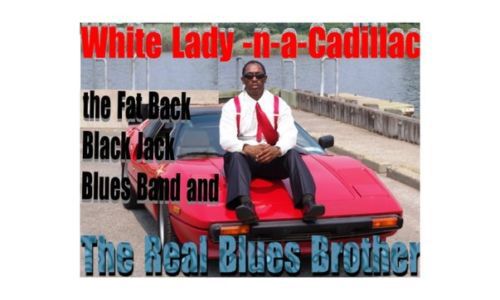

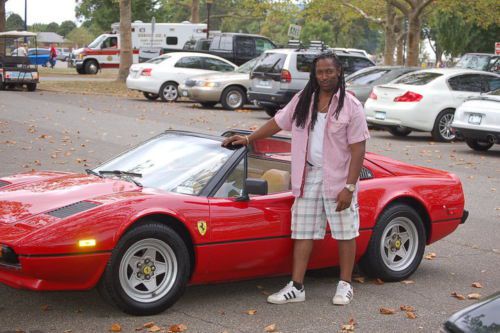

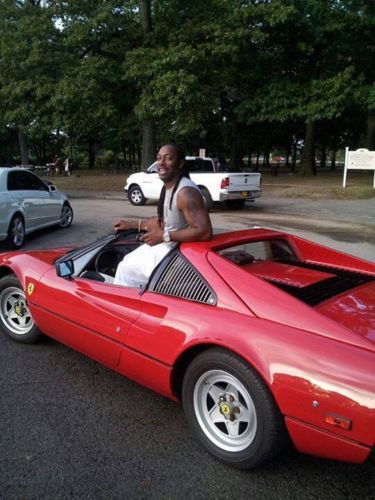

Red Ferrari For Sale Low Miles Retiree Selling All on 2040-cars

Uniondale, New York, United States

|

Great toy to add to any collection

|

Ferrari 308 for Sale

Auto Services in New York

Youngs` Service Station ★★★★★

Whos Papi Tires ★★★★★

Whitney Imports ★★★★★

Wantagh Mitsubishi ★★★★★

Valley Automotive Service ★★★★★

Universal Imports Of Rochester ★★★★★

Auto blog

Mike Tyson's 1995 Ferrari F50 packs one helluva punch

Tue, Feb 21 2017Despite a reputation as a bit of a letdown following the now legendary Ferrari F40, the Ferrari F50 is still one of the most raw and unfettered sports cars to ever grace public roads. RM Sotheby's auctions is now selling a pristine 5,694-mile example that was once owned by former professional boxer Mike Tyson. Like Tyson, the F50 and its Formula One derived V12 is sure to leave a lasting impact on anyone that crosses its path. Though the celebrity tax varies from car to car, Hagerty's valuation tool says even a heavily used F50 is still a million-plus dollar car. RM Sotheby's expects the car to sell for between $2.2 and $2.4 million, slightly more than the $2.25 million estimate for a nearly flawless example, which this car appears to be. According to the listing, the car has never been driven hard and has been well maintained throughout its life. The 1990s weren't Ferrari's best years for design with soft edges and questionable fascias. Likewise, the F50 is a love it or hate it sort of design. The paint appears to be in good condition and free of any damage. The bare carbon fiber and leather interior shows little to no wear. The gated manual shifter connected to a 4.7-liter naturally-aspirated 520 horsepower V12 is a combo that's gone out of vogue. The engine is derived from the one that powered the Alain Prost's 1990 Ferrari 641 Formula One car. This car is number 73 out of 349 and one of only 50 built to US spec. Tyson sold the car with roughly 4,900 miles, with the rest accumulating since about 2005. The car's service records are incomplete, though it has had an a couple of engine-out services along a full electronic updates, a new rear seal, rebuilt oil and water pumps, the dashboard pod removed, serviced, and reinstalled, the lighting system upgraded, the ride height actuator replaced, new tires, new fuel bladders, a full brake system service, and new main seals. In addition, the car comes with two sets of tools in the front deck, owner's manuals and warranty booklet in their leather folio, wheel socket, car cover in bag, both the removable hardtop and emergency soft top with bag, utility light, its window sticker, and the "circus trunk" containing roll bars, and a carbon rear tonneau cover. Look for the car to head across the auction block on Saturday March 11. No Internet bidding, but if you have the cash to pony up the you probably can afford to be there in person. Related Video:

