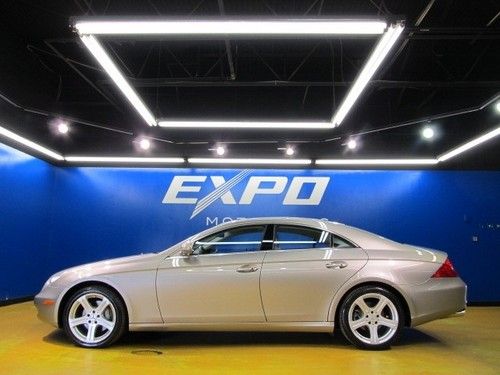

Mercedes Benz Cls500 Keyless Go Navigation on 2040-cars

Houston, Texas, United States

Body Type:Sedan

Vehicle Title:Clear

Fuel Type:GAS

Engine:5.0L 4966CC V8 GAS SOHC Naturally Aspirated

For Sale By:Dealer

Make: Mercedes-Benz

Model: CLS500

Trim: Base Sedan 4-Door

Disability Equipped: No

Drive Type: RWD

Mileage: 75,203

Doors: 4

Exterior Color: Tan

Drivetrain: Rear Wheel Drive

Interior Color: Tan

Number of Doors: 4

Number of Cylinders: 8

Mercedes-Benz CLS-Class for Sale

Cls 63 amg black navi low miles leather moon roof harman kardon audio bi-xenons(US $49,900.00)

Cls 63 amg black navi low miles leather moon roof harman kardon audio bi-xenons(US $49,900.00) 1978 mercedes 280 slc 2 door

1978 mercedes 280 slc 2 door 2008 mercedes-benz cls550 base sedan 4-door 5.5l(US $36,900.00)

2008 mercedes-benz cls550 base sedan 4-door 5.5l(US $36,900.00) 2006 mercedes cls500 sedan - blue/tan - 32k mi - vent seats - nav - clear bra

2006 mercedes cls500 sedan - blue/tan - 32k mi - vent seats - nav - clear bra Diamond white $80k msrp amg loaded v8 bi-turbo(US $65,941.00)

Diamond white $80k msrp amg loaded v8 bi-turbo(US $65,941.00) Mercedes cls550 cls low miles mint cond flat paint palm beach car

Mercedes cls550 cls low miles mint cond flat paint palm beach car

Auto Services in Texas

Youniversal Auto Care & Tire Center ★★★★★

Xtreme Window Tinting & Alarms ★★★★★

Vision Auto`s ★★★★★

Velocity Auto Care LLC ★★★★★

US Auto House ★★★★★

Unique Creations Paint & Body Shop Clinic ★★★★★

Auto blog

Race recap: 2016 Bahrain Grand Prix was everything good and bad about F1

Mon, Apr 4 2016Nothing was as it seemed heading into Bahrain. We were told team bosses had nixed the qualifying experiment that flunked every test by every measure in Australia, but that didn't happen. The FIA didn't give the teams the option of a wholesale return to the old format, the governing body only held a vote on whether to revert back to the old format in Q3 but stick with elimination gimmicks in Q1 and Q2. McLaren and Red Bull dissented, denying the chance for hybrid rounds. We're surprised none of the smaller teams voted against since elimination qualifying is hardest on them. Given the chance to fix the system again in Bahrain, Formula 1 failed again. The FIA and Bernie Ecclestone don't want to go back to the old system – because the race promoters don't want to go back to the old system – so all we know for sure is that there will be more meetings. We also thought Fernando Alonso would race in Bahrain after being given medical clearance, but a follow-up scan by the FIA showed fractured ribs and a damaged lung, ruling him out. And we thought Ferrari might have the pace to conquer Mercedes-AMG Petronas this year – and they might yet, but not on Saturday. That's why the Bahrain race began with another Mercedes one-two, Lewis Hamilton ahead of Nico Rosberg, Ferrari drivers Sebastian Vettel and Kimi Raikkonen behind. The Australian outback is plagued with rabbits, which must have something to do with how Daniel Ricciardo keeps pulling them out of his helmet; the Aussie got his Red Bull up to a surprising fifth on the grid. Williams drivers Valtteri Bottas in sixth and Felipe Massa in seventh would need to get him out of the way quickly to show what the car can do after an unsatisfying race in Australia. Nico Hulkenberg lined up in eighth for Sahara Force India. As proof the qualifying format failed again with its sophomore attempt, the last five minutes of Q2 were disappointing. Hulkenberg had the track completely to himself for his quali run, the only two cars on track after him were the Williams duo who weren't setting a time, but getting a set of soft tires ready to start the race on. As for Q1, the only reason for on-track action in the last three minutes was because Hamilton flubbed his first timed run. Romain Grosjean continued Haas F1's fruitful start to the season with ninth place, ahead of Max Verstappen in the Toro Rosso closing out the top ten. At the end of a long red light to start the race, Rosberg claimed his right to victory before Turn 1.

