Early 1993 Dodge Viper on 2040-cars

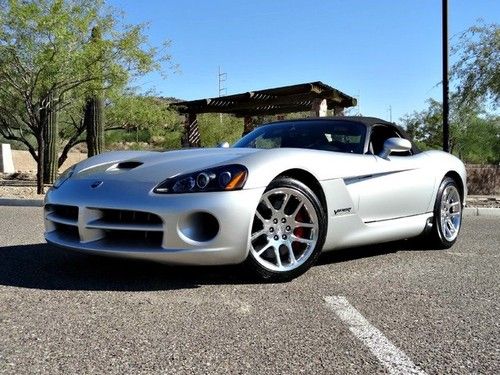

Flagstaff, Arizona, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:8.0L 7990CC 488Cu. In. V10 GAS OHV Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 10

Make: Dodge

Model: Viper

Trim: Base Convertible 2-Door

Options: Leather Seats, CD Player, Convertible

Drive Type: RWD

Mileage: 55,000

Exterior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Interior Color: Gray

Dodge Viper for Sale

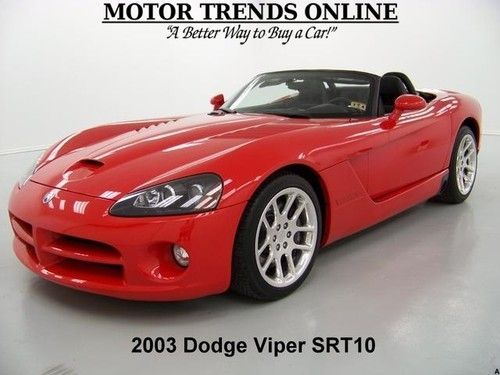

2003 dodge viper srt-10 srt 10 convertible alpine audio media leather 11k(US $45,900.00)

2003 dodge viper srt-10 srt 10 convertible alpine audio media leather 11k(US $45,900.00) 2003 dodge viper srt-10 roadster triple black only 11k texas direct auto(US $42,980.00)

2003 dodge viper srt-10 roadster triple black only 11k texas direct auto(US $42,980.00) 2008 dodge viper srt-10 convertible 3k miles! perfect! brett myers viper!(US $69,995.00)

2008 dodge viper srt-10 convertible 3k miles! perfect! brett myers viper!(US $69,995.00) No reserve 04 dodge viper convertible srt 10 clean carfax low miles !!!

No reserve 04 dodge viper convertible srt 10 clean carfax low miles !!! Srt10 coupe gts blue with white stripe only 7501 miles(US $56,980.00)

Srt10 coupe gts blue with white stripe only 7501 miles(US $56,980.00) 2000 dodge viper r/t-10 convertible 49k miles! look!

2000 dodge viper r/t-10 convertible 49k miles! look!

Auto Services in Arizona

Wades Discount Muffler, Brakes & Catalytic Converters ★★★★★

Unique Auto Repair ★★★★★

Transmission Plus ★★★★★

Super Discount Transmissions ★★★★★

Suntec Auto Glass & Tinting ★★★★★

Sluder`s Garage ★★★★★

Auto blog

Zombie cars: Discontinued vehicles that aren't dead yet

Thu, Jan 6 2022Car models come and go, but as revealed by monthly sales data, once a car is discontinued, it doesn't just disappear instantly. And in the case of some models, vanishing into obscurity can be a slow, tedious process. That's the case with the 12 cars we have here. All of them have been discontinued, but car companies keep racking up "new" sales with them. There are actually more discontinued cars that are still registering new sales than what we decided to include here. We kept this list to the oldest or otherwise most interesting vehicles still being sold as new, including a supercar. We'll run the list in alphabetical order, starting with *drumroll* ... BMW 6 Series: 55 total sales BMW quietly removed the 6 Series from the U.S. market during the 2019 model year. It had been available in three configurations, a hardtop coupe, a convertible and a sleek four-door coupe-like shape. BMW i8: 18 total sales We've always had a soft spot for the BMW i8, despite the fact that it never quite fit into a particular category. It was sporty, but nowhere near as fast as similarly-priced competitors. It looked very high-tech and boasted a unique carbon fiber chassis design and a plug-in hybrid powertrain, but wasn't really designed for maximum efficiency or maximum performance. Still, the in-betweener was very cool to look at and drive, and 18 buyers took one home over the course of 2021. Chevy Impala: 750 total sales The Impala represented classic American tastes at a time when American tastes were shifting away from soft-riding sedans with big interior room and trunk space and into higher-riding crossovers. A total of 750 sales were inked last year. Chrysler 200: 15 total sales The Chrysler 200 was actually a pretty nice sedan, with good looks and decent driving dynamics let down by a lack of roominess, particularly in the back seat. Of course, as we said regarding the Chevy Impala, the number of Americans in the market for sedans is rapidly winding down, and other automakers are following Chrysler's footsteps in canceling their slow-selling four-doors. Even if Chrysler never really found its footing in the ultra-competitive midsize sedan segment, apparently dealerships have a few leftover 2017 200s floating around. And for some reason, 15 buyers decided to sign the dotted line to take one of these aging sedans home last year.

Dodge performance trio thrashed on Roadkill

Tue, Apr 14 2015Of all the shows that Motor Trend does, Roadkill is probably the last one we'd pick to evaluate the latest performance automobiles. That's not a slight against David Freiburger or Mike Finnegan, who host the show: they're certified gear-heads and the go-to guys when it comes to hot rods, rat rods and anything grungier than it is shiny. But as exemplary as they are of Detroit muscle, the Charger Hellcat, Challenger Hellcat and Viper are also shiny new pieces of metal. Still, since it will now be sponsoring the show, someone at Dodge apparently thought it would be a good idea to hand Freiburger and Finnegan the keys to the company's top performance models. So to ring the best out of them, they solicited help from some of their colleagues at MT, gained access to a closed-down air strip, devised as many ways as they could to destroy the tires, and proceeded to set about doing exactly that. Watch the grin-inducing mayhem unfold in the half-hour clip above. Related Video:

2014 Dodge Durango leaks ahead of NY rollout

Wed, 27 Mar 2013Even though Chrysler will reportedly discontinue the Dodge Durango after the current model's lifespan - said to be around 2016 - that isn't stopping the automaker from improving its full-size, three-row SUV. The vehicle won't debut at the New York Auto Show until tomorrow, but images are already leaking out ahead of the embargo lift, and they show that the 2014 model is getting even more aggressive styling to go with more technology inside and out.

Dodge limited its early press shots of the new Durango to just the R/T trim level, but this new look adds a meaner look to this model with more dramatic projector-beam headlights along with a "floating" crosshair grille and a restyled fascia. At the rear of the Durango, LED racetrack taillights show a family resemblance to the Charger and Dart, while a new rear fascia adds to the styling while also allowing for an integrated trailer hitch.

On the tech side, the instrument panel looks to have been redesigned to include a standard seven-inch thin-film transistor (TFT) gauge cluster, and it also appears as if Chrysler's well-liked UConnect system has been updated with the 8.4-inch touchscreen found in other Chrysler vehicles. The 2013 model's conventional console shifter has been replaced by a rotary knob for gear selection, suggesting that there are transmission changes afoot as well. We'll have more details when the silks slide off this big boy tomorrow, so stay tuned.