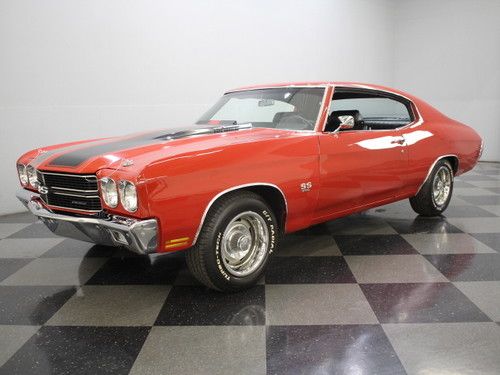

71 Chevelle Ss, 2 Door, Hardtop,v8 on 2040-cars

Benton, Tennessee, United States

Fuel Type:Gasoline

For Sale By:Private Seller

Engine:V8,4 Bbl carb,350,270 HP

Transmission:TH-350

Body Type:2D

Make: Chevrolet

Power Options: Air Conditioning

Model: Chevelle

Trim: SS

Number of Doors: 2

Drive Type: RWD

Interior Color: Green

Mileage: 100,000

Number of Cylinders: 8

Exterior Color: Green

Warranty: Vehicle does NOT have an existing warranty

Vehicle is in dry storage and has been for about 17 years. Was running when put into storage.Has very minimal body damage or rust.Complete SS package with original Wheels and spare. Car has bench seat and I believe the TH-350 transmission. My brother was the third owner and has had the vehicle for 25 years. Made in Texas and always southern driven. Car would have to be removed by seller from drive up accessible location. No allowance for shipping or transport.

Chevrolet Chevelle for Sale

1969 chevelle ss396 like new condition

1969 chevelle ss396 like new condition 1965 ss malibu chevelle no post' 138 car #s' 220hp factory a/c daily driver

1965 ss malibu chevelle no post' 138 car #s' 220hp factory a/c daily driver 1969 chevelle ss convertible frame off restoration

1969 chevelle ss convertible frame off restoration 1969 chevrolet chevelle v8 350 2dr

1969 chevrolet chevelle v8 350 2dr 396 v8, 700r4 automatic, holley double-pumper, edlebrock intake, lots of new par(US $39,995.00)

396 v8, 700r4 automatic, holley double-pumper, edlebrock intake, lots of new par(US $39,995.00) 1972 malibu chevelle

1972 malibu chevelle

Auto Services in Tennessee

White Bluff Car Care Inc ★★★★★

Veach`s Auto Repair ★★★★★

Tune Up & Exhaust Shop ★★★★★

Triple B Automotive ★★★★★

TLC Automotive ★★★★★

Tennessee Clutch & Supply Inc ★★★★★

Auto blog

2014 Chevrolet SS makes its live debut

Sat, 16 Feb 2013Chevrolet showed off the new 2014 SS in an airport hangar last night, its first rear-wheel-drive performance sedan in the US since the Impala SS from 1997. We'll have more to say about the SS later today, but this is the sedan that Chevrolet sees as the final piece in restoring its performance credentials. For those of you looking for a manual transmission, however, that wish will go unfulfilled - at least for now: the only two options buyers will have are the color and whether or not they want a sunroof.

We'll work on getting some more angles (in better light) today at Daytona International Speedway, but with fans seeing the car for the first time, we don't hold out much luck of getting a clear shot. So for now, enjoy the high-res gallery above.

PickupTrucks.com's latest test results in a familiar winner [w/video]

Wed, 19 Jun 2013PickupTrucks.com has gone and thrown the latest batch of half-ton pickups into a cage match to see who would come out on top. The site put the 2014 Chevrolet Silverado 1500, GMC Sierra 1500, 2013 Ford F-150, Ram 1500, Toyota Tundra and Nissan Titan through a battery of tests. Those included 0-60 miles per hour acceleration, 60-0 mph deceleration, fuel economy, a hill climb, and payload and towing. They even threw the rigs on an autocross course to evaluate overall handling. Each truck was given points based on how it scored in each evaluation.

Who came out on top? Somewhat surprisingly, the 2013 Ford F-150 walked away with the gold, though fewer than 50 points separated first and fourth place. Head over to PickupTrucks.com to read the full evaluation and the final results. You may be shocked to see exactly where some of the segment's newest additions placed. You can also watch a video on the test below.

Canada opens probe into 250,000 GM pickups, SUVs over brake performance

Sun, Jun 23 2019Transport Canada, the auto safety regulator, has opened a probe into braking issues in nearly 250,000 General Motors full-size pickups and SUVs after U.S. officials launched a similar probe last year, the agency said on its website. The U.S. National Highway Traffic Safety Administration (NHTSA) in November into 2.73 million U.S. 2014-2016 model year SUVs and pickups after receiving 487 reports of hard brake pedal effort accompanied by extended stopping distance that were attributed to deterioration of the engine-driven brake assist vacuum pump. Transport Canada's probe covers 249,700 2015 through 2017 model year vehicles including the Cadillac Escalade, Chevrolet Suburban, Chevrolet Tahoe and GMC Yukon as well as 2014-2017 Chevrolet Silverado LD and GMC Sierra LD vehicles. The U.S. agency said it had reports of nine incidents of vehicles incurring damage as a result of colliding with another vehicle or fixed object at low speeds and reports of two injuries. NHTSA said if the pump fails to operate, the amount of brake power assist can be significantly reduced, extending vehicle stopping distance. The NHTSA sent GM an information request in a Feb. 7 letter. A GM spokesman said he had no update on the investigation. Reporting by David Shepardson; editing by Jonathan Oatis