2003 Chrysler Sebring Convertible on 2040-cars

Saint Petersburg, Florida, United States

Body Type:Convertible

Engine:V-6

Vehicle Title:Clear

Number of Cylinders: 6

Make: Chrysler

Model: Sebring

Trim: convertible

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

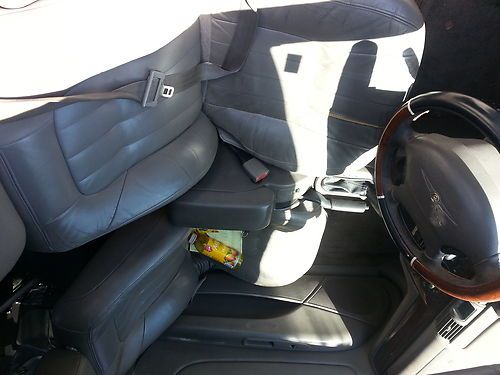

Options: Leather Seats, CD Player, Convertible

Mileage: 182,030

Safety Features: Driver Airbag, Passenger Airbag

Exterior Color: Dark Blue

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Interior Color: Dark Grey

This car is in decent condition. Everything works on the car. Car needs to be clean up on the inside. The seats are in good condition (leather seats). The back widows need motor. The ac works. The motor was replaced. Have receipt. Overall, the car is very reliable. Runs and drive very, very well.

Chrysler Sebring for Sale

2004 limited used 3l v6 24v automatic fwd coupe(US $6,900.00)

2004 limited used 3l v6 24v automatic fwd coupe(US $6,900.00) 2001 chrysler sebring convertible(US $1,500.00)

2001 chrysler sebring convertible(US $1,500.00) 2004 chrysler sebring touring convertible 2-door 2.7l(US $4,995.00)

2004 chrysler sebring touring convertible 2-door 2.7l(US $4,995.00) 2001 chrysler sebring, no reserve

2001 chrysler sebring, no reserve Convertible! pre-owned! clean! low miles! must sell! very low reserve!!

Convertible! pre-owned! clean! low miles! must sell! very low reserve!! 2000 chrysler sebring jxi black 120k miles clean title no reserve!

2000 chrysler sebring jxi black 120k miles clean title no reserve!

Auto Services in Florida

Xtreme Auto Upholstery ★★★★★

Volvo Of Tampa ★★★★★

Value Tire Loxahatchee ★★★★★

Upholstery Solutions ★★★★★

Transmission Physician ★★★★★

Town & Country Golf Cars ★★★★★

Auto blog

FCA's UAW workers to get $8,010 profit-sharing payout

Wed, Mar 3 2021UAW workers at FCA will soon be receiving $8,010 checks, which represent profit-sharing based on the company's 2020 performance. Although FCA's profit margins in 2020 were slimmer than the year prior, the union-employee payouts are slightly larger, due to a change in the formula that was negotiated in 2019 and has now gone into effect. Employees are now paid $900 for every 1% of profit margin FCA achieves in its North American operations. For 2020, the company enjoyed an 8.9% profit margin, and although that was down slightly from 9.1% in 2019, the checks are larger than last year's $7,280 payout. Still, FCA employees didn't fare quite as well as their counterparts at GM, who stand to receive profit-sharing checks of up to $9,000. GM workers did even better last year, netting $10,000. UAW workers at Ford had less to celebrate. They'll receive $3,525, based on the company's 2020 performance. That's a steep drop from last year's $6,600. FCA earned $6.472 billion in North America in 2020. The company is expecting an improved financial performance in 2021, as it's expected to avoid another coronavirus-related shutdown. It's also expected to benefit from the launch of the three-row Grand Cherokee L, as well as the Jeep Wagoneer and Grand Wagoneer, all of which are high-margin products. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Why this could be the perfect time for Apple to make a car play

