2023 Ram 1500 Limited Longhorn Crew Cab 4x4 5'7" Box on 2040-cars

Tomball, Texas, United States

Engine:8 Cylinder Engine

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

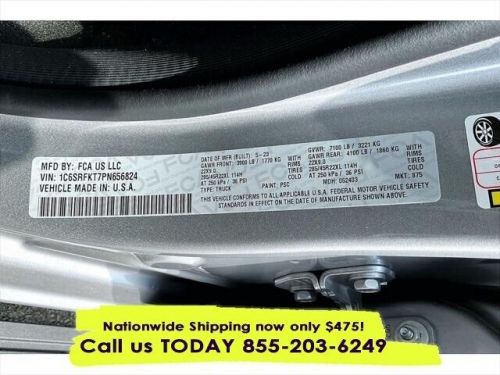

VIN (Vehicle Identification Number): 1C6SRFKT7PN656824

Mileage: 8025

Make: Ram

Trim: Limited Longhorn Crew Cab 4x4 5'7" Box

Drive Type: 4WD

Features: --

Power Options: --

Exterior Color: Silver

Interior Color: Brown

Warranty: Unspecified

Model: 1500

Ram 1500 for Sale

2014 ram 1500 big horn(US $7,500.00)

2014 ram 1500 big horn(US $7,500.00) 2022 ram 1500 limited night edition, trailer tow group, limited level 1(US $52,500.00)

2022 ram 1500 limited night edition, trailer tow group, limited level 1(US $52,500.00) 2019 ram 1500 classic slt(US $12,950.00)

2019 ram 1500 classic slt(US $12,950.00) 2022 ram 1500 laramie(US $56,000.00)

2022 ram 1500 laramie(US $56,000.00) 2021 ram 1500 limited(US $39,789.00)

2021 ram 1500 limited(US $39,789.00) 2022 ram 1500 laramie(US $38,904.00)

2022 ram 1500 laramie(US $38,904.00)

Auto Services in Texas

Zepco ★★★★★

Z Max Auto ★★★★★

Young`s Trailer Sales ★★★★★

Woodys Auto Repair ★★★★★

Window Magic ★★★★★

Wichita Alignment & Brake ★★★★★

Auto blog

Chrysler recalling nearly 141k vehicles over electrical woes

Wed, 02 Oct 2013Software glitches that randomly illuminate warning lights and cause instrument cluster blackouts are forcing Chrysler to recall 140,800 vehicles, The Detroit News reports. The automaker is recalling 132,000 2014 Jeep Grand Cherokees, 91,559 of which are in the US. In addition to the Jeep recalls, Chrysler is adding 10,800 2014 Ram 1500, 2500 and 3500 trucks to the list for similar problems.

Chrysler reportedly says, "Both events occurred infrequently and appeared to resolve themselves by tuning the vehicle's ignition off and then on."

Engineers discovered a problem with the anti-lock-braking system software that causes the instrument cluster display of the Grand Cherokee to illuminate warning lights and black out - even its ABS and electronic stability control systems are affected. To fix the Jeeps, Chrysler will update the vehicle's software.

Stellantis not looking for further mergers, including with Renault

Mon, Feb 5 2024MILAN — Stellantis Chairman John Elkann on Monday denied the carmaker was hatching merger plans, responding to press speculation about a possible French-led tie-up with rival Renault. Elkann said that the Peugeot owner, the world's third largest carmaker by sales, was focused on the execution of its long-term business plan. "There is no plan under consideration regarding merger operations with other manufacturers," said Elkann, who also heads Exor, the Agnelli family holding company that is the largest single shareholder in Stellantis. After abandoning the Russian market, at the time its second largest after France, and reducing the scope of its global cooperation with Nissan, Renault has been seen as a potential M&A target. Speculation intensified after an electric vehicle market slowdown forced it last week to cancel IPO plans for its EV and software unit Ampere. Its market cap remains stubbornly low at little over 10 billion euros ($10.8 billion) despite a financial recovery over the past few years. Stellantis, the product of a 2021 merger between France's PSA and Fiat Chrysler and one of the most profitable groups in the industry, has a market cap of more than 85 billion euros when unlisted shares are factored in. It has a 14 brand portfolio also including Citroen, Jeep, Opel and Alfa Romeo. NEWSPAPER REPORT Italian daily Il Messaggero had said on Sunday that the French government, which is Renault's largest shareholder and also has a stake in Stellantis, was studying plans for a merger between the two groups. A spokeswoman for Renault said on Monday the group did not comment on rumors. France's Finance Ministry had declined to comment on Sunday. Stellantis has crossed swords with the Italian government, which has accused it of acting against the national interest on occasions. Industry Minister Adolfo Urso last week raised the prospect of the Italian government taking a stake in Stellantis to help to balance the French influence. Renault shares pared gains after Elkann's comments to stand 1.2% higher by 1220 GMT, having initially risen more than 4%. Stellantis CEO Carlos Tavares, a Portuguese-national, last week said in an interview with Bloomberg that the group was "ready for any kind of consolidation" and that its job was to make sure that it would be "one of the winners". Analysts, however, question the rationale of a Stellantis-Renault merger, which would also expand the group's excess capacity in Europe.

FCA to invest $4.5B for new Detroit plant, expanded production at current facilities

Tue, Feb 26 2019We expected some shifts in manufacturing plans as Fiat Chrysler plans to begin electrifying its Jeep brand, but this news bodes well for Michigan. FCA announced today that it would spend $4.5 billion to expand production in the state, including building a new assembly plant in Detroit and increasing capacity at five other facilities in the state. The plan, which FCA says will create nearly 6,500 new jobs, will help to meet increasing demand for Ram and Jeep products, and to electrify Jeep models. $1.6 billion will be set aside to transform the Mack Avenue Engine Complex into a site to build the next generation of Jeep Grand Cherokee, as well as an unspecified, new three-row Jeep model. FCA says this part of the plan will create 3,850 new jobs. FCA is increasing its investment in the Warren Truck plant to $1.5 billion in order to continue building the Ram 1500 Classic, as well as the new Jeep Wagoneer and Grand Wagoneer, creating 1,400 new jobs. FCA says that the new Ram 1500 Heavy Duty will still be built in Saltillo, Mexico. At FCA's Jefferson North facility, the automaker will invest $900 million to upgrade the plant. This site will continue to build the Dodge Durango, as well help build the next Jeep Grand Cherokee. FCA expects this to create 1,100 new jobs. As Jeep plans to electrify models in its SUV lineup, each of the above plants will produce plug-in hybrid versions of the Jeep models produced there, "with flexibility to build fully battery-electric models in the future," the company said in its announcement. "Three years ago, FCA set a course to grow our profitability based on the strength of the Jeep and Ram brands by realigning our U.S. manufacturing operations," said FCA CEO Mike Manley, referring in part to earlier investments in Illinois, Ohio and Michigan. "Today's announcement represents the next step in that strategy," Manley continued. "It allows Jeep to enter two white space segments that offer significant margin opportunities and will enable new electrified Jeep products, including at least four plug-in hybrid vehicles and the flexibility to produce fully battery-electric vehicles." Other investments include $119 million to move production of the 3.0-, 3.2- and 3.6-liter Pentastar engines from Mack I to the Dundee Engine Plant, and $400 million for increased capacity and 80 new jobs at the Sterling and Warren stamping plants. This comes at a time when FCA's U.S.