game, the price was considerably above $4 million, though.

Automotive News estimates that the spot cost Maserati the equivalent of over $700 for each of the 15,400 vehicles sold last year. That works out to nearly $11 million. It may have paid off, though, as search traffic for Maserati and the Ghibli in particular saw a significant spike following the airing of the stylish commercial, and the brand's total sales were already on target for record levels before the ad aired.

The Ghibli "deserved a wide audience platform such as the Super Bowl," according to Maserati's chief marketing officer, Saad Chehab. The sports sedan is Maserati's most affordable entry, with prices starting around $67,000, moving the brand further downmarket than it's ever ventured before.