1956 Chevy 3100 Pickup - Restored' Short Narrow on 2040-cars

Jenks, Oklahoma, United States

|

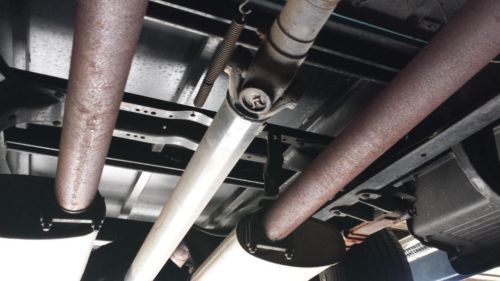

Well Another of my favorite vehicles needs to go to help fund my son's college. 1956 Chevy Short bed P/U SBC 4 speed. Converted to 5 lug all around, front Disc brakes and 9" Ford rear. Complete nut and bolt restoration in 2002 driven about 5k miles and then stored in a warehouse till 2012. Laser straight body nice paint showing minor storage wear and age. Base / clear. No rust anywhere, very clean under side, everything was painted, all new rubber, under dash looks like a new truck! Older American Racing wheels 15x4 front and 15x10 rear with nice BFG radials. New Aluminum radiator with elect fan. New Chrome bumpers and Headlight bezels This is one of the nicest trucks I have ever seen, runs, drives and looks great. Call with questions, fly in drive home. 918-814-1973 $19,995 NO TRADES. |

Chevrolet Other Pickups for Sale

1956 chevrolet stepside pick up-daily driver-hot rod-1955-1957-kustom-apache(US $8,500.00)

1956 chevrolet stepside pick up-daily driver-hot rod-1955-1957-kustom-apache(US $8,500.00) 1951 chevrolet truck 3100 pickup

1951 chevrolet truck 3100 pickup 2006 chevy kodiak 4wd c4500 crew cab 4x4 monroe conversion duramax diesel 64k(US $49,950.00)

2006 chevy kodiak 4wd c4500 crew cab 4x4 monroe conversion duramax diesel 64k(US $49,950.00) Chevy rat rod utility shop truck(US $3,000.00)

Chevy rat rod utility shop truck(US $3,000.00) 1947 international custom street hot rat rod chopped lowered 350 v8 new build

1947 international custom street hot rat rod chopped lowered 350 v8 new build 39 chevy custom rat rod pickup - chopped - suicide - tilt - well built rod(US $13,900.00)

39 chevy custom rat rod pickup - chopped - suicide - tilt - well built rod(US $13,900.00)

Auto Services in Oklahoma

Worlund Collision ★★★★★

Welch Auto Repair ★★★★★

TLC Automotive Inc ★★★★★

Sowers Auto Salvage ★★★★★

Shade Tree Diy Garage ★★★★★

Ruedy`s Auto Shop ★★★★★

Auto blog

Pure Vision Design TT Camaro has 1,400 reasons to want it

Wed, 06 Nov 2013We've talked about Pure Vision Design before, a California-based company that made waves at last year's SEMA show with its Martini-liveried, Indy-car-powered Ford Mustang. That same car later starred in a Petrolicious video we showed you just a few weeks back. The company's latest creation is a menacing car it calls the Pure Vision Design TT Camaro. Based on a 1972 model, this car shares the Martini Mustang's clean styling and obsession with details.

Unlike the Mustang, which draws its power from a mid-60s Lotus-Ford Indycar engine, the "TT" in this Camaro's name implies something far more potent. The Nelson Racing Engines 427-cubic-inch V8 has been fitted with a pair of turbochargers, with a claimed output of 1,400 horsepower. That's almost 1,000 more than the Martini Mustang.

A six-speed Magnum transmission dispatches that power to the ground, while Pirelli PZero tires are tasked with (somehow) trying to grip the road. Baer brakes hide behind those HRE rims, while JRI coilovers and HyperTech springs bless the Camaro with some degree of competency in the bends.

Hertz and GM team up to put 175,000 rental EVs on the road

Tue, Sep 20 2022Hertz and General Motors have announced a significant partnership that will send up to 175,000 electric vehicles into rental fleets across the country. The deal will unfold over the next five years and include vehicles from all GM brands. ¬† The partnership will run through 2027. Hertz estimates that the electric fleet can save as many as 8 billion gasoline-powered miles, removing 1.8 million metric tons of carbon dioxide-equivalent emissions from the air. Hertz says it will invest in becoming the largest renter of EVs in North America and notes that it already has tens of thousands available at 500 locations in 38 states. By the end of 2024, it plans to electrify a quarter of its fleet. Electric rental cars are a great way for travelers wanting to avoid gas, and they make excellent urban commuter cars. Hertz will also likely save a few dollars by avoiding oil changes and other routine maintenance that gas engines need. However, a hidden societal benefit of this deal may come when Hertzís EV rental customers begin shopping for new cars. Many people are skeptical of EVs for various reasons, including range, charging, ease of operation, and cost. Giving people a low-risk introduction to EVs and the ability to test-drive one without a pressuring salesperson could drive more people to electrics. At the same time, there's also the risk that renters wanting to take their Hertz-GM EV on a road trip into sparsely populated areas may return with charging and range-related horror stories. Hertz currently doesn¬ít ask what you¬íre planning to do with your rental, but it does offer a chat service for questions, and range information is presented clearly on each vehicle. Related video: 2023 Cadillac Lyriq walkaround

GM is training more first responders for EV emergencies in the U.S. and Canada

Mon, Jul 4 2022GM is training more first responders to be able to handle emergencies involving electric vehicles. The automaker is "significantly expanding" its EV First Responder Training program in the United States and Canada as electric vehicle sales continue to grow. Its initiative will primarily focus on training firefighters and equipping them with the necessary knowledge about full electric vehicle technologies. GM says it's hoping to dispel misconceptions when it comes to handling EVs in emergency situations. One of those misconceptions is that water is dangerous around EV batteries ó turns out the recommended way to put out lithium-ion battery fires is by using copious amounts of water.¬† Andrew Klock, a senior manager of education and development at the National Fire Protection Association (NFPA), said: "The best way for the public and private vehicle fleet owners to rapidly adopt EVs is to train firefighters and emergency responders on how to handle incidents involving battery powered vehicles. The fire service has had more than 100 years to gain the knowledge needed to respond to internal combustion engine fires, and it is critical that they are now educated on EV safety." The NFPA held trainings of its own that had benefited 300,000 first responders, but it believes more than 800,000 members of the community still need further training.¬†¬† GM previously piloted the program in southeast Michigan, but now it's conducting training events across Michigan and in Fort Worth, Texas, as well. Later this summer, it's bringing the program to metro New York City and Southern California. Participants will have to attend four-hour sessions, with up to two per day, held in various venues, such as fire houses and dealerships. Interested first and second responders can register through the program's dedicated website and earn a certificate from the Illinois Fire Service Institute if they score higher than 70 percent on the learning assessment by the end of their training.¬† The automaker already has a few EV models on the market, including the Chevy Bolts, the GMC Hummer EV and the Cadillac Lyriq. It has huge electrification plans for the future, though, and training responders could help make potential customers more receptive to the idea of switching to electric vehicles. GM aims to launch 30 EV models by 2025 and to exclusively sell EVs ten years after that. Related video: Green Cadillac Chevrolet GM GMC Safety Electric