Limited Suv 5.7l Cd Heavy Duty Service Group Trailer Tow Group 8 Speakers on 2040-cars

Miami, Florida, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Make: Chrysler

Warranty: Unspecified

Model: Aspen

Mileage: 80,645

Options: CD Player

Sub Model: Limited

Power Options: Power Windows

Exterior Color: Other

Interior Color: Gray

Number of Cylinders: 8

Vehicle Inspection: Inspected (include details in your description)

Chrysler Aspen for Sale

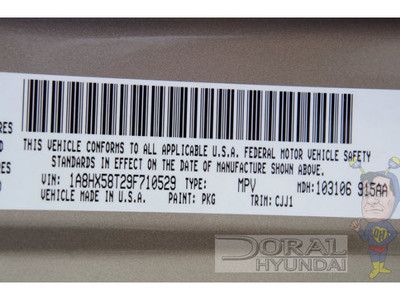

2008 chrysler aspen limited automatic 4-door suv

2008 chrysler aspen limited automatic 4-door suv Chrysler aspen 2007 limited,4x4,"hemi",leather,moon,sat,6cd,trailer tow,video(US $15,500.00)

Chrysler aspen 2007 limited,4x4,"hemi",leather,moon,sat,6cd,trailer tow,video(US $15,500.00) Mint limited suv 5.7l cd 4x4 navigation running boards heated seats sunroof

Mint limited suv 5.7l cd 4x4 navigation running boards heated seats sunroof 2007 chrysler aspen 2wd 4dr limited(US $13,998.00)

2007 chrysler aspen 2wd 4dr limited(US $13,998.00) Leather 3rd row roof rack mp3 dvd alpine audio sunroof navigation alloy wheels

Leather 3rd row roof rack mp3 dvd alpine audio sunroof navigation alloy wheels 70k clean miles nav sunroof leather hemi navigation chrome wheels autoamerica

70k clean miles nav sunroof leather hemi navigation chrome wheels autoamerica

Auto Services in Florida

Zephyrhills Auto Repair ★★★★★

Yimmy`s Body Shop & Auto Repair ★★★★★

WRD Auto Tints ★★★★★

Wray`s Auto Service Inc ★★★★★

Wheaton`s Service Center ★★★★★

Waltronics Auto Care ★★★★★

Auto blog

FCA issuing software update for 1.4M vehicles to prevent hacking

Fri, Jul 24 2015In the wake of a Jeep Cherokee being hacked remotely while on the road through its Uconnect infotainment system, FCA US is now issuing a software update for 1.4 million vehicles in the United States. Affected customers will receive a USB stick in the mail with the improved version; owners can check this website to see if their cars are affected. A large variety of models with FCA's 8.4-inch touchscreen infotainment system are affected. They include the 2015 Chrysler 200, 2015 Chrysler 300, 2015 Dodge Charger, and 2015 Dodge Challenger; 2013-2015 Dodge Viper; 2013-2015 Ram 1500, 2500, and 3500; 2013-2015 Ram 3500, 4500, and 5500 chassis cab; 2014-2015 Jeep Grand Cherokee and Cherokee; and 2014-2015 Dodge Durango. According to FCA in its announcement, the new software "insulates connected vehicles from remote manipulation." As of July 23, the company also "fully tested and implemented within the cellular network" additional security to prevent access to many of a vehicle's systems. FCA US says that it's conducting this campaign out of an abundance of caution and disputes the notion that there's a defect with these vehicles. Beyond the demonstration of the hack in the Cherokee, the automaker says that it's unaware of any other reports of these attacks actually happening. Related Video: Statement: Software Update July 24, 2015 , Auburn Hills, Mich. - FCA US LLC is conducting a voluntary safety recall to update software in approximately 1,400,000 U.S. vehicles equipped with certain radios. The recall aligns with an ongoing software distribution that insulates connected vehicles from remote manipulation, which, if unauthorized, constitutes criminal action. Further, FCA US has applied network-level security measures to prevent the type of remote manipulation demonstrated in a recent media report. These measures – which required no customer or dealer actions – block remote access to certain vehicle systems and were fully tested and implemented within the cellular network on July 23, 2015. The Company is unaware of any injuries related to software exploitation, nor is it aware of any related complaints, warranty claims or accidents – independent of the media demonstration.

Ford tumbles to second worst in Consumer Reports reliability survey, list dominated by Japanese [w/video]

Mon, 29 Oct 2012It's no secret that MyFord Touch has had its share of problems since being introduced, but the most recent reliability survey from Consumer Reports shows just how much this infotainment system has affected Ford. Just two years ago, the automaker was in the top 10 for the institute's reliability rankings, but since then, it has tumbled to the second-lowest rung just above dead-last Jaguar. In addition to MyFord Touch, CR also attributes a handful of new products that have had issues right out of the gate.

Compiled from 1.2 million subscriber surveys, this year's auto reliability survey heavily favors Japanese automakers, with eight of the 10 spots hailing from Japan. Toyota brands grabbed the top three spots (Scion, Toyota and Lexus - in that order) with Mazda, Subaru, Honda and Acura filling the next four spots. The only non-Asian automaker cracking the top 10 was Audi at number eight.

Audi climbed a total of 18 spots from last year, and Cadillac and GMC round out this year's top gainers breaking into the top 15. Helping Cadillac's upward movement, the CTS Coupe was named the most reliable domestic car. Lincoln, Volvo and Chrysler join Ford on this year's biggest loser list.

Junkyard Gem: 1990 Plymouth Laser RS Turbo

Mon, Jul 3 2017When Diamond Star Motors, a Chrysler-Mitsubishi joint venture, came online in the late 1980s, the first products to come out of the Normal, Illinois assembly plant were versions of the first-generation of the Mitsubishi Eclipse. There was the Eclipse itself, the Eagle Talon, and the Plymouth Laser. Here's a somewhat tattered example of the latter type, spotted in a Northern California self-serve yard. This car is unrelated to the Chrysler Laser of a few years earlier, which was based on the K-platform-derived Dodge Daytona. The Plymouth Laser was a pure Mitsubishi design. This one has the DOHC turbocharged 2.0-liter Sirius engine, rated at 190 horsepower. That was plenty of power by 1990 standards, a year in which the wildest possible Chevrolet Camaro (the IROC-Z, of course) packed just 230 hp under the hood. The IROC-Z weighed 3,149 pounds versus the Laser's 2,483, giving the Laser a slightly better power-to-weight ratio, not to mention a price tag more than $500 lower. CD players in cars were still uncommon in 1990; this Laser has the much more mainstream "computer controlled deck" cassette player, complete with nine-band graphic equalizer. Badging in futuristic typefaces was all the rage when this car was new. The all-wheel-drive Eclipse/Talon/Laser didn't hit dealerships until the 1991 model year, so all the '90s are front-wheel-drive only. The torque steer experienced in these cars could be exciting. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. In the United States, Tina Turner pitched the Laser. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. North of the border, Celine Dion did the Laser's TV ads. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. In Japan, the 1990 Eclipse featured "international breeze," whatever that is. Featured Gallery Junked 1990 Plymouth Laser RS Turbo View 23 Photos Auto News Chrysler Mitsubishi mitsubishi eclipse