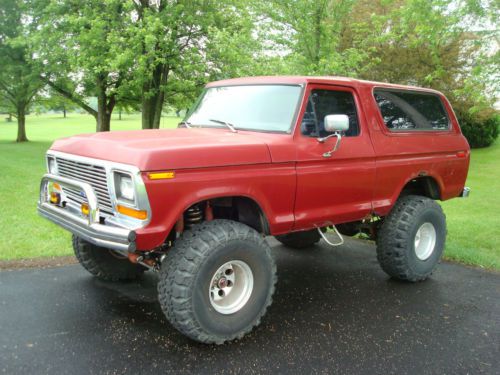

1979 Ford Bronco on 2040-cars

South Vienna, Ohio, United States

|

This is a 1979 Ford Bronco. This truck was a show truck in its prime. The original owner was family and kept it in the garage most of its life until the last 10 years. The body does have rust so please see pictures. It is maroon with grey leather interior that is in excellent condition. It has shaved door handles.The tires are 38"x 15.5" and has a 1971 Lincoln 460 motor with everything being replaced around 2000 including the pistons, rods, cranks, and bored out 30 over. Originally had 370HP but with modifications is much over that. Recommended to use a mix of high premium with some racing fuel to keep the engine from pinging. Was completely chrome plated underneath in 1985, but please see pictures for rust damage from over the years. The motor sounds healthy when running. It does run, but has been sitting without being driven much except to move it around in the driveway. Has an extra set of factory wheels and tires.

|

Ford Bronco for Sale

Low miles, last body style, 4x4, v8, automatic, a/c, sunroof, clean, lifted

Low miles, last body style, 4x4, v8, automatic, a/c, sunroof, clean, lifted 1978 ford bronco ranger xlt no reserve

1978 ford bronco ranger xlt no reserve 1979 ford bronco 4wd custom "one of a kind" 400ci, exxo cage, new bfg's, yellow(US $12,500.00)

1979 ford bronco 4wd custom "one of a kind" 400ci, exxo cage, new bfg's, yellow(US $12,500.00) 1988 ford bronco 4x4 5.0

1988 ford bronco 4x4 5.0 1986 ford bronco eddie bauer sport utility 2-door

1986 ford bronco eddie bauer sport utility 2-door 1970 ford bronco 5.0 fuel injected

1970 ford bronco 5.0 fuel injected

Auto Services in Ohio

West Side Garage ★★★★★

Wally Armour Chrysler Dodge Jeep Ram ★★★★★

Valvoline Instant Oil Change ★★★★★

Tucker Bros Auto Wrecking Co ★★★★★

Tire Discounters Inc ★★★★★

Terry`s Auto Service ★★★★★

Auto blog

Ford reveals 345-horsepower output for new Focus RS [w/video]

Thu, Jun 25 2015When Ford revealed the new Focus RS at the Geneva Motor Show, it promised it would deliver "well in excess of 315 horsepower." It didn't say exactly how much that would come to, but now it has. On the eve of its dynamic debut at the hands of Ken Block at the Goodwood Festival of Speed, Ford has confirmed that its new hot hatch will pack 350 metric horsepower. Those reaching for their calculators will find that works out to 345 horsepower by our standards. The power output is backed up by 324 pound-feet of torque, capable of being boosted up to 347 for up to fifteen seconds at a time. Those figures come from a retuned version of the same 2.3-liter EcoBoost turbo four as the one available in the Mustang, but produces over ten percent more power thanks to a new turbocharger, upgraded intake and exhaust, and a larger radiator. All that muscle will be channeled to all four wheels through Ford Performance's new all-wheel drive system with dynamic torque vectoring, launch control, and selectable drive modes, including a Drift Mode that (as you can see from the video below) allows the hot hatch to get more than a little sideways. Ford still isn't saying what those specs will translate to in terms of measurable performance figures, but as far as output goes, things are looking pretty good. The 30th Ford RS model already packs more power and torque than the new Honda Civic Type R (306 hp, 295 lb-ft), Volkswagen Golf R (292 hp, 280 lb-ft), Subaru WRX STI (305 hp, 290 lb-ft) or the Nurburgring-conquering Renault Megane 275 Trophy-R (271 hp, 266 lb-ft) and Seat Leon Cupra (276 hp, 258 lb-ft). It even respectably holds its own against the more upscale BMW M235i (320 hp, 330 lb-ft), Mercedes A45/CLA45 AMG (355 hp, 332 lb-ft), and Audi RS3 (362 hp, 343 lb-ft). Whether it'll outshine them all in real-world conditions remains to be seen, but we're looking forward to finding out whenever Ford deems fit to drops those performance stats on us. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Ford celebrating 80 years of Aussie utes as it prepares to shutter Oz manufacturing

Wed, 26 Feb 2014Ford is ending Australian production after 90 years in 2016, and with it may go perhaps the most iconic vehicles in its auto market - the ute. Car-based pickup trucks like the Ford Ranchero and Chevrolet El Camino were always more of a curiosity than a true market force here, but in Australia, they have long proven hugely popular.

As the legend goes, Ford invented the niche after a farmer's wife had asked Ford Australia's managing director for a more utilitarian car. Her request was simple: "My husband and I can't afford a car and a truck but we need a car to go to church on Sunday and a truck to take the pigs to market on Monday. Can you help?"

Ford's design team came up with a two-passenger, enclosed, steel coupe body with glass windows and a steel-paneled, wooden-frame load area in the rear. The sides of the bed were blended into the body to make it look more unified, and to keep costs down, the front end and interior were based on the Ford Model 40 five-window coupe. Power came from a V8 with shifting chores handled by a three-speed manual. Within a year, the new vehicle was ready, and production began in 1934. Lead designer Lewis Bandt christened it the coupe-utility.

New car market raining on convertibles' parade

Mon, 08 Jul 2013Whether fitted with soft or hard folding lids, today's droptops are better than ever for year-round motoring. Advancements in power top mechanisms, sealing, aerodynamics, structural rigidity, rollover safety and creature comforts like heated and cooled seats mean that modern convertibles are more versatile and better to drive than ever before. Yet the segment's sales took a dive during the recession and haven't come back, Automotive News reports.

Part of that is because automakers are looking at today's more sensible buyers and simply not developing as many new models, and that lack of fresh iron is curbing sales. AN cites R.L. Polk data which notes that only about one percent of new vehicles registered in the US last year had tops that folded. Back in 2009, it was 1.4 percent, and it was 2 percent in 2006. All-in, some 151,636 convertibles were registered in 2012. That's more units more than were registered in each of the past three years, but the market has also grown as the economy has picked up speed, and as a percentage of new vehicles purchased, convertible sales are lagging.

Thus far in 2013, the Ford Mustang is America's top-selling convertible, with 6,421 units registered through the end of April, followed by its rival, the Chevrolet Camaro, at 4,751 units. The Volkswagen Beetle isn't far behind, with 4,305, but from that point, it's a steep drop off to the fourth-place Mercedes-Benz SL-Class and its 2,380 sales.