2021 Chrysler Pacifica Wheelchair Handicap Mobility on 2040-cars

Engine:3.6L V6

Fuel Type:Gasoline

Body Type:Wheelchair Vans

Transmission:Automatic

For Sale By:Dealer

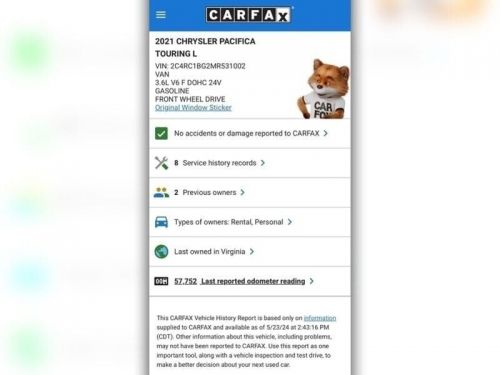

VIN (Vehicle Identification Number): 2C4RC1BG2MR531002

Mileage: 57773

Make: Chrysler

Trim: Wheelchair Handicap Mobility

Drive Type: --

Number of Cylinders: 3.6L V6

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Disability Equipped: Yes

Model: Pacifica

Chrysler Pacifica for Sale

2022 chrysler pacifica touring l(US $28,354.00)

2022 chrysler pacifica touring l(US $28,354.00) 2017 chrysler pacifica touring l 4dr mini van(US $100.00)

2017 chrysler pacifica touring l 4dr mini van(US $100.00) 2017 chrysler pacifica touring-l(US $11,824.40)

2017 chrysler pacifica touring-l(US $11,824.40) 2024 chrysler pacifica limited(US $35,279.30)

2024 chrysler pacifica limited(US $35,279.30) 2020 chrysler pacifica touring l braunability rear entry wheelchair ramp van(US $51,920.00)

2020 chrysler pacifica touring l braunability rear entry wheelchair ramp van(US $51,920.00) 2019 chrysler pacifica touring l plus fwd(US $20,791.00)

2019 chrysler pacifica touring l plus fwd(US $20,791.00)

Auto blog

Stellantis teases mystery electric Chrysler concept

Thu, Jul 8 2021Today's Stellantis "EV Day" information dump was littered with hints and teasers, but one of the most mysterious is this Chrysler EV that was rolled out during the company's discussion of its new vehicle architecture strategy. We know virtually nothing about the concept apart from the fact that it's clearly electrified (duh, EV Day) and appears to have a fairly production-friendly interior; there are even visible panel gaps on the dash and center console, which would be indicative of more than just a simple rendering based on a hypothetical future product. The screens on the dash and seatbacks would be generous for a mainstream product in today's market, but for a future premium EV? Looks the part. Sitting somewhere between a four-door sedan and the "c" word, the silhouette gives us some Polestar 2 vibes. If it's to be built, we expect it will be marketed as more SUV than sedan, which would mean an all-wheel drive option is pretty much guaranteed. Stellantis hinted that it is based on its new STLA Large EV platform, which will offer battery capacities between 101 and 118 kWh and up to 500 miles of range. We've reached out to Chrysler for more information, but we expect they won't have much for us until they're ready to make a formal announcement. Stay tuned. Stellantis EV Day coverage: Dodge will launch the 'world's first electric muscle car' in 2024 Fully electric Ram 1500 will begin production in 2024 Jeep will have 4xe plug-in hybrid models across the lineup by 2025 Stellantis teases mystery electric Chrysler concept Stellantis previews 4 electric platforms: Here's how they'll be used Fiat says all Abarth models to be electric from 2024 Opel Manta E will be the electric revival of the classic German coupe Stellantis says its 2021 performance has been better than expected  Â

Detroit Three autoworkers could get huge bonuses

Mon, 06 Jan 2014For a long time, being a line worker for one of the Detroit Three has meant living with an uncertain future. With the health of American automakers on the rise, though, things are also starting to look up for the men and women building the cars. The latest sign that things aren't bad? Big profit-sharing checks.

According to The Detroit News, Ford, General Motors and Chrysler could end up paying over $800 million to 130,000 workers as part of a profit-sharing plan. According to The News, the economic impact of these profits in Michigan alone could exceed $400 million, besting the NFL's Super Bowl, MLB's All-Star Game and the NHL's Winter Classic for their economic impact.

This is the third straight year the Detroit Three have issued profit-sharing checks to UAW employees, and for many workers, the checks are as close as they'll get to a raise, due to the most recent contract between the union and the manufacturers. On average, employees at GM and Ford receive $1 for every $1 million in North American (not just the US) pre-tax profits. Chrysler, meanwhile, gets a similar deal, although the Auburn Hills-based company calculates profit sharing using 85 percent of the brand's global profits.

EV cost burden pushing automakers to their limits, says Stellantis' CEO Tavares

Wed, Dec 1 2021DETROIT — Stellantis CEO Carlos Tavares said external pressure on automakers to quickly shift to electric vehicles potentially threatens jobs and vehicle quality as producers struggle with EVs' higher costs. Governments and investors want car manufacturers to speed up the transition to electric vehicles, but the costs are "beyond the limits" of what the auto industry can sustain, Tavares said in an interview at the Reuters Next conference released Wednesday. "What has been decided is to impose on the automotive industry electrification that brings 50% additional costs against a conventional vehicle," he said. "There is no way we can transfer 50% of additional costs to the final consumer because most parts of the middle class will not be able to pay." Automakers could charge higher prices and sell fewer cars, or accept lower profit margins, Tavares said. Those paths both lead to cutbacks. Union leaders in Europe and North America have warned tens of thousands of jobs could be lost. Automakers need time for testing and ensuring that new technology will work, Tavares said. Pushing to speed that process up "is just going to be counter productive. It will lead to quality problems. It will lead to all sorts of problems," he said. Tavares said Stellantis is aiming to avoid cuts by boosting productivity at a pace far faster than industry norm. "Over the next five years we have to digest 10% productivity a year ... in an industry which is used to delivering 2 to 3% productivity" improvement, he said. "The future will tell us who is going to be able to digest this, and who will fail," Tavares said. "We are putting the industry on the limits." Electric vehicle costs are expected to fall, and analysts project that battery electric vehicles and combustion vehicles could reach cost parity during the second half of this decade. Like other automakers that earn profits from combustion vehicles, Stellantis is under pressure from both establishment automakers such as GM, Ford, VW and Hyundai, as well as start-ups such as Tesla and Rivian. The latter electric vehicle companies are far smaller in terms of vehicle sales and employment. But investors have given Tesla and Rivian higher market valuations than the owner of the highly profitable Jeep and Ram brands. That investor pressure is compounded by government policies aimed at cutting greenhouse gas emissions. The European Union, California and other jurisdictions have set goals to end sales of combustion vehicles by 2035.