Ferrari SUV officially being considered

Mon, Oct 9 2017A new report from Bloomberg seems to confirm that Ferrari is very seriously looking at creating some type of SUV. The news outlet reports that CEO Sergio Marchionne said the sports car builder will come to a final decision on the crossover in 30 months. This of course means that actual production will be several years off, if it happens at all. He also referred to the hypothetical crossover as an "FUV," which we assume means something like Ferrari Utility Vehicle or Fast Utility Vehicle. We doubt it's something offensive, but Marchionne has been quoted as preferring to be shot than have Ferrari build an SUV. If we had to guess whether Ferrari will build an SUV, we would go with, yes. Both Car Magazine and Bloomberg have reported that the company is in the early development phase of some utility vehicle. Both sources also mention similar details such as the fact that it will be based on the all-wheel-drive GTC4 Lusso platform and that there will be a hybrid powertrain option. Adding an SUV of some sort to the Ferrari line-up could also provide an opportunity to score a healthy number of sales and grow the company. According to Bloomberg, Marchionne said any sales expansion would have to be balanced with maintaining some exclusivity. But even if Ferrari sold just 2,000 units a year, as mentioned in a previous report, that would still be a 25-percent increase over the roughly 8,000 cars Ferrari sold in 2016. That number of vehicles would also keep Ferrari close to the 10,000-vehicle-per-year target Marchionne proposed a couple of years ago. Besides the chance for growth, building a Ferrari SUV would also keep the company in direct competition with other sports car builders planning their own utilities. Aston Martin will begin producing its DBX crossover sometime in 2019 and Lamborghini will reveal its production Urus SUV in December. Related Video: Featured Gallery Ferrari GTC4Lusso T: Paris 2016 View 17 Photos News Source: BloombergImage Credit: Drew Phillips Ferrari Crossover SUV Future Vehicles Performance Sergio Marchionne

Ford GT40 makes historic return to racing at Goodwood

Wed, 23 Oct 2013Is there a more iconic, American racecar than the Ford GT40? That may be a discussion for another day (although by all means, tell us how wrong we are in Comments), but this video of heaps of GT40s running in the Goodwood Revival races certainly has us thinking that Ford's Ferrari-killer might just be the best racer the Land Of The Free and Home Of The Brave has ever come up with.

That's completely ignoring the fact that the GT40 was largely developed by Brits using American money, but that's besides the point (there was also a rather brash Texan, who had a big role later in development). The resulting vehicle was dominant, besting the cars of Il Commendatore from 1966 to 1969, although it should be noted that Ford's GT40 was unable to beat Ferrari in its first two Le Mans outings in 1964 and 1965.

Those four years of dominance, which started with Ford sweeping the podium, were enough to establish the GT40's legend. And now, here we are almost 50 years later, celebrating the mid-engined monsters at Goodwood, in their first ever one-make race. Take a look below for the entire video.

Ferrari 308 gts replica

Ferrari 308 gts replica 1977 ferrari 308 gtb in excellent condition

1977 ferrari 308 gtb in excellent condition 1979 ferrari 308 gts base coupe 2-door 3.0l

1979 ferrari 308 gts base coupe 2-door 3.0l Dino gt-4 74,000 miles

Dino gt-4 74,000 miles 1980 ferrari 308 gtbi - us version

1980 ferrari 308 gtbi - us version 1981 ferrari 308 gtbi red on black leather 2.9l v8

1981 ferrari 308 gtbi red on black leather 2.9l v8