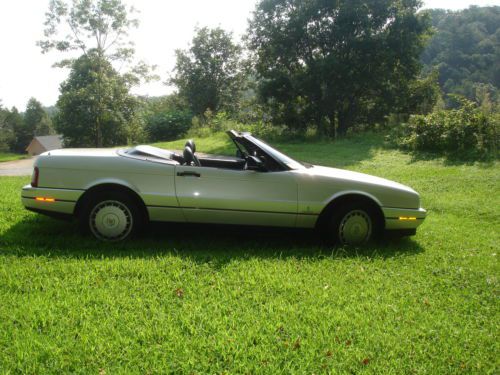

1989 Cadillac Allante Base Convertible 2-door 4.5l on 2040-cars

West Palm Beach, Florida, United States

|

1989 CADILLAC ALLANTE

YOU ARE BIDDING ON A VERY WELL KEPT ALLANTE............... THIS CAR RUNS GREAT........................ LOOKS GREAT................ YOU WILL NOT FIND A NICER ALLANTE FOR THE PRICE THIS CAR DOES COME WITH A REMOVABLE HARD TOP ALL SERVICE IS UP TO DATE, IT ALSO INCLUDES NEW TIRES, NEW WINDOW MOTOR, NEW AIR CONDITION, AND NEW OIL CHANGE. PLEASE CALL FOR MORE INFORMATION. SCOTT 561-577-3890 OR 888-575-0041 ATTENTION: I WILL NOT ENTERTAIN ANYONE OFFERING TO PAY THRU PAYPAL, I WILL NOT ALLOW YOU PEOPLE TRY TO SCAM ME, INCLUDING PEOPLE WHOM SAY THEY ARE OFFSHORE DRILLERS, OR BUYING FOR YOUR FATHERS WHAT EVER IT MAYBE DO NOT CONTACT ME... GO TRY AND SCAM OTHER PEOPLE I'M SMARTER THEN YOU..... |

Cadillac Allante for Sale

Very reliable daily driver

Very reliable daily driver 1991 cadillac allante convertible 4.5l v8 fwd leather 80pics

1991 cadillac allante convertible 4.5l v8 fwd leather 80pics 07 dts extra clean carfax , special edition , florida car call 888-300-7031(US $13,950.00)

07 dts extra clean carfax , special edition , florida car call 888-300-7031(US $13,950.00) 1990.5 cadillac allante convertible - perfect carfax - 59,500 miles - runs great

1990.5 cadillac allante convertible - perfect carfax - 59,500 miles - runs great Stunning "one-of-a-kind" 1993 cadillac allante convertible

Stunning "one-of-a-kind" 1993 cadillac allante convertible 1993 cadillac allante base convertible 2-door 4.6l(US $14,995.00)

1993 cadillac allante base convertible 2-door 4.6l(US $14,995.00)

Auto Services in Florida

Zephyrhills Auto Repair ★★★★★

Yimmy`s Body Shop & Auto Repair ★★★★★

WRD Auto Tints ★★★★★

Wray`s Auto Service Inc ★★★★★

Wheaton`s Service Center ★★★★★

Waltronics Auto Care ★★★★★

Auto blog

GM winding down Chevrolet brand in Europe

Thu, 05 Dec 2013If you've taken even a cursory look at GM's European strategy and wondered how it can target the market there with both Chevrolet and Opel/Vauxhall, you're not alone. In fact General Motors itself has found it difficult to justify the two-pronged approach. That's why it's essentially pulling Chevy from the European marketplace.

Instead of trying to ply European buyers with what are mostly former Daewoo products rebadged as Chevys, GM will now let Opel (or Vauxhall in the UK) represent its mass-market aspirations. Chevrolet will keep its presence in Russia and other former Soviet markets, and will continue selling certain niche products in Eastern and Western Europe. The Corvette, for example, has long been sold in Europe through Cadillac dealerships, which for its part is currently "finalizing plans for expanding in the European market".

While the shift in strategy is expected to help GM get a stronger foothold in the European market in the long run, in the short term the restructuring will cost it dearly: between $700 million and $1 billion, according to its own estimates, split between the last quarter of this year and the first half of the next. Jump into the full press release below for more.

U.S. new-vehicle sales in 2018 rise slightly to 17.27 million [UPDATE]

Thu, Jan 3 2019DETROIT — Sales of new vehicles in the U.S. rose slightly in 2018, defying predictions and highlighting a strong economy. Automakers reported an increase of 0.3 percent over a year ago to 17.27 million vehicles. The increase came despite rising interest rates, a volatile stock market, and rising car and truck prices that pushed some buyers out of the new-vehicle market. Industry analysts and automakers said strong economic fundamentals pushed up sales and should keep them near historic highs in 2019. "Economic conditions in the U.S. are favorable and should continue to be supportive of vehicle sales at or around their current run rate," Ford Chief Economist Emily Kolinski Morris said after the company and other automakers announced their sales numbers Thursday. That auto sales remain near the 2016 record of 17.55 million is a testimonial to the strength of the economy, said Mark Zandi, chief economist at Moody's Analytics. The job market, he said, has created new employment, and wage growth has accelerated. "That's fundamental to selling anything," he said. "If there are lots of jobs and people are getting bigger paychecks, they will buy more." The unemployment rate is 3.7 percent, a 49-year low. The economy is thought to have grown close to 3 percent last year, its best performance in more than a decade. Consumers, the main driver of the economy, are spending freely. The Federal Reserve raised its key interest rate four times in 2018 but is only expected to raise it twice this year. Auto sales also were helped by low gasoline prices and rising home values, Zandi said. It all means that people are likely to keep buying new vehicles this year even as they grow more expensive. The Edmunds.com auto-pricing site estimates that the average new vehicle price hit a record $35,957 in December, about 2 percent higher than the previous year. It will be harder for automakers to keep the sales pace above 17 million because they have been enticing buyers for several years now with low-interest financing and other incentives, Zandi said. He predicts more deals in the coming year as job growth slows and credit tightens for higher-risk buyers. Edmunds, which provides content, including automotive tips and reviews, for distribution by The Associated Press, predicts that sales will drop this year to 16.9 million.

Cadillac CTS Vsport laps the N"urburgring in 8:14.10 [w/video]

Wed, 28 Aug 2013You don't have to be German to test your car at the Nürburging. You just have to be serious about beating the Germans on their own home turf. That's why Nissan tests its GT-R at the Nordschleife to challenge the Porsche 911, and why Cadillac - which is no less serious about putting up a fight to German performance sedans - has returned to the 'Ring once again with its latest.

This time it's the turn of the new CTS Vsport, the sportier version of Cadillac's new mid-range sedan that aims to bridge the gap until the arrival of the next CTS-V. So how'd it fare? At the end of what we're sure was an exhaustive test session, the new CTS Vsport clocked a time of 8:14.10.

To put that into context, General Motors points out that the time places the new sedan six seconds ahead of the first-gen CTS-V, whose 400-horsepower V8 engine was actually less potent than the Vsport's new 410hp 3.6-liter twin-turbo V6. That's still a good fifteen seconds slower than the outgoing CTS-V that clocked a 7:59 in 2009 with its 556hp supercharged V8, but only a second behind the E60-generation BMW M5 with its high-revving 500hp V10.