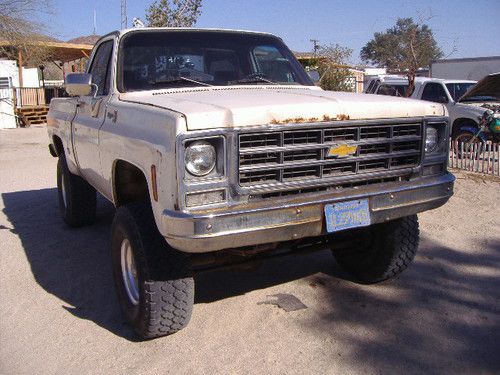

1979 Chevy C-10, 4x4 Short Bed, 3 Speed Automatic on 2040-cars

Fallbrook, California, United States

Body Type:Pickup Truck

Engine:350 V8

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Chevrolet

Model: C-10

Trim: basic

Warranty: Vehicle does NOT have an existing warranty

Drive Type: 4x4

Options: 4-Wheel Drive

Mileage: 113,432

Power Options: power brakes, power steering, Air Conditioning, Power Windows

Sub Model: short bed

Exterior Color: off white

Interior Color: Red

Disability Equipped: No

1979 Chevy C-10, 4x4 short bed, 3 speed automatic. Truck is lifted 4-6 inches and has big tires and wheels with 70% tread.

Tires and wheels cost $1500 when new, and will service you for some time to come. Truck is setup for desert exploration or

back wood's and hunting. It has dual tanks for extended range. I would prefer to sell outside of California because of smog issues.

It has a newer 350 and 4bbl carb, and headers with dual exhaust. Power brakes, windows, steering and air conditioning that is not

hooked up, needs some air parts but the big stuff is there. The radiator and carb just rebuilt along with fuel tanks cleaned and new

sending units. This truck is a beast with lots of power, body has some dings but hey it's for the desert or woods...

These are going up in value and this is a good candidate for a restoration.

Mileage on engine is only 30,000.

Chevrolet C-10 for Sale

1979 chevy truck(US $7,000.00)

1979 chevy truck(US $7,000.00) 68 chevy pickup truck

68 chevy pickup truck 1963 chevy c-10

1963 chevy c-10 1970 chevrolet c-10(US $16,000.00)

1970 chevrolet c-10(US $16,000.00) 1972 chevrolet c-10 cheyenne

1972 chevrolet c-10 cheyenne Nice clean 1969 chevy c-10 automatic

Nice clean 1969 chevy c-10 automatic

Auto Services in California

Young`s Automotive ★★★★★

Yas` Automotive ★★★★★

Wise Tire & Brake Co. Inc. ★★★★★

Wilson Motorsports ★★★★★

White Automotive ★★★★★

Wheeler`s Auto Service ★★★★★

Auto blog

GM tinkering with Silverado, Sierra model mix amidst strong early sales

Mon, 04 Nov 2013Variety, as they say, is the spice of life. That's a lesson that is currently being taught to General Motors, because despite a strong showing from its 2014 Chevrolet Silverado and GMC Sierra, the General's pickup sales still can't best those of cross-town rival Ford.

With 59,163 trucks moved, GM fell just over 1,000 units short of toppling Ford, and one of the main reasons for that, according to GM's chief sales analyst, was due to a lack of variety in the engines and body styles available on dealer lots. "We are still over-weighted toward crew-cab V8 trucks. Our light-duty mix will moderate over time as our launch progresses," said Kurt McNeil.

Loading dealers with the popular combination of the 5.3-liter V8 and the four-door, Crew Cab body style was intentional during the truck's launch, but as supplies of leftover 2013 models, which are being sold at heavy incentives, are beginning to wane, both budget-conscious and high-dollar buyers are looking elsewhere instead of at the volume model pickups.

GM recalls 3.8 million vehicles in North America due to braking issue

Wed, Sep 11 2019WASHINGTON — General Motors Co said Wednesday it was recalling 3.46 million U.S. pickup trucks and SUVs to address a vacuum pump issue that could make braking more difficult and that has been linked to 113 accidents and 13 injuries. The recall covers 2014-2018 model year vehicles, including some Cadillac Escalade, Chevrolet Silverado, Chevrolet Tahoe, GMC Sierra, Chevrolet Suburban and GMC Yukon vehicles. In late June, GM recalled 310,000 vehicles in Canada for the same issue. GM did not immediately explain why the Canadian recall occurred more than two months before it called back the vehicles in the United States. The recall was triggered because the amount of vacuum created by the vacuum pump may decrease over time, GM told the National Highway Traffic Safety Administration (NHTSA) in documents posted on Wednesday. The NHTSA opened a preliminary investigation into the issue last November, and said it had reports of nine related crashes and two injuries. It provided GM in July with additional field reports that prompted the automaker to open an investigation. GM said it could affect braking in "rare circumstances." The NHTSA said in a statement the "vehicles may experience brake boost failure, which would require increased brake pedal effort, leading to a hard brake pedal feel, and potentially increased stopping distance." GM said dealers will reprogram the electronic brake control module to improve how the system utilizes the hydraulic brake boost assist function when vacuum assist is depleted. GM said the vacuum assist pump, which is lubricated with engine oil that flows into the pump through a filter screen, can in some cases lose effectiveness over time, as debris such as oil sludge can accumulate on the filter screen. GM told NHTSA that prior model years used a different brake assist system design, and vehicles manufactured after 2018 were not equipped with the affected pump design. Separately, GM said on Wednesday it is recalling 270,000 additional U.S. vehicles in three smaller recalls, including 177,000 2018 Chevrolet Malibu cars with 1.5L turbo engines because an error in the engine control module software may result in the fuel injectors being disabled.

Seeing the Detroit Auto Show via drone

Sun, Jan 18 2015Seeing the Chevrolet display at the Detroit Auto Show is worth doing this year, and not just because of the new Corvette Z06, Volt and Bolt concept. In order to attract the new kids, The Bowtie has gone what the old kids used to call "buck wild" with their show stand at Cobo Hall. A Corvette Z06, Trax, and Colorado are parked along a central aisle, called Mainstreet, at the end of which is a 20-foot-tall, 73-foot long transparent screen lording over the new Volt. Elsewhere are five more 20-foot-tall screens broadcasting nine stories today's Chevrolet wants to tell about its vehicles, from performance to belief in the power of play to its 4G LTE-equipped OnStar telematics service. Then there are the social media and virtual reality safety installations, the community presentations and more. Chevrolet flew a drone through the stand to show off what it's doing, which is has replaced eye-level video as the next best thing to being there. You can check it out in the video above.