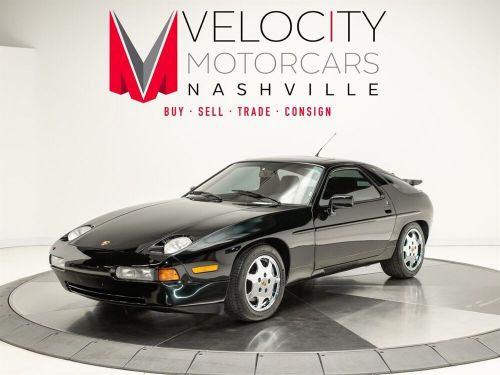

1988 Porsche 928 S-4 on 2040-cars

Clayton, North Carolina, United States

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

Engine:5.0L Gas V8

VIN (Vehicle Identification Number): WP0JB0924JS860380

Mileage: 52000

Trim: S-4

Number of Cylinders: 8

Make: Porsche

Drive Type: RWD

Model: 928

Exterior Color: Black

Porsche 928 for Sale

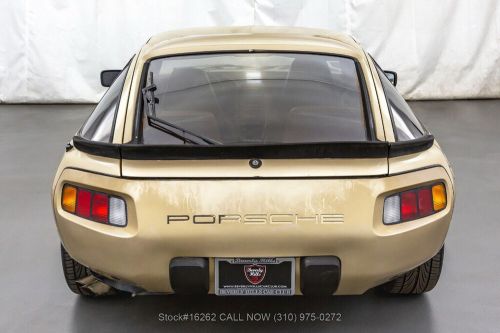

1983 porsche 928(US $9,750.00)

1983 porsche 928(US $9,750.00) 1990 928 gt(US $99,995.00)

1990 928 gt(US $99,995.00) 1989 porsche 928 s4(US $33,250.00)

1989 porsche 928 s4(US $33,250.00) 1983 porsche 928(US $9,750.00)

1983 porsche 928(US $9,750.00) 1988 porsche 928 s-4(US $25,000.00)

1988 porsche 928 s-4(US $25,000.00) 1983 porsche 928(US $15,750.00)

1983 porsche 928(US $15,750.00)

Auto Services in North Carolina

Window Genie ★★★★★

West Lee St Tire And Automotive Service Center Inc ★★★★★

Upstate Auto and Truck Repair ★★★★★

United Transmissions Inc ★★★★★

Total Collision Repair Inc ★★★★★

Supreme Lube & Svc Ctr ★★★★★

Auto blog

The mood at this year’s Paris Motor Show: Quiet

Tue, Oct 2 2018The Paris Motor Show, held every other year in the early fall, typically kicks off the annual cavalcade of automotive conclaves, one that traverses the globe between autumn and spring, introducing projective, conceptual and production-ready vehicle models to the international automotive press, automotive aficionados and a public hungry for news of our increasingly futuristic mobility enterprise. But this year, at the press preview days for the show, the grounds of the Porte de Versailles convention center felt a bit more sparsely populated than usual. This was not simply a subjective sensation, or one influenced by the center's atypically dispersed assemblage of seven discrete buildings, which tends to spread out the cars and the crowds. There were not only fewer new vehicles being premiered in Paris this year, there were fewer manufacturers there to display them. Major mainstream European OEM stalwarts such as Alfa Romeo, Fiat, Nissan and Volkswagen chose to sit out Paris this year, as did boutique manufacturers like Bentley, Aston Martin and Lamborghini. This is not simply based in some antipathy on the part of the German, British and Italian manufacturers toward the French market — though for a variety of historical and societal reasons that market may be more dominated by vehicles produced domestically than others. Rather, it is part of a larger trend in the industry. Last year, Mercedes-Benz announced that it would not be participating in the flagship North American International Auto Show in 2019 — and that it might not return. Other brands including Jaguar/Land Rover, Audi, Porsche, Mazda and nearly every exotic carmaker have also departed the Detroit show. Some of these brands will still appear in the city in which the show is taking place, and host an event offsite, to capitalize on the presence of a large number of reporters in attendance. And even brands that do have a presence at the show have shifted their vehicle introductions to the days before the official press opening in an attempt to stand out from the crowd. In many ways, this makes sense. With an expanding number of automakers, with diversification and niche-ification of models and with wholesale shifts that necessitate the introduction of EV or autonomous sub-brands, there is a growing sense that, with everyone shouting at the same time, no one can be heard.

2014 Porsche Panamera arrives with new E-Hybrid, long-wheelbase models

Wed, 03 Apr 2013Porsche will officially unveil the refreshed 2014 Panamera at the Shanghai Motor Show later this month, and there's a whole lot in store for the updated model, far beyond the minimal styling tweaks you see here. Sure, there's a new fascia with more prominent LED lighting (including full LED headlamps) and the rump has been tweaked ever so slightly, but the big news for 2014 concerns what's underneath that rakish skin.

First up, Porsche will now offer a Panamera S E-Hybrid model - a plug-in hybrid that builds on the technology first introduced in the Panamera S Hybrid that we tested in 2011. For this new application, a more powerful electric motor and higher-performance battery have been fitted (official specs have not been released just yet), and Porsche says the battery can be recharged in just two and a half hours when the car is plugged in to a 240-volt outlet, and the charging (as well as other vehicle data) can be monitored via a new Porsche Car Connect app available for Android and iOS devices.

The E-Hybrid will have an all-electric driving range of "greater than 20 miles" and will be able to travel at speeds up to 84 miles per hour solely on electric power.

Porsche 918 Spyder officially priced from $845K, Weissach package $84K more

Wed, 23 Jan 2013Porsche has released official pricing for its entire lineup of 2013 models, which just happens to include the upcoming 918 Spyder hybrid supercar. The 795-horsepower advanced-technology-lab-on-wheels is now officially confirmed to have a starting price of $845,000 in the US, which is the exact amount we were told earlier when we had the opportunity to ride shotgun in some 918 Spyder pre-production test vehicles.

What we didn't know at the time was the cost of the Weissach trim package, which is a high-performance upgrade to the standard vehicle that includes the deletion of some interior amenities and addition of lighter-weight carbon fiber appointments, magnesium wheels, flame-resistant upholstery, racing belts and aerodynamic aids - it's meant for track-going folk who intend to use their 918 Spyders as God, country and manufacturer intended.

All told, the Weissach package should drop the 918 Spyder's curb weight by some 80 pounds, while also lightening your wallet of an additional $84,000 - the car's MSRP with the Weissach package is $929,000. These prices don't, however, include destination charges, which, for something like the very limited edition 918 Spyder (only 918 will be made), could very well cost considerably more than your average Porsche.