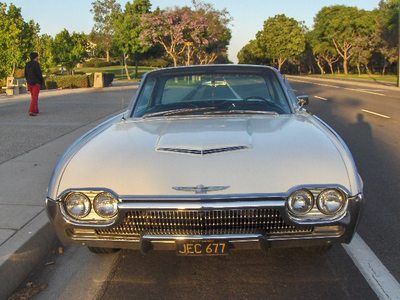

All Original 1963 Tb ,38k Miles, Cal Car Black Plate Runs Great on 2040-cars

Santa Ana, California, United States

Body Type:Coupe

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Make: Ford

Model: Thunderbird

Warranty: Vehicle does NOT have an existing warranty

Mileage: 38,670

Exterior Color: White

Options: Leather Seats

Interior Color: Black

Number of Cylinders: 8

Ford Thunderbird for Sale

1970 ford thunderbird 429 all original paint, seats, carpet, wheels and hubcaps.

1970 ford thunderbird 429 all original paint, seats, carpet, wheels and hubcaps. 69 ford t-bird. 45k miles. 429 thunderjet big block v8. original and unrestored.

69 ford t-bird. 45k miles. 429 thunderjet big block v8. original and unrestored. 2002 ford thunderbird base convertible 2-door 3.9l(US $19,000.00)

2002 ford thunderbird base convertible 2-door 3.9l(US $19,000.00) 2002 ford thunderbird convertible low miles with ford extended warranty(US $21,500.00)

2002 ford thunderbird convertible low miles with ford extended warranty(US $21,500.00) 2002 ford thunderbird convertible removable hardtop 41k texas direct auto(US $19,980.00)

2002 ford thunderbird convertible removable hardtop 41k texas direct auto(US $19,980.00) 1964 ford thunderbird

1964 ford thunderbird

Auto Services in California

Windshield Repair Pro ★★★★★

Willow Springs Co. ★★★★★

Williams Glass ★★★★★

Wild Rose Motors Ltd. ★★★★★

Wheatland Smog & Repair ★★★★★

West Valley Smog ★★★★★

Auto blog

FBI Seizes Computers, Listening Devices From Ford Headquarters

Fri, Jul 25 2014FBI agents searched Ford Motor Company's headquarters in Dearborn, Michigan, this month as part of an investigation into possible corporate espionage. Eight devices, along with documents, computers and financial records, were among the items seized by federal agents on July 11, according to documents obtained by The Detroit News. The FBI searched Leach's home on June 20 and seized more than two dozen items in that search, Reuters reported. Former engineer Sharon Leach, a 17-year Ford veteran of company, was fired last month, according to The News, which first reported the story. She admitted to placing recording devices under conference tables before meetings. She told Ford security she used the recordings to assist in her meeting notes. She couldn't remove the devices after meetings without drawing attention to herself, leaving the devices to record other meetings. Leach has not been charged for any wrongdoing. Former federal prosecutor and Wayne State University law professor Peter Henning told The News that using a search warrant, rather than a subpoena, shows the FBI suspects more employees could be implicated. "If it's an economic espionage case or trade-secrets case, that rarely involves one individual," Henning told The Detroit News. "So the concern is if you send a subpoena and ask for recording devices, those things can be erased." Leach, Ford and the FBI declined to comment on the investigation. Related Gallery AOL Autos Test Drive: 2014 Ford Fiesta ST Auto News Ford espionage corporate

Project Ugly Horse: Part VI

Thu, 21 Mar 2013Solid axle? What solid axle?

I was fully prepared to embark on a seven-day journey down a rabbit hole of broken bolts, internet hearsay and consternation.

This should not have gone this easily. Having a long and checkered history of simple projects punctuated by much wailing and gnashing of knuckles, I was fully prepared to embark on a seven-day journey down a rabbit hole of broken bolts, internet hearsay and consternation when I finally decided to lay hands on the '89 Mustang with the goal of relieving the car of its stock rear axle. Instead, it took less than a full morning's worth of work to carve the old 7.5-inch solid axle from its moorings and mock up something, well, different.

Ford wants smart cruise that's speed and grade sensitive

Thu, Jul 23 2015Ford is working to make adaptive cruise control even smarter and more economical for future vehicles. The automaker now has a patent (pdf link) on a system to use information on the grade of the road, traffic data, and a driver's preferences to eke out better fuel mileage over a journey. This solution would essentially put a little hypermiling right into a model's software. The Blue Oval's patent refers to this tech as "route navigation with optimal speed profile," and the system starts by splitting the way to the driver's ultimate destination into many smaller pieces. Each one is analyzed based on GPS data, and traffic info is also constantly updated. Based on the occupants' preferred travel time, all this info is combined to figure out the most efficient speed for each leg of the journey. All of these calculations are actually more than the car's computers can handle, so some of the math is offloaded to a cloud-based network. According to Ford, some of the benefits come when tackling hills while diving. Maintaining a single speed when going up and down steep grades isn't the most efficient method, but current technology can't easily make the necessary adjustments. This system uses the GPS data to adapt the vehicle's speed and leave the situation with better fuel economy. Ford is currently making major investments into autonomous driving technology and has some prestigious partners. While the patent documents don't specifically mention the optimal speed profiles for driverless vehicles, they seem like a natural fit. Over the course of an entire trip, the fuel economy gains would likely be even greater than over a few miles on a relatively flat interstate.