Sunday Drive: A new Rambo Lambo takes center stage

Sun, Dec 10 2017Surprise! Autoblog readers love fast cars. Doesn't matter what shape; doesn't matter what size. As long as it's got big power, wicked acceleration, and ludicrous speed, you're interested. Take, for instance, the brand-new Lamborghini Urus. It's got a 4.0-liter twin-turbocharged V8 sending 641 horsepower and 627 pound-feet of torque through an 8-speed automatic transmission to all four wheels. It hits 62 miles per hour in 3.6 seconds, and has a top speed of 189.5 mph. Ludicrous speed? Check. And although you'd be hard pressed to draw a line straight back from the upcoming Urus to the old, off-road-ready LM002, at least you can say that Lamborghini does have a history of producing overpowered SUVs. A 5.2-liter V12 engine producing 444 horsepower and borrowed from the Countach certainly qualifies as big power, especially considering this was in the 1980s and '90s. A prime example just sold for nearly half a million bucks. Moving along to more traditional sportscars, we got a sneak peek at the next Porsche 911's interior, thanks to some intrepid spy photographers. And we spy with our little eyes some major changes to the quintessential German sportscar. Finally, we round out this Sunday Drive with two First Drive reports. Both are German, but past that, they couldn't be more different. Either way, ludicrous speed is all but guaranteed by either one. As always, stay tuned to Autoblog for all the latest automotive news that's fit to print. The 2019 Lamborghini Urus, fastest SUV in the world, has landed Rare U.S.-spec 1990 Lamborghini LM002 fetches $467,000 at auction Next Porsche 911 will get a major interior overhaul 2018 Mercedes-Benz S-Class Coupe/Cabriolet Review | Creamy goodness 2018 BMW M5 First Drive Review | Power meets traction

Mercedes teams with Pebble for smartwatch tech

Tue, 24 Dec 2013Most automakers have realized by now that a good infotainment system is a must-have feature for many buyers, and have, as a result, invested increasing amounts of time and money developing these technologies. But some automakers are going above and beyond in-car entertainment and navigation technology by focusing on wearable technology as well.

Nissan has emerged as one such company, developing its own alternative to Google Glass and performance-oriented smartwatch. But Mercedes-Benz is also putting itself at the forefront of wearable tech - not by developing competing products to those designed by dedicated tech companies, but by working with them. The German automaker, as we recently reported, is developing its own app for Google Glass, and is now doing the same with smartwatches as well.

Set to be unveiled at the upcoming Consumer Electronics Show in Las Vegas, Mercedes has collaborated with Pebble Technologies to develop the Digital DriveStyle app. The system will display tell its wearer where the car is, whether the doors are locked and if it needs fuel. Inside the car it'll alert the driver to potential hazards coming up on the road, while making functions like re-routing the nav system, controlling the audio system or activating Siri that much easier.