Fri, Aug 31 2018While the automotive and technology worlds have been pouring billions into autonomous vehicles (AVs) and preparing to bring them to market soon as shared robo-taxis, Apple has mostly sat on the sidelines. Of course, Apple is the last company to ever make its intentions known, and the super-secret tech cult giant hasn't been totally out of the AV game based on the clues that have slipped out of its Cupertino, Calif., citadel over the past few years. Related: Apple self-driving cars are real — one was just in an accident News first broke in 2015 that it had assembled an automotive development team, in part by poaching high-profile talent from car companies, to work on a top-secret self-driving vehicle project code-named Titan. (Thank you very much, Nissan.) Apple also subsequently broke cover by making inquiries into using a Northern California AV testing facility and receiving a permit to test AVs on public roads in California. But then as the AV race started to heat up in the last few years, Apple reportedly began scaling back its car activities by downsizing team Titan. More recently, Apple's car project has shown signs of life with the hiring a high-level engineer away from Waymo and luring one Tesla's top engineers and a former employee back to Apple. It also inked a deal with Volkswagen to provide a technology platform and software to convert the automaker's new T6 Transporter vans into autonomous shuttles for employees at tech company's new campus. That is a far cry from giving rides to Wal-Mart shoppers, like Waymo is doing as part of its AV testing in Phoenix. But this could be the perfect time for Apple to enter the AV market now that ride-sharing is reaching critical mass and automakers and others are planning to deploy fleets of robo-taxis. Apple could easily establish a niche as a high-end ride-sharing service – and charge a premium – given its cult-like brand loyalty and design savvy. The growth of car subscription models could also play in Apple's favor since is already has many people hooked on paying for phones in monthly installments – and eager to upgrade when a new and better model becomes available. To achieve this, some believe Apple will fulfill co-founder and CEO Steve Job's dream of building a car. And as the world's first and only $1 trillion company it's sitting on a mountain of cash that certainly gives it the means. But other tech darlings like Tesla and Google have discovered how difficult it can be to build cars at scale.

Detroit automakers keep their masks on to keep the factories running

Tue, Oct 27 2020United Auto Workers members leave the Fiat Chrysler Automobiles Warren Truck Plant in May. Fiat Chrysler along with rivals Ford and General Motors Co., restarted the assembly lines after several weeks of coronavirus lockdown. (AP)  DETROIT — When the coronavirus pandemic slammed the United States in March, the Detroit Three automakers shut their plants and brought their North American vehicle production to an unprecedented cold stop. Now, four months after a slow and sometimes bumpy restart in May, many General Motors, Ford and Fiat Chrysler Automobiles factories are working at close to full speed, chasing a stronger-than-expected recovery in sales. So far, none of the Detroit Three has had a major COVID-19 outbreak since restarting production, even as the coronavirus is surging in Midwestern and Southern communities outside factory walls. "We have people testing positive, but it's not affecting operations," said Ford global manufacturing chief Gary Johnson. Keeping the pandemic at bay has pushed the automakers and 156,000 U.S. factory employees represented by the United Auto Workers into unfamiliar work routines and extraordinary levels of cooperation among the rival automakers that will have to be sustained for months to come. For automakers, the automakers' COVID response has been as much about instilling new habits as relying on new technology. Workers log their symptoms, or lack of them, into smartphone apps and walk past temperature scanners to get to their work stations. But company and union executives said masks, along with physical distancing, are the key to keeping assembly lines rolling. "The mask is the foundation" of protecting workers on the job, said Johnson. Complaints about masks Autoworkers are accustomed to wearing protective gear such as shatterproof glasses and gloves. Masks that cover the mouth and nose, however, were not standard equipment on auto assembly lines, and were a tough sell at first. "The biggest complaint is wearing a mask," United Auto Workers President Rory Gamble told Reuters. "A lot of our members perform physical tasks. Wearing the mask inhibits breathing." Beyond that, Gamble said, masks and distancing make it harder for workers to have conversations on the job or socialize during breaks. "ThatÂ’s pretty much out the window, and it makes for a longer day," he said. Masks make it harder for co-workers to read each other's expressions — often crucial in the noisy environment of a car plant.