1956 Chrysler 2 Door Ht on 2040-cars

Saco, Maine, United States

Transmission:Powerflite

Vehicle Title:Clear

Mileage: 77,000

Make: Chrysler

Exterior Color: Red

Model: Newport

Interior Color: Red and White

Trim: 2 Door HT

Number of Cylinders: 8

Drive Type: Push Button

1956 Chrysler Windsor Newport 2 Door HT Excellent Condition - Car was restored body and interior 6 yrs ago. Engine was completely rebuilt 2 yrs ago. Car presently has 354 Hemi. Car drives and runs as it should. Have original motor (goes with the car).

Chrysler Newport for Sale

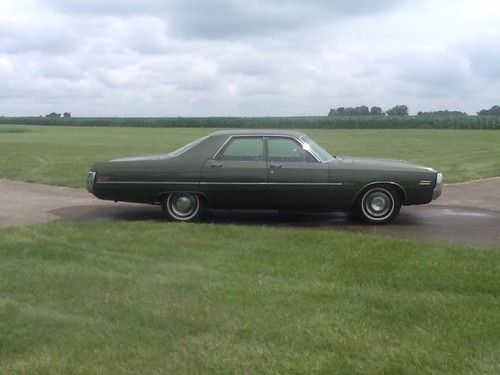

1977 chrysler newport_400 ci v8_auto_31k miles_1 owner_all original_#'s match

1977 chrysler newport_400 ci v8_auto_31k miles_1 owner_all original_#'s match 1961 chrysler newport 2-dr hardtop coupe(US $18,750.00)

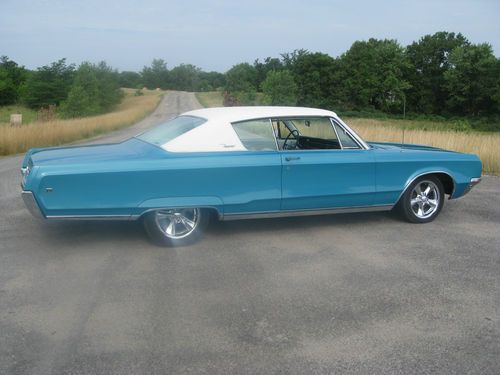

1961 chrysler newport 2-dr hardtop coupe(US $18,750.00) 1967 chrysler newport 4-door 6.3l

1967 chrysler newport 4-door 6.3l 1968 chrysler newport custom hardtop 2-door mopar big block(US $7,750.00)

1968 chrysler newport custom hardtop 2-door mopar big block(US $7,750.00) 1971 chrysler newport royal 6.3l(US $5,500.00)

1971 chrysler newport royal 6.3l(US $5,500.00) 1962 chrysler newport, 4 door, all original, mopar, classic car, 383 big block

1962 chrysler newport, 4 door, all original, mopar, classic car, 383 big block

Auto Services in Maine

Whitney`s Collision West ★★★★★

Union Street Towing ★★★★★

Showroom Collision Center ★★★★★

Prompt Transmission ★★★★★

Prior Brothers Auto Repair ★★★★★

Nankin Value Battery ★★★★★

Auto blog

UPDATED: ‘The auto industry has lost a true giant’

Wed, Jul 25 2018Former Fiat Chrysler Chief Executive Sergio Marchionne, one of the auto industry's most tenacious and respected auto chiefs, has died, succumbing to complications from surgery. Following are some of THE tributes paid to Marchionne:Apple CEO Tim Cook: "Sad to hear of the unexpected passing of Sergio Marchionne, an auto industry visionary and a remarkable leader. Our thoughts are with his family, friends and everyone at Fiat Chrysler."U.S. President Donald Trump: "Sergio Marchionne, who passed away today, was one of the most brilliant & successful car executives since the days of the legendary Henry Ford. It was a great honor for me to get to know Sergio as POTUS, he loved the car industry, and fought hard for it. He will be truly missed!"Canadian Prime Minister Justin Trudeau: "He was a giant in the auto industry, a friend of the Italian-Canadian community, and a visionary in the corporate world. Sergio Marchionne's death is a huge loss, and Sophie and I send our condolences to his family and friends."PSA Group CEO Carlos Tavares: "I am extremely sorry to hear this very sad news and I extend my sincere condolences to the family of Sergio Marchionne. Marchionne's leadership will remain our benchmark in the automotive industry."Aston Martin CEO Andy Palmer: "We are deeply saddened to learn of the passing of Sergio Marchionne. On behalf of all of us at Aston Martin Lagonda, I would like to extend our sincere sympathies and condolences to his family, friends and colleagues at Fiat Chrysler Automobiles."Daimler Chief Executive Dieter Zetsche: "The auto industry has lost a real giant. And many of us have lost a very dear friend: Sergio Marchionne."Gary Jones, United Auto Workers President: "During the industry's dark days of the recession, Chrysler, Dodge, Jeep and RAM were at a perilous point. Working with the UAW members, the FCA rebirth was born when many doubted it would come. As in all labor-management relationships, there were clashes and disagreements." "And when history looks back at his legacy, despite bumps and bruises along the way, in the end, the sun wasn't setting when he left the company, the sun was rising. That will long be remembered."Chase Carey, Chairman and CEO of Formula One motor racing: "He led with great passion, energy and insight, and inspired all around him. His contributions to Formula 1 are immeasurable.

Chrysler's Hurricane engine detailed ahead of 2016 launch

Fri, 20 Sep 2013We've been hearing distant rumblings about Chrysler's new Hurricane engine for some time now, but details have been hard to come by. Now, Automotive News is adding some specifics to the scuttlebutt, citing Chrysler documents. According to the industry publication, the Hurricane will blow onto the scene in 2016, but it's not an all-new engine. Rather, it will be rooted in the company's existing 2.0-liter four-cylinder Tigershark powerplant (shown above), albeit with "many new technologies to achieve excellent fuel economy."

It's not clear what sort of technologies Chrysler is referring to, but the Hurricane is expected to continue to use an aluminum block, and the finished product is expected to generate even better figures than the existing 2.0-liter's 160 horsepower and 148 pound-feet of torque (as found in the Dodge Dart). Automotive News notes that the updated 2.4-liter Tigershark debuting in the entry-level 2014 Jeep Cherokee has its basis in the 2.0-liter lump, but unlike the smaller engine, it's been fitted with MultiAir2 electrohydraulic variable valve timing to realize 184 hp and 171 lb-ft and greater efficiency.

Perhaps the Hurricane will incorporate the latter in its bag of tricks? Either way, we're hoping for a more generous torque curve than the what's in the current 2.0-liter Tigershark, which is something of a slug in the Dart - even for a base economy compact.

Chrysler Pacifica adds sixth trim level: Touring Plus

Thu, Apr 27 2017While some of us might not want to admit our fondness for the homely minivan, there's something about the Chrysler Pacifica that gets unlikely drivers giving it the up-and-down on the sly (speaking from experience, here). A year into its life, the kinda-cool people hauler is getting a sixth trim level, called Touring Plus, that falls about in the middle of the lineup. Slotting in above the Touring trim ($32,090), the $33,455 Touring Plus offers a number of visual and convenience upgrades, but retains the cloth seats (for leather, you'll still have to move up to the Touring L level, at $36,090). On the outside, it gets the mesh lower fascia and foglights shared with the higher trim levels, plus projector headlights and LED taillights. For comfort and convenience, it offers three-zone climate control, power liftgate, a universal garage door opener, and second- and third-row sunshades to give your kids the limo treatment. As an added bonus for Touring Plus customers who opt for the 18-inch wheels and the 8.4-inch Uconnect infotainment center, Chrysler will throw in the single overhead DVD player for free. If you were waiting for the "just right" Pacifica to become available, and this higher-content, cloth-seat version suits you just right, there's no need to wait. The Pacifica Touring Plus is available now. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Related Gallery 2017 Chrysler Pacifica: First Drive View 35 Photos News Source: FCA Auto News Chrysler Minivan/Van chrysler pacifica