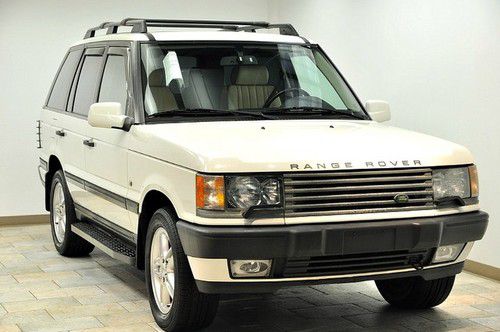

2000 Land Rover Ranger Rover Hse White/tan Low Miles on 2040-cars

Paterson, New Jersey, United States

For Sale By:Dealer

Engine:4.6L 4554CC 278Cu. In. V8 GAS OHV Naturally Aspirated

Body Type:Sport Utility

Transmission:Automatic

Fuel Type:GAS

Cab Type (For Trucks Only): Other

Make: Land Rover

Warranty: Vehicle does NOT have an existing warranty

Model: Range Rover

Trim: HSE Sport Utility 4-Door

Disability Equipped: No

Drive Type: 4WD

Doors: 4

Mileage: 99,594

Drive Train: All Wheel Drive

Sub Model: HSE

Inspection: Vehicle has been inspected

Exterior Color: White

Interior Color: Tan

Number of Cylinders: 8

Land Rover Range Rover for Sale

1995 range rover 4x4

1995 range rover 4x4 2006 range rover hse full size,just serviced,very nice condition,rustfree az!!!!(US $16,995.00)

2006 range rover hse full size,just serviced,very nice condition,rustfree az!!!!(US $16,995.00) Range rover(US $3,400.00)

Range rover(US $3,400.00) Range rover supercharged awd black/black 1-owner/ navigation/ luxury/ heated(US $70,800.00)

Range rover supercharged awd black/black 1-owner/ navigation/ luxury/ heated(US $70,800.00) 2006 supercharged land rover silver/black navigation rear entertainment 20 whls(US $28,995.00)

2006 supercharged land rover silver/black navigation rear entertainment 20 whls(US $28,995.00) 2008 range rover supercharged luxury headrest tv/dvd perfect carfax(US $31,900.00)

2008 range rover supercharged luxury headrest tv/dvd perfect carfax(US $31,900.00)

Auto Services in New Jersey

Xclusive Auto Tunez ★★★★★

Volkswagen Manhattan ★★★★★

Vito`s Towing Inc ★★★★★

Vito`s Towing Inc ★★★★★

Singh Auto World ★★★★★

Reese`s Garage ★★★★★

Auto blog

Jaguar Land Rover building new R&D center for hybrids, EVs, autonomous cars

Wed, 25 Sep 2013The success of Jaguar Land Rover in recent years has largely been down to a resurgent product lineup, but a recent move into the research and development will see the British-based, Indian-owned brands take the fight to its German rivals more aggressively than ever before.

JLR is investing 50 million pounds ($80,345,000, as of this writing) in a joint R&D center in central England. The move will more than triple its staff dedicated to research, from 150 to 500, with Wolfgang Epple, JLR's Director of Research and Technology telling Automotive News Europe, "In order to play among the big animals in automotive and to be anchored in the mind of customers you have to have offered something unique, to be first in market. We want to be one of the key premier automotive manufacturers."

Jaguar Land Rover's 50-million-pound contribution represents more than half of the 94-million-pound tab, on the so-called National Automotive Innovation Campus. Based at Warwick University, Tata's European Technical Center, Warwick Manufacturing Group and the Higher Education Funding Council, an agency of the British government, are all chipping in for the facility.

Jaguar Land Rover opens winter testing facility in Minnesota

Wed, 12 Dec 2012As it begins the rollout of the all-wheel-drive Jaguar XJ and XF models, Jaguar Land Rover has just announced that it has opened a new facility in northern Minnesota for winter testing. Located in International Falls, MN (on the US and Canadian border), the British automaker says it is one of the coldest locations in the Continental US. Jaguar's new Instinctive All Wheel Drive system was developed primarily to help sell more cars in the northern US, so it only makes sense to open a testing area in the US as well.

With temperatures that can drop to minus 55 degrees Fahrenheit, International Falls was chosen to mimic some of the worst weather a Jaguar or Land Rover will ever see. The grounds house testing chambers, various road surfaces and even a frozen lake. This new facility complements the hot-weather testing grounds in Phoenix, AZ.

The official press release is posted below.

Jaguar Land Rover details JustDrive connectivity suite

Tue, 18 Nov 2014

JustDrive will allegedly deliver on the long-promised idea of natural communication between driver and car.

Jaguar Land Rover's all-new InControl system is set to get a big bump as the British company will add a new service called JustDrive, which expands on the smartphone-focused infotainment system by adding a singular voice controller for a wide array of the system's currently available apps.