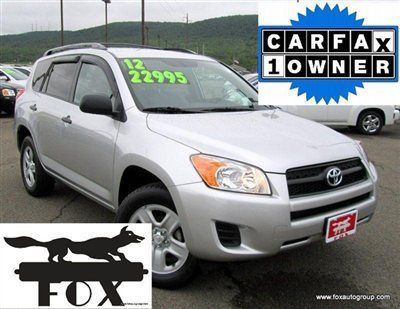

No Reserve Toyota Rav~4 L Ev 13k Miles Sport Utility 4x4 Runner Crv (01 02 03 04 on 2040-cars

Dedham, Massachusetts, United States

Body Type:SUV

Vehicle Title:Clear

Engine:2.0 4CYL

Fuel Type:Gasoline

For Sale By:Dealer

Make: Toyota

Model: RAV4

Trim: 5 DOOR SUV

Options: Cassette Player, 4-Wheel Drive, CD Player, Convertible

Safety Features: Anti-Lock Brakes, Driver Airbag, Side Airbags

Drive Type: AWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 13,850

Sub Model: RAV4~LEV

Exterior Color: Silver

Disability Equipped: No

Interior Color: Blue

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 4

Toyota RAV4 for Sale

Auto Services in Massachusetts

Westgate Tire & Auto Center ★★★★★

Stewie`s Tire & Auto Repair ★★★★★

School Street Garage ★★★★★

Saugus Auto-Craft ★★★★★

Raffia Road Service Center ★★★★★

Quality Auto Care ★★★★★

Auto blog

Toyota promoting Mirai as if hydrogen tax credit never went away

Wed, Jan 28 2015At the end of December, the US federal government let the $8,000 tax credit for hydrogen-powered vehicles expire. Despite this little wrinkle, Toyota is still promoting the upcoming 2016 Mirai fuel cell vehicle as a car that will cost under $50,000. In some cases a lot less, since it may also qualify for a $5,000 incentive in California. The car has a $57,500 MSRP, but Nihar Patel, vice president of North American Business Strategy for Toyota Motor Sales, spoke at the 2015 Washington Auto Show last week, and said that the Mirai could cost $44,500 in California. You can see this in the video at around minute four. Toyota knows that the federal incentives have expired, since the real news from the show was Patel's public request to the federal government that the $8,000 tax credit be extended. "We think that the federal credit expiration last year puts [hydrogen] customers in a fairly disadvantageous postion," he said. Plug-in vehicle buyers can still get up to $7,500 tax credit and, "we believe that this inequity needs to be fixed," he said. You can see this in the video at minute 10:20. Toyota said including both the after-incentives price and the call to reinstate those incentives was intentional since it shows a discrepancy between hydrogen and plug-in vehicles in the eyes of the feds. We asked Toyota's director of Energy and Environmental Research, Technical and Regulatory Affairs, Robert Wimmer, for more details on Toyota's request. "[The Mirai] being a ZEV and battery electrics also being ZEVs, we just want to make the playing field as level as possible," he said, adding that any extension would last "for the run of the vehicle," which would be three years. He admitted that the extension might only be for one or two years, if it happens at all. (A Toyota spokesperson clarified to AutoblogGreen that the Mirai program will not end after three years.) And that's the problem. "The tax process is difficult to predict," he said. "The two challenges we have now are that both houses of Congress are Republican and also that there has been talk for a while about comprehensive tax reform. If that moves forward, then extenders would probably be put on the back burner as comprehensive tax reform is discussed." Wimmer would not reveal any details about how Toyota is pressuring the government to act, only saying that Toyota's has people lobbying up on Capitol Hill.

Toyota investing $200M in Southern manufacturing

Sun, 23 Jun 2013Over the past two years, Toyota has invested more than $2 billion at its North American production facilities, and it apparently doesn't plan on stopping there. To keep up with recent strong sales, Toyota is investing an additional $200 million at its engine plants in the Southern US to increase production capacity of its V6 engines.

The bulk of this money ($150 million) will go to expand Toyota's engine plant in Huntsville, AL, which is currently responsible for supplying engines - four-cylinder, V6 and V8 - to eight of Toyota's 12 domestically produced vehicles. That includes the best-selling Toyota Camry (shown above).

Toyota didn't say exactly what improvements are being made to the plant, but this follows last year's $80 million investment in the plant that is set to be completed by next year raising the engine capacity to 750,000 annual units including 362,000 V6s. The remaining $50 million will go to the casting plants of Toyota-owned Bodine Aluminum in Missouri and Tennessee, which supply engine blocks and cylinder heads to the Huntsville engine plant as well as others in Kentucky and West Virginia. Scroll down below for the official press release.

GM, Ford, Toyota, Stellantis CEOs want EV tax credit cap lifted

Mon, Jun 13 2022For just over a decade now, the U.S. has had a federal tax credit worth up to $7,500 for buyers of electric cars and plug-in hybrids. The catch has been that, once 200,000 of them were claimed for a manufacturer, that credit would be phased out. Now, automakers are asking for this cap to be lifted across the board, specifically General Motors, Ford, Toyota and Stellantis. The request comes in the form of a joint letter to Congress (which you can read here), signed by the CEOs of each company. And the ask really is as simple as that. The automakers would like the cap lifted for all EV manufacturers, and instead have a sunset date for the tax credit put in place. Broadly speaking, they want it lifted because of concerns about rising costs from materials and supply chain issues, which can lead to higher prices and could discourage buyers from getting an EV. It would also put automakers back on an even playing field. GM reached its tax credit cap a few years ago, meaning that none of its EVs are eligible for the tax credit. So while it reaped the benefits early on, it now has something of a disadvantage to competitors with credits remaining, such as those that signed on to this letter. GM wouldn't be the only beneficiary. Tesla ran out of credits years ago, too. Nissan still has credits, but likely not for much longer, as InsideEVs reports around 190,000 Leafs have been sold in the U.S. as of April. So it will probably face a phase-out soon, just as the anticipated, and more expensive, Ariya is heading to market. Making this change would also seem like a good choice for continuing to stimulate EV sales, if that's what the government is looking to do. While EVs are now reaching parity in practicality and performance with gas-powered cars, having an additional financial incentive will surely keep them looking more attractive. And automakers can push EVs without fear of running out of credits early. Certainly some sorts of changes to the EV tax credit are likely. There are bills in the works focusing on cap changes as well as the amount of money available, and which vehicles are eligible. Credits up to $12,500 have been proposed, plus possible credits for used EV sales and restricting some credits to vehicles of certain price brackets. Of course, any changes will require some cooperation in a deeply divided Congress. Related Video: Government/Legal Green Chevrolet Chrysler Ford Toyota Electric EV tax credit

2007 toyota rav4 sport v-6

2007 toyota rav4 sport v-6

2004 toyota rav4, silver, excellent condition, 146k, clean, no smoke/pets rav 4

2004 toyota rav4, silver, excellent condition, 146k, clean, no smoke/pets rav 4 2000 toyota rav4 sport utility 4-door 2.0l, like new

2000 toyota rav4 sport utility 4-door 2.0l, like new 1998 toyota rav4, no reserve

1998 toyota rav4, no reserve 2011 tan!

2011 tan!