1983 Chrysler Lebaron Convertible, Mark Cross, Wood Trim, 28k Miles, New Top on 2040-cars

Sarasota, Florida, United States

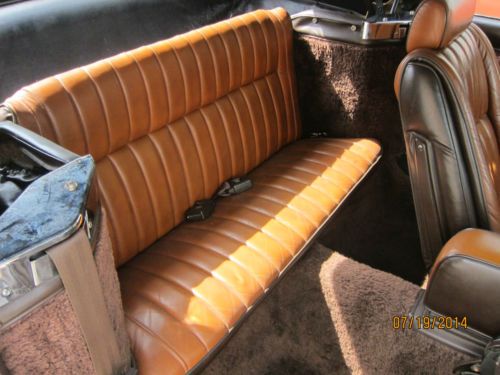

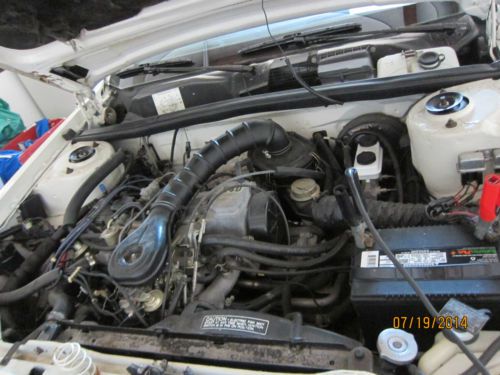

This vehicle is in near showroom condition and mileage is correct. Minor cosmetics may be needed: Some wood panels on door need replacement, estimate: $300; some surface rust on trunk lid. |

Chrysler LeBaron for Sale

1985 chrysler lebaron convertible

1985 chrysler lebaron convertible --w@w--check this out---no reserve--high bidder wins--rare find---you will love

--w@w--check this out---no reserve--high bidder wins--rare find---you will love 1987 chrysler lebaron convertible indy 500 pace car

1987 chrysler lebaron convertible indy 500 pace car 1979 chrysler lebaron 4 door 8 cyclinder 318 cu.in. 5.2 litre non running

1979 chrysler lebaron 4 door 8 cyclinder 318 cu.in. 5.2 litre non running 1989 chrysler lebaron tc by maserati !! 47,007 act miles, pristine

1989 chrysler lebaron tc by maserati !! 47,007 act miles, pristine 1989 chrysler lebaron convertable no reserve out of storage for 7 yrs rust free!

1989 chrysler lebaron convertable no reserve out of storage for 7 yrs rust free!

Auto Services in Florida

Zephyrhills Auto Repair ★★★★★

Yimmy`s Body Shop & Auto Repair ★★★★★

WRD Auto Tints ★★★★★

Wray`s Auto Service Inc ★★★★★

Wheaton`s Service Center ★★★★★

Waltronics Auto Care ★★★★★

Auto blog

GM, FCA retain financial advisors amid merger rumors

Thu, Jun 18 2015Well, here we go again. Despite allegedly shutting down the idea of a merger, General Motors has retained financial advisors to, well, advise it on Fiat Chrysler Automobiles' advances. GM brought in New York-based Goldman Sachs, while FCA is currently working with Switzerland's UBS. Another source told Reuters that GM was working with Morgan Stanley, as well. But what does all this mean? Well, as we know, FCA boss Sergio Marchionne still has his eyes set very much on merging his automaker to combat what he claims are the prohibitive costs that come from developing today's vehicles. And while GM has said "no thanks," to a merger, the FCA boss is still looking to shareholders of the world's third-largest automaker to force the issue. Rather than a sign of an impending merger, voluntary or otherwise, between the two automotive powers – analysts called a hostile move by FCA "beyond ambitious," after all – retaining financial advisors on both sides could be viewed as just good business. News Source: ReutersImage Credit: Paul Sancya / AP Chrysler Fiat GM Sergio Marchionne FCA

For some, getting a Fiat 500e last week was almost free

Sun, Mar 22 2015Auto-racing clubs know a thing or two about moving fast. And a couple of them out in California appeared to do just that when a bunch of incentives for the Fiat 500e electric vehicle added up to a pretty sweet deal. Actually, a borderline free one. Green Car Reports was kind enough to do the math on the calculation of an $83-a-month, three-year lease deal on that included a $2,100 perk and required an $11,000 downpayment on the $32,000 car. California and federal government incentives for EVs cut that downpayment down to $1,000 out of pocket once the incentives ($7,500 from the feds, $2,500 from the state) were factored in by the leasing company. Then, Fiat-Chrysler was throwing in another $1,000 for folks who were leasing a car from another car company, hence the freebie. That means some lucky people, at least temporarily, were able to work basically a zero-downpayment agreement for a three-year lease on a car whose monthly payment is the equivalent of about two full tanks of gas. Once word of those perks got around to some California racing clubs, about 100 500e vehicles to be moved off of California lots during the past week or so. Plugged in, indeed. Related Videos: Featured Gallery 2013 Fiat 500e: Review View 40 Photos News Source: Green Car Reports Green Chrysler Fiat incentives fiat 500e

Court ruling to delay Fiat's Chrysler buyout?

Thu, 01 Aug 2013We've already reported on the attempts of Fiat to purchase the remaining 41.5-percent stake in Chrysler, currently owned by the United Auto Workers' VEBA healthcare trust. And while the issues still aren't resolved, Fiat has received both a bit of good news and a bit of bad news from a Delaware judge.

The good news is that the court ruled in favor on two key arguments of Fiat's, relating to what is a fair price for the Chrysler shares. The rulings essentially slash half a billion dollars off the price of the 54,000 shares owned by VEBA, according to a report from Reuters.

The bad news is that this makes the UAW an even more difficult opponent in negotiations. Its VEBA fund is meant to cover ever escalating retiree healthcare costs, so naturally, the UAW wants to get as much money as possible. Losing a big chunk of cash isn't likely to make the union more cooperative.