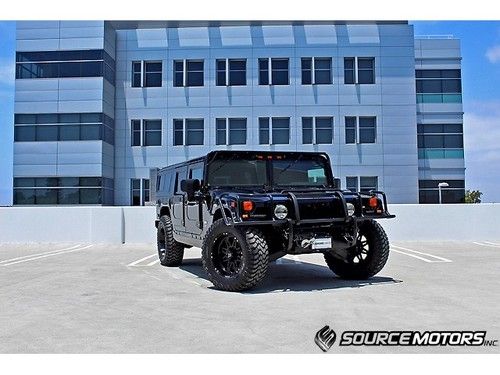

H1 Wagon,california Car, Predator Stage 1, 20" Wheels, Momo, Leather, Navigation on 2040-cars

Costa Mesa, California, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:6.5L 395Cu. In. V8 DIESEL OHV Turbocharged

Body Type:Sport Utility

Fuel Type:DIESEL

Make: Hummer

Warranty: No

Model: H1

Trim: Base Sport Utility 4-Door

Doors: 4

Drive Type: 4WD

Fuel: Diesel

Mileage: 43,901

Drivetrain: 4WD

Sub Model: Wagon

Exterior Color: Black

Number of Cylinders: 8

Interior Color: Gray

Hummer H1 for Sale

1992 hummer h1 wagon 4x4 diesel desert storm tribute 5k texas direct auto(US $56,780.00)

1992 hummer h1 wagon 4x4 diesel desert storm tribute 5k texas direct auto(US $56,780.00) Rare hummer h1 hmc4 with slant back,duramax turbo diesel,allison transmission(US $89,999.00)

Rare hummer h1 hmc4 with slant back,duramax turbo diesel,allison transmission(US $89,999.00) Hummer h1 cummins turbo diesel predator elite series custom conversion(US $99,999.00)

Hummer h1 cummins turbo diesel predator elite series custom conversion(US $99,999.00) 2000 hummer h1 slant back 1 of 39 original made in the world many upgrades(US $149,999.00)

2000 hummer h1 slant back 1 of 39 original made in the world many upgrades(US $149,999.00) 2000 hummer h1 hmc4 with slant back shell lifted 4" 38 tires rock rails winch(US $64,999.00)

2000 hummer h1 hmc4 with slant back shell lifted 4" 38 tires rock rails winch(US $64,999.00) Heavy duty brush guard, central tire inflation system (with stock wheels)(US $73,999.00)

Heavy duty brush guard, central tire inflation system (with stock wheels)(US $73,999.00)

Auto Services in California

Zube`s Import Auto Sales ★★★★★

Yosemite Machine ★★★★★

Woodland Smog ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Service ★★★★★

Western Brake & Tire ★★★★★

Auto blog

Nissan Z Proto, next-gen Hyundai Tucson and a hi-po mystery Bronco | Autoblog Podcast #645

Fri, Sep 18 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder and News Editor Joel Stocksdale. In the news this week, Ford has teased some sort of high-performance Bronco, Nissan unveiled the Z Proto, Hyundai revealed the next-gen Tucson and GMC teased the Hummer EV's "Crab Mode." Our editors break that all down for you, and share some insights and opinions before they turn to the cars in their own driveways. This week, they've been spending time with the 2020 Mercedes-AMG G 63, as well as the 2020 BMW Alpina B7. Autoblog Podcast #645 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Ford's beefed-up Bronco prototype stars in new teaser photo Nissan Z Proto previews the retro, rear-drive, turbo, manual future of the Z All the Nissan Z cars that got us to the Z Proto 2022 Hyundai Tucson debuts with striking styling inside and out GMC Hummer teases crab mode, reveal set for Oct. 20 Cars we're driving: 2020 Mercedes-AMG G 63 2020 BMW Alpina B7 Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Humvee maker AM General reportedly for sale, with interest from FCA, GM

Wed, Oct 3 2018WASHINGTON — AM General has put itself up for sale and has hired investment bank Macquarie Group Ltd to seek potential bidders in a deal that could value the builder of Humvee military vehicles at more than $2 billion, people familiar with the matter said this week. Potential bidders include competitors in the military ground vehicle market, such as General Dynamics, Oshkosh Corp and BAE Systems, according to two people familiar with the matter. Automakers like Fiat Chrysler and General Motors may also be potential buyers. GM licensed Hummer from AM General in 1998 to build civilian SUVs. None of the companies would comment or reply to a request for comment. The South Bend, Indiana-based AM General is currently owned by private equity firms. A possible sale of AM General follows a rash of deals over the past 18 months among defense contractors. But relatively fewer makers of defense equipment have gone on the auction block. Last year, United Technologies acquired Rockwell Collins for $30 billion, and in March, TransDigm Group continued its acquisition spree with a $525 million deal for Extant Components Group. AM General could fetch about 10 times its annual earnings of $160 million, one of the people said. The company's favorable tax treatment because of its current status as an limited liability corporation, would allow a buyer to reduce the company's taxable earnings for 15 years. That coupled with recent contract awards could push the ultimate value of the company to over $2 billion in a sale. The sale, should it happen, comes as the U.S. Army is gearing up for a broad effort to modernize its forces, including seeking prototypes of its Next-Generation Combat Vehicle in fiscal year 2022. Last month, AM General was awarded an Army contract for as many as 2,800 new M997A3 High Mobility Multipurpose Wheeled Vehicle (HMMWV) ambulances. The contract could be worth as much as $800 million if all options were exercised, AM General said at the time. Last year, the Pentagon awarded AM General a $550 million contract to deliver HMMWVs for use as protected weapons carriers, cargo transporters and ambulances to Afghanistan, Iraq, Ukraine, Jordan, Slovenia, Bahrain, Columbia, Bosnia and Kenya as a part of a larger Foreign Military Sales agreement. The sale of AM General offers an opportunity to purchase a prime contractor that delivers a finished product to the Pentagon, and not just an add-on system or service.

MEV rocks up with electric mini Hummer HX

Tue, 07 Jun 20112011 MEV Hummer HX - Click above to watch the video after the jump

The 2008 Hummer HX concept was supposed to be General Motors' answer to the Jeep Wrangler. To put it mildly, that failed to materialize. General Motors killed Hummer as part of its bankruptcy-induced limb severing in 2009, before the HX could be brought to fruition as the H4, as had been rumored.

For those of you who wish the HX had indeed surfaced, we have some excellent news: My Electric Vehicle, or MEV, has appropriated the HX concept, added an electric drivetrain and created the MEV Hummer HX. The MEV HX is a fully electric golf cart resort vehicle, licensed by GM and sporting Hummer wheels and skid plates.