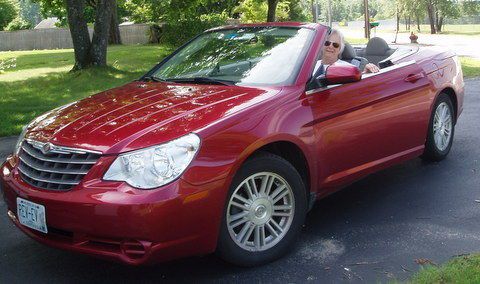

08 Sebring Touring-114k-special Touring Group-sat Radio-heated Seats-leather on 2040-cars

Mountain Lakes, New Jersey, United States

Chrysler Sebring for Sale

2008 chrysler sebring touring "z" hardtop convertible inferno red color(US $11,999.99)

2008 chrysler sebring touring "z" hardtop convertible inferno red color(US $11,999.99) Rare 4c 2.4l, gas saver, 2dr convertible, super low miles 30k, clean, no reserve

Rare 4c 2.4l, gas saver, 2dr convertible, super low miles 30k, clean, no reserve 2000 chrysler sebring jxi convertible 2-door 2.5l(US $3,500.00)

2000 chrysler sebring jxi convertible 2-door 2.5l(US $3,500.00) 2001 chrysler sebring lxi convertible--mechanic special with only 73k miles(US $2,199.99)

2001 chrysler sebring lxi convertible--mechanic special with only 73k miles(US $2,199.99) 2002 chrysler sebring limited convertible(US $4,900.00)

2002 chrysler sebring limited convertible(US $4,900.00) 2000 chrysler sebring jxi convertible 2-door 2.5l, 27500 original miles!(US $5,975.00)

2000 chrysler sebring jxi convertible 2-door 2.5l, 27500 original miles!(US $5,975.00)

Auto Services in New Jersey

Zp Auto Inc ★★★★★

World Automotive Transmissions II ★★★★★

Voorhees Auto Body ★★★★★

Vip Honda ★★★★★

Total Performance Incorporated ★★★★★

Tony`s Auto Service ★★★★★

Auto blog

2018 Chrysler Pacifica Hybrid long-term wrap-up | We're really gonna miss this one

Wed, Nov 6 2019Last year, we had the opportunity to live the (mini) van life for a year, with a loan from Chrysler. Even better, ours was going to be a plug-in hybrid. We took delivery of an Ocean Blue 2018 Chrysler Pacifica Hybrid Limited late last summer, and it quickly became more than a simple mode of transportation. The plug-in Pacifica was a much-beloved member of the Autoblog family, so much so that one editor considered buying it at the end of our loan. The end of that loan has, indeed, come, but not before this thing ferried editors, video producers and their families, friends, dogs and a whole lot of their belongings over a considerable portion of the country. It spent a lot of time in the wild woods of Northern Michigan, took a road trip through the Northeast and a vacation to Florida. It braved the cold in Buffalo, New York, on Nokian winter tires. The heated steering wheel didnít quite keep us warm, but we didn¬ít mind so much, with this quiet van¬ís peaceful manner. We didn¬ít drive this Pacifica Hybrid out West, but West Coast Editor James Riswick got one in Oregon to find out what it was like, and we told Big Blue all about it. We worried a bit when she went in for a recall, and were proud of how the Pacifica stood up to a rival. In all, we put close to 26,000 miles on the Pacifica Hybrid ¬ó roughly 9,000 of which were under electric power alone ¬ó before reluctantly giving it back. We¬íre not sure where she ended up, but there¬ís a good chance that giant interior still carries a part of us with it, whether it¬ís a stray dog hair under a carpet mat, a Cheerio wedged in a seat cushion or a fingerprint on some tucked-away surface. We loved that damn minivan. Let us tell you why, one last time. Senior Editor, Green, John Beltz Snyder: The Pacifica Hybrid made countless trips with me between my home in Ann Arbor and our office in Birmingham, with a fair share of 500-mile round trips to our cottage Up North. Whenever I had it, my son ¬ó who grew from a large toddler to a large pre-schooler over the course of our loan ¬ó wanted to sit inside. Sometimes, he wanted to go for quiet laps around the driveway. Others, he¬íd want to play the letter game on the rear-seat entertainment system, or play with the power doors. He¬íd pretend it was an airplane taking us to Dublin again, or a spaceship he could show off to the babysitter. It was a safe, comfortable space for him, and for me.

The problem with how automakers confront hacking threats

Thu, Jul 30 2015More than anyone, Chris Valasek and Charlie Miller are responsible for alerting Americans to the hacking perils awaiting them in their modern-day cars. In 2013, the pair of cyber-security researchers followed in the footsteps of academics at the University of Cal-San Diego and University of Washington, demonstrating it was possible to hack and control cars. Last summer, their research established which vehicles contained inherent security weaknesses. In recent weeks, their latest findings have underscored the far-reaching danger of automotive security breaches. From the comfort of his Pittsburgh home, Valasek exploited a flaw in the cellular connection of a Jeep Cherokee and commandeered control as Miller drove along a St. Louis highway. Remote access. No prior tampering with the vehicle. An industry's nightmare. As a result of their work, FCA US recalled 1.4 million cars, improving safety for millions of motorists. For now, Valasek and Miller are at the forefront of their profession. In a few months, they could be out of jobs. Rather than embrace the skills of software and security experts in confronting the unforeseen downside of connectivity in cars, automakers have been doing their best to stifle independent cyber-security research. Lost in the analysis of the Jeep Cherokee vulnerabilities is the possibility this could be the last study of its kind. In September or October, the U.S. Copyright Office will issue a key ruling that could prevent third-party researchers like Valasek and Miller from accessing the components they need to conduct experiments on vehicles. Researchers have asked for an exemption in the Digital Millennial Copyright Act that would preserve their right to analyze cars, but automakers have opposed that exemption, claiming the software that runs almost every conceivable vehicle function is proprietary. Further, their attorneys have argued the complexity of the software has evolved to a point where safety and security risks arise when third parties start monkeying with the code. Their message on cyber security is, as it has been for years, that they know their products better than anyone else and that it's dangerous for others to meddle with them. But in precise terms, the Jeep Cherokee problems show this is not the case. Valasek and Miller discovered the problem, a security hole in the Sprint cellular connection to the UConnect infotainment system, not industry insiders.

May 2016: FCA wins, Ford and GM stumble on weak car volumes

Wed, Jun 1 2016The May 2016 sales numbers are in, and it looks as though FCA is getting some vindication for boldly cancelling two slow-selling car models. Meanwhile, Ford saw overall sales dip and GM's May volume took a big dive versus the same month in 2015. While Marchionne's decision to axe the Chrysler 200 and Dodge Dart has drawn criticism as being short-sighted, it's working for FCA so far. Although the Dart and 200 aren't out of production yet and no capacity has been shifted to crossover or trucks, May's numbers show that the emphasis on Jeep and Ram models makes sense right now. FCA's US sales rose 1 percent last month compared to May 2015, putting the year-to-date total at 955,186 vehicles, an increase of 6 percent compared to the same period last year. Standouts included the Jeep Renegade, Compass, and Patriot, and the Fiat 500X. Ram pickup sales were down 3 percent. And your fun fact is that Alfa Romeo sales were up precisely 10 percent, for a total of 44 4Cs sold versus 40 in the same month last year. At FoMoCo, the Ford brand took a hit to the tune of 6.4 percent from May 2015 to 2016, registering 226,190 sales last month. Lincoln showed improvement on its modest numbers, going from 9,174 to 9,807, a 6.9 percent increase. Overall, Ford was down 5.9 percent for the month to 235,997; despite the slump, year-to-date total Ford sales are up 4.2 percent to 1,112,939. Strong sellers included Escape, Expedition, F-Series, and Transit - big stuff. Most small and/or efficient models (Fiesta, Focus, Fusion, C-Max) saw sales slides. Fusion sales were also down, likely due to effects of model changeover to the freshened 2017 model. Ford has promised four new crossovers and SUVs by 2020 and if things keep trending this way the company will be able to sell them, but things could change in the next four years. GM saw the worst of it for domestic brands. Retail and fleet sales were down for each of the four divisions, with the May 2016 total dropping 18 percent to 240,450 vehicles. GM's year-to-date sales are down 5.0 percent in 2016 to 1,183,705. Both the Sierra and Silverado were down significantly, and the majority of Chevy, Buick, GMC, and Cadillac nameplates saw sales decreases, with both small cars and larger utilities included. Not even big stuff could help GM this month, it seems. We'll have more on the rest of the industry's May sales as those figures trickle in.