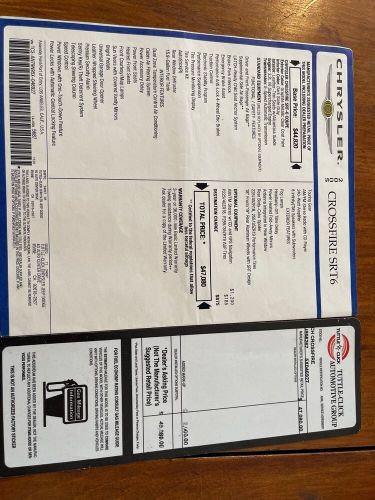

2005 Chrysler Crossfire Srt-6 on 2040-cars

Norco, California, United States

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

Engine:3.2L Gas V6

Year: 2005

VIN (Vehicle Identification Number): 1C3AN79N95X046927

Mileage: 106442

Trim: SRT-6

Number of Cylinders: 6

Make: Chrysler

Drive Type: RWD

Model: Crossfire

Exterior Color: Grey

Chrysler Crossfire for Sale

2005 chrysler crossfire(US $5,000.00)

2005 chrysler crossfire(US $5,000.00) 2005 chrysler crossfire(US $10,995.00)

2005 chrysler crossfire(US $10,995.00) 2005 chrysler crossfire limited(US $13,400.00)

2005 chrysler crossfire limited(US $13,400.00) 2004 chrysler crossfire(US $14,500.00)

2004 chrysler crossfire(US $14,500.00) 2008 chrysler crossfire limited(US $11,950.00)

2008 chrysler crossfire limited(US $11,950.00) 2005 chrysler crossfire limited(US $11,548.00)

2005 chrysler crossfire limited(US $11,548.00)

Auto Services in California

Zoll Inc ★★★★★

Zeller`s Auto Repair ★★★★★

Your Choice Car ★★★★★

Young`s Automotive ★★★★★

Xact Window Tinting ★★★★★

Whitaker Brake & Chassis Specialists ★★★★★

Auto blog

Dodge to resurrect Scat Pack?

Fri, 27 Sep 2013Before social media ever existed, if automotive enthusiasts wanted to be noticed or recognize other fans, they joined a car club. For Dodge muscle car lovers from 1968 through 1971, that group was known as the Scat Pack. Just like the Charger, Challenger and Dart nameplates, it looks like the Scat Pack could be getting a resurrection by Chrysler.

Automotive News is reporting that Chrysler recently renewed its trademark on the Scat Pack name, and while this is in no way a guarantee that the name will return, AN talked to Tim Kuniskis, Dodge President and CEO, who stoked the fire a little more. In the article, Kuniskis said that the name is "a very important part of our history" and added that "we like the whole idea of having a Scat Pack of cars." Scat Pack models were identified by their bumblebee stripes and helmet-wearing bumblebee logo, and the idea of a modern Scat Pack doesn't seem all that outlandish in light of recent vehicles like the Charger SRT Super Bee and the Ram 1500 Rumble Bee Concept.

What do you think, is this a cool idea, or is it just an unwelcome bit of nostalgia? Have you say in Comments.

European new car sales drop nearly 8% in first half of 2019

Thu, Jul 18 2019PARIS ó European car sales dropped 7.9% in June, led by bigger declines for Nissan, Volvo and Fiat Chrysler (FCA), according to industry data published on Wednesday. Registrations fell to 1.49 million cars last month from 1.62 million a year earlier across the European Union and EFTA countries, the Brussels-based Association of European Carmakers said in a statement. Calendar effects resulted in two fewer sales days in most markets, accentuating the decline. Registrations for the first half closed 3.1% lower, ACEA said. For European carmakers, weakening demand at home compounds the pressure from a sharper contraction in China and emerging markets that may yet bring more profit warnings. Nissan¬ís aging model lineup contributed to a 26.6% June sales slump while Volvo Cars, owned by China¬ís Geely, saw deliveries tumble 21.7%. Registrations also fell 13.5% last month at FCA, 10.1% at BMW, 9.6% at Volkswagen Group and 8.2% for both Mercedes parent Daimler and France¬ís PSA Group. The Peugeot maker¬ís domestic rival Renault suffered less, posting a 3.9% decline. By the Numbers BMW Chrysler Fiat Nissan Volkswagen Volvo Peugeot Renault

France tries to dodge blame for blowing up FCA-Renault merger deal

Thu, Jun 6 2019PARIS ó France sought to fend off a hail of criticism on Thursday after it was blamed for scuppering a $35 billion-plus merger between carmakers Fiat-Chrysler and Renault only 10 days after it was officially announced. Shares in Italian-American FCA and France's Renault fell sharply in early trading after FCA pulled out of talks, saying "the political conditions in France do not currently exist for such a combination to proceed successfully." French finance minister Bruno Le Maire said the government, which has a 15% stake in Renault, had engaged constructively, but had not been prepared to back a deal without the endorsement of Renault's current alliance partner Nissan. Nissan had said it would abstain at a Renault board meeting to vote on the merger proposal. However, a source close to FCA played down the significance of Nissan's stance in the discussions, believing French President Emmanuel Macron was looking for a way out of the deal after coming under pressure at home. Context The FCA-Renault talks were conducted against the backdrop of a French public outcry over 1,044 layoffs at a General Electric factory. The U.S. company had promised to safeguard jobs there when it acquired France's Alstom in 2015. The collapse of the deal, which would have created the world's third-biggest carmaker behind Japan's Toyota and Germany's Volkswagen, revives questions about how both FCA and Renault will meet the challenges of costly investments in electric and self-driving cars on their own. The merger had aimed to achieve 5 billion euros ($5.6 billion) in annual synergies, with FCA gaining access to Renault's and Nissan's superior electric drive technology and the French firm getting a share of FCA's lucrative Jeep and Ram brands. FCA has long been looking for a merger partner, and some analysts say its search for a deal is becoming more urgent as it is ill-prepared for tougher new regulations on emissions. It previously held unsuccessful talks with Peugeot maker PSA Group, in which the French state also owns a stake. French budget minister Gerald Darmanin said the door should not be closed on the possibility of a deal with Renault, adding Paris would be happy to re-examine any new proposal from FCA. "Talks could resume at some time in the future," he told FranceInfo radio.