Certified Pre-owned Cpo Clean Title Low Miles Warranty on 2040-cars

Los Altos, California, United States

Ford Edge for Sale

1 owner clean carfax heated leather seats panoramic sunroof sync mp3 bluetooth(US $14,000.00)

1 owner clean carfax heated leather seats panoramic sunroof sync mp3 bluetooth(US $14,000.00) 2008 ford edge sel sport utility 4-door 3.5l

2008 ford edge sel sport utility 4-door 3.5l 13 edge sport, 3.7l v6, leather, pano sunroof, navi, dual dvd, clean!

13 edge sport, 3.7l v6, leather, pano sunroof, navi, dual dvd, clean! 2011 ford edge sel heated leather rearview cam 70k mi texas direct auto(US $17,980.00)

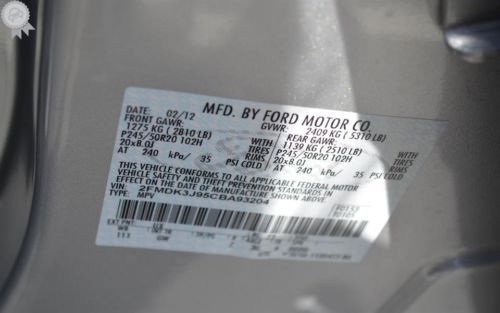

2011 ford edge sel heated leather rearview cam 70k mi texas direct auto(US $17,980.00) 2014 sport new 3.7l v6 24v fwd suv

2014 sport new 3.7l v6 24v fwd suv 08 parking sensors navigation heated leather microsoft sync tow tint

08 parking sensors navigation heated leather microsoft sync tow tint

Auto Services in California

Xtreme Auto Sound ★★★★★

Woodard`s Automotive ★★★★★

Window Tinting A Plus ★★★★★

Wickoff Racing ★★★★★

West Coast Auto Sales ★★★★★

Wescott`s Auto Wrecking & Truck Parts ★★★★★

Auto blog

Ford making Fusion production moves to challenge Camry on volume

Mon, 26 Aug 2013The Ford Fusion may already beat the Toyota Camry in terms of models offered, transaction price and sales increase so far this year, but if the Fusion wants to make a run at the title of best-selling car in the US, Bloomberg reminds us that volume is key. Opening a second production line at the Flat Rock, MI assembly plant will reportedly allow Ford to produce around 350,000 Fusions annually, which compares Toyota's ability to crank out 475,000 Camrys and Honda's capacity to build around 450,000 Accords.

For the Fusion, that's an extra 100,000 units compared to the car's current pace, and the article adds that the Fusion is "Ford's best shot" to regain the passenger car sales crown - a title it (or any other US automaker, for that matter) hasn't held since the mid-1990s. Despite hiccups with recalls and fuel economy numbers, the Ford Fusion is still red hot when it comes to sales. Fusion sales are up 13 percent so far this year (compared to a 0.6 percent decrease for Camry), and its average transaction price of $26,343 is about $2,300 more than its rival from Toyota.

The Fusion's popularity has helped Ford improve its sales in California; the Dearborn-based automaker has a market share of 18 percent in the state, which is just a fraction of a percentage behind Honda. And this popularity should continue as Ford ups Fusion production and expands the model lineup even further for 2014 with a new 1.5-liter EcoBoost engine soon to become an option.

New York Mets outfielder turns spring training into his personal car show

Wed, Feb 24 2016New York Mets outfielder Yoenis Cespedes is known for his wide range of talents. He can hit for power, average, has good speed, and is solid in the field. His car collection is equally versatile and diverse, and it's been on display this week at spring training. Every day has brought a different car, and it has his teammates and the media atwitter. Cespedes rolled up Wednesday to the Mets facility in Port St. Lucie in a Lamborghini Aventador. It's black with blue trim. Anthony DiComo with MLB.com tweeted this: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. ESPN's Darren Rovell tweeted the Lambo has a custom exhaust that cost $80,000 and shoots out flames. Of course, that's already old news. His Alfa Romeo showed up today, too. Apparently Mets infielder Wilmer Flores has been driving it. That's an ultra-rare 8C Competizione, brought to you by Robert Brender of SNY.TV. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. The Italian delights are stunning, but his Tuesday arrival was arguably the craziest: a Polaris Slingshot. DiComo captured this. It's customized with gaudy wire wheels, red accents, and Cespedes' No. 52 on the hood. Subtle. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Only in this fleet would Monday's ride appear pedestrian. It was 'only' an F-250. It was raised on huge wheels, had a custom grille, and towered over that Maserati behind it. Jon Santucci of Scripps newspapers observed it. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. At this rate, we should probably skip Geneva and get credentialed for Mets spring training. Cespedes signed a three-year $75-million contract with the Mets in the off-season. He's also played for the Oakland Athletics, Boston Red Sox, and Detroit Tigers. Related Video: Image Credit: Getty Images Celebrities Design/Style Ford Lamborghini Performance baseball

Watch Ken Block's scary Rally America crash from inside the cockpit

Wed, 19 Feb 2014Ken Block became famous for his series of Gymkhana videos, but he's a real racer in his own right. Block has competed many rounds in the FIA World Rally Championship and also rallied in the 2013 Rally America series. He nearly won that latter title last year - if not for a massive crash in the final event of the season.

Block and his co-driver Alex Gelsomino went into the Lake Superior Performance Rally needing a win to take the championship. However, missing a clump of dirt on the side of the road and one little word in the pace notes was all it took to catapult Block's Fiesta off the road and into a tumbling accident. Block says his initial reaction was anger because the crash came out of nowhere.

For 2014, Block is joining the FIA World Rallycross Championship for at least three rounds. He'll drive a Ford Fiesta for the Hoonigan Racing Division at the Norwegian, French and Turkish events of the 12-round championship. Former Formula One World Champion Jacques Villeneuve will also compete in the series.