1970 Gmc Jimmy on 2040-cars

Stow, Massachusetts, United States

Vehicle Title:Clean

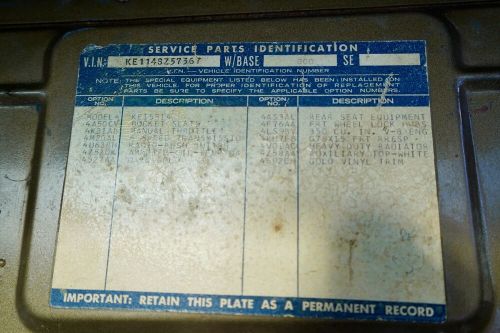

VIN (Vehicle Identification Number): KE114SZ57367

Mileage: 50720

Model: Jimmy

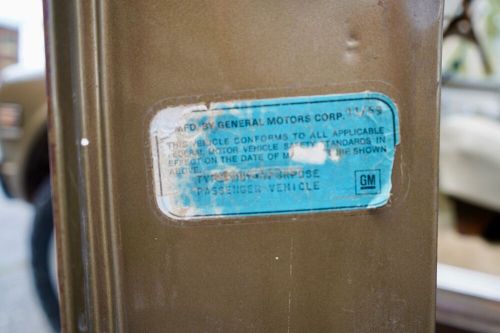

Make: GMC

Number of Seats: 5

GMC Jimmy for Sale

1988 gmc jimmy(US $29,900.00)

1988 gmc jimmy(US $29,900.00) 1986 gmc jimmy 4x4(US $7,100.00)

1986 gmc jimmy 4x4(US $7,100.00) 1991 gmc jimmy v15(US $500.00)

1991 gmc jimmy v15(US $500.00) 1989 gmc jimmy v15(US $14,000.00)

1989 gmc jimmy v15(US $14,000.00) 1981 gmc jimmy(US $13,500.00)

1981 gmc jimmy(US $13,500.00) 1987 gmc jimmy v15(US $9,999.00)

1987 gmc jimmy v15(US $9,999.00)

Auto Services in Massachusetts

Tiny & Sons Glass ★★★★★

T & S Autobody ★★★★★

Patrick Subaru ★★★★★

Paradise Auto Service ★★★★★

Paradise Auto Service ★★★★★

Musicarro Auto Sound ★★★★★

Auto blog

GM recalls select Tahoes, Yukons, Escalades for rear driveshaft issue

Mon, Feb 7 2022GM is recalling a number of its full-size SUVs due to an issue with the rear driveshaft assembly that could ultimately result in driveshaft failure. The actual number of total vehicles involved in the recall is small at just 1,789, but itís spread out across the entire 2021 model year full-size GM vehicle lineup. That means a small number of every model is being recalled, including the Chevrolet Tahoe, Suburban, GMC Yukon, Yukon XL and the Cadillac Escalade and Escalade ESV. GM traced the issue back to certain driveshaft assemblies with ball bearings that were not properly heat treated. If they¬íre not properly heat treated, GM says that the balls may deform over time, causing noise and vibration. Continue to drive in this condition, and GM says the affected joint in the driveshaft assembly could seize, causing loss of drive power. However, the problem won¬ít present itself all at once, as GM says there will be a gradual increase of noises and vibrations before total failure. For those few owners with affected vehicles, GM says that it will replace the left and right rear driveshaft assemblies with properly-built units. Per usual with recalls, this will be done at your local dealership at no cost to the owner. If you have one of the recalled SUVs, expect to be notified mid-March. Related video:

GM dealers have ordered 30k Colorado and Canyon pickups, 3rd shift added

Wed, 17 Sep 2014General Motors has an early success on its hands in the form of the initial rollout of the Chevy Colorado and GMC Canyon midsize pickup trucks. According to the automaker, dealers have ordered nearly 30,000 of the trucks thus far, a number that far exceeded GM's early expectations.

This high demand for the Colorado and Canyon twins has prompted GM to add a third shift to its Wentzville Assembly plant where the trucks are built, starting early next year. An extra shift will add an additional 750 jobs at the location to the 1,315 that were already employed there, according to the press release that you're welcome to read down below.

Such positive sales projections for the Canyon and Colorado may portend good things for the midsize pickup segment, which was once hugely popular but has more recently contracted, with the Nissan Frontier and Toyota Tacoma standing firm as the market leaders. Now that GM's entries are the most up-to-date, and with the segment's first diesel engine on the way, it will be interesting to see how the trucks continue to sell and if their hopeful success leads more automakers back onto the playing field.

GM drops diesel engines for 2020 Chevy Equinox and GMC Terrain crossovers

Fri, Jul 12 2019GM is officially discontinuing the diesel engine in the Chevy Equinox and GMC Terrain for the 2020 model year. The 1.6-liter turbodiesel was always an oddball of an engine in the compact crossover segment, and now the experiment has come to an end. The Car Connection initially reported the news, and a GMC spokesperson, Stuart Fowle, confirmed it to us this morning.¬† ďA huge majority of our Terrain customers have opted for one of our two gas engines," says Fowle. We can¬ít say this eventuality comes as a massive surprise, as we saw news from couple of months ago that GM was dropping all-wheel drive from the diesel-powered cars for 2020. Low demand was cited as the reason for that cull, and it¬ís the same for the little GM crossovers this time around, too. These vehicles were the only ones powered with a diesel engine in their class, but that¬ís going to be changing. Just as GM is going away from the diesel, Mazda is finally bringing its diesel to market in the CX-5. You¬íll only be able to get that engine in the most expensive ($42,045) trim level, combined with all-wheel drive, though. The cheapest Equinox diesel starts at a comparably low $30,795. That¬ís a $2,400 upcharge over the base 1.5-liter turbo four-cylinder, and the value is questionable. Mileage is better, but diesel fuel is more expensive. Towing capability didn¬ít increase over the base engine¬ís 1,500-pound capacity, but the extra torque around town was nice. As diesels go in the U.S., this one was rather rough and noisy, possibly contributing to some turning their noses up after a test drive. Perhaps another reason for its demise was that the much quicker 2.0-liter turbo Equinox was only $100 more than the diesel. This engine offered significantly better towing at 3,500 pounds, too. You can read all about what we thought of the diesel in our first drive review here, but the 2019 model year is the last one if you had it on your shortlist. This article has been updated to indicate the source.