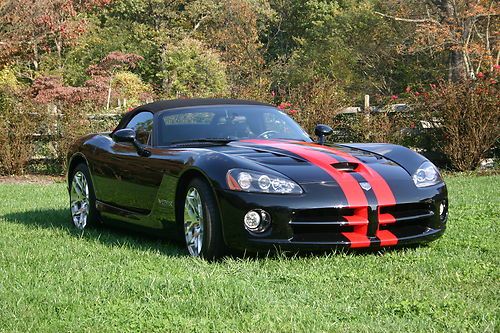

Dodge Viper 2006 on 2040-cars

Hagatna, Guam, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:8.3L 8275CC 505Cu. In. V10 GAS OHV Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Dodge

Model: Viper

Trim: SRT-10 Coupe 2-Door

Options: Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: RWD

Power Options: Air Conditioning, Power Locks, Power Windows

Mileage: 20,000

Sub Model: SRT-10

Exterior Color: Black

Disability Equipped: N/A

Interior Color: Black

Number of Doors: 2

Number of Cylinders: 10

Warranty: Vehicle does NOT have an existing warranty

2006 Dodge Viper, Perfect every thing works. Engine and drive train have about 1000 miles, all parts are very low milage. Car runs 11.3 at 133 in the quarter on a non prepped track. The next thing I would add to the car wold be a SPEC stage 5 clutch. Would make it a high to mid ten second car. Car is currently on Guam I am active duty military, Shipping to the states runs $2-3000.00. Not enough time to use the car it sits in the garage, and I have a baby on the way. I have over 30k in performance parts in the car.

Dodge Viper for Sale

2008 dodge viper srt-10 convertible 2-door 8.4l(US $71,000.00)

2008 dodge viper srt-10 convertible 2-door 8.4l(US $71,000.00) 2005 dodge viper 2 owner chrome wheels southern car signed by ralph giles of srt(US $41,989.00)

2005 dodge viper 2 owner chrome wheels southern car signed by ralph giles of srt(US $41,989.00) 1998 dodge viper r/t-10 convertible 2-door 8.0l

1998 dodge viper r/t-10 convertible 2-door 8.0l 1995 dodge viper convertible 2-door 8.0l low miles!

1995 dodge viper convertible 2-door 8.0l low miles! 1998 dodge viper gts(US $39,500.00)

1998 dodge viper gts(US $39,500.00) 2008 dodge viper srt-10 coupe 2-door 8.4l black red stripes low miles excellent!(US $72,000.00)

2008 dodge viper srt-10 coupe 2-door 8.4l black red stripes low miles excellent!(US $72,000.00)

Auto blog

Jeep Wrangler 4xe's hybrid powertrain: Could it be headed to other FCA products?

Fri, Sep 4 2020On its own, the 2021 Jeep Wrangler 4xe plug-in hybrid is a big deal for the brand and the model line. It's the most powerful and most efficient Wrangler by significant margins, and it doesn't give up the off-road capability that makes the Wrangler so special. But another great thing about this hybrid powertrain is its potential to be transplanted into other FCA vehicles. Just to recap, the layout of the Wrangler's hybrid powertrain, front to back, is as follows: engine, clutch, electric motor, clutch, transmission. The engine is the same 2.0-liter turbocharged four-cylinder that's a standalone engine for the Wrangler. The transmission and electric motor are sort of one unit, with the motor and clutch replacing the torque converter of the transmission. And the transmission itself is the ubiquitous eight-speed ZF automatic gearbox. Its transmission code name is 8HP75PH. The ZF eight-speed is available in every FCA product with a longitudinally-mounted engine and rear-wheel drive or four-wheel drive, with variations in the amount of power and torque it can handle. Not only that, but the Ram 1500 and 2500 and the Jeep Wrangler and Gladiator all have powertrains that utilize the non-hybrid version of the 8HP75 transmission specifically. Even the gear ratios for that transmission as well as the 8HP70 used in the Jeep Grand Cherokee, Dodge Durango, Dodge Charger and Chrysler 300 are nearly identical to those in the 8HP75PH. And a Fiat-Chrysler representative confirmed that the transmission portion of the hybrid drivetrain is basically carry-over from the regular 8HP75. So a transplant could be a relatively simple process. As for which of these models would be the most likely to receive the hybrid powertrain first, the Jeep Gladiator and Ram 1500 would seem like good bets, since they likely have the most similar transmissions, and the Gladiator in particular because of its closely-related underpinnings to the Wrangler. Both are also highly profitable trucks that sell well and could justify the development costs of adapting another powertrain. And in the case of the Ram, there's the impending F-150 hybrid to think about. Although Ram isn't going after a fully electric model, a PHEV could be a nice middle ground. A potential limiting factor would be whether the hybrid powertrain would be sufficiently robust to handle heavy payload and towing demands, particularly over longer periods.

2015 Dodge Challenger gets 6.4L 485-HP V8 Scat Pack

Thu, 17 Apr 2014While it's not seeing the drastic facelift of its brother, the Charger, at the 2014 New York Auto Show, the 2015 Challenger is packing some upgrades of its own. It wears even more retro-inspired styling cues, and there are new 6.4-liter Scat Pack and Shaker trims.

If you thought the Challenger looked retro before, Dodge is taking things even farther with inspiration for the refresh coming from the iconic 1971 model. Up front, it has a new split grille, a larger power bulge in the hood and projector fog lights. At the rear, the classic inspiration continues with split LED taillights with Gloss Black trim, and a rear valance panel redesigned to make the 2015 model look wider and lower.

The '71 motif is carried inside as well with a high-sill center console and aluminum gauge bezels. There's still more than a touch of modernity, with an available 8.4-inch Uconnect infotainment system and 7-inch customizable display between the retro-inspired speedometer and tachometer. For better safety, the Challenger is also now available with forward collision warning, adaptive cruise control, blind-spot monitoring and rear cross path detection. Stability control and electric power steering are standard across all models too.

Watch this Dodge Viper get clawed to death

Tue, 07 Jan 2014There's a scene in the James Bond movie, Casino Royale, where Daniel Craig's Agent 007 is captured by villain Le Chiffre, played by Mads Mikkelsen. Le Chiffre tortures Bond in a scene that is rather difficult to watch (especially for blokes) and impossible to describe on these digital pages (Google at your own risk). This video is the automotive equivalent of the Casino Royale torture scene.

It shows a Dodge Viper - a late, first-generation GTS judging by the center-exit exhausts - getting assaulted by a giant piece of heavy equipment. The large claw shows no mercy on the V10-powered sports car, rending its muscular curves into pieces and then running it over, just for good measure. It's a painful video to watch (and hear!), made worse because we don't know what the Viper did to deserve such a fate. About a third of the way through the video, the cameraman indicates that the man with the claw is a new operator from Chrysler, and it appears there may be some fire damage, but beyond that, we don't have much to go on.

Scroll down for the video but be warned, it isn't for the faint of heart.