1955 Chrysler Imperial Base Sedan 5.4l V8 Project Car. Needs Restoration, Parts on 2040-cars

Bolingbrook, Illinois, United States

|

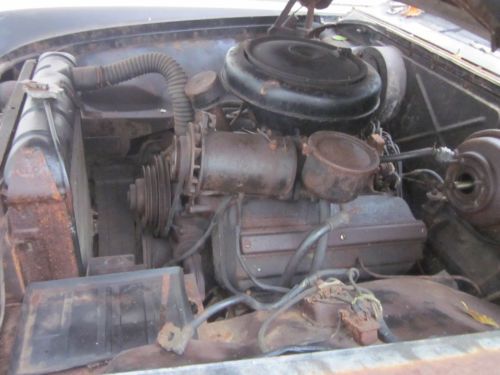

For sale from my personal collection is this 1955 Chrysler Imperial serial number C556507 which can be a great project car or a parts car. The car is all there has engine and transmission. Glass is all there except for the rear driver side window which has a crack. Please see pictures. This vehicle was purchased as a donor for another 1956 Imperial which I also have for sale. Too many projects and too little time are forcing me to sell them. They can be purchased as a package or individually. Please see item number 231188373501 for the other 56' Imperial in have for sale. This Car comes with a bill of sale. Any questions I can answer or any concerns you have please don't hesitate to contact me and I will try to answer them.

|

Chrysler Imperial for Sale

1931 chrysler imperial custom 8 sedan, 50,242 actual documented miles!(US $119,900.00)

1931 chrysler imperial custom 8 sedan, 50,242 actual documented miles!(US $119,900.00) 1963 chrysler imperial crown excellent condition(US $19,500.00)

1963 chrysler imperial crown excellent condition(US $19,500.00) 1963 chrysler imperial crown convertible

1963 chrysler imperial crown convertible 1983 chrysler imperial base hardtop 2-door 5.2l

1983 chrysler imperial base hardtop 2-door 5.2l 1954 chrysler imperial

1954 chrysler imperial Rare find 1 of 9,415 made all original very solid classic collector car wow !!(US $4,900.00)

Rare find 1 of 9,415 made all original very solid classic collector car wow !!(US $4,900.00)

Auto Services in Illinois

Waukegan-Gurnee Auto Body ★★★★★

Walker Tire & Exhaust ★★★★★

Twin City Upholstery ★★★★★

Tuffy Auto Service Centers ★★★★★

Top Line ★★★★★

Top Gun Red ★★★★★

Auto blog

GM seeks appeals court ruling to continue legal fight with Fiat Chrysler

Sun, Jun 28 2020DETROIT — General Motors on Friday asked a U.S. appeals court to allow it to continue pursuing its civil racketeering suit against rival Fiat Chrysler Automobiles, rejecting a lower court judge's belittling of the complaint. The automaker's filing with the Sixth Circuit Court of Appeals comes less than a week after U.S. District Court Judge Paul Borman called GM's suit against Fiat Chrysler a "waste of time and resources" at a time when both automakers should be focused on surviving the coronavirus pandemic. Borman ordered GM Chief Executive Mary Barra and Fiat Chrysler CEO Mike Manley to meet by July 1 to negotiate a resolution. "As we have said from the date this lawsuit was filed, it is meritless," FCA said on Friday. "FCA will continue to defend itself vigorously and pursue all available remedies in response to GM's groundless lawsuit. We stand ready to comply with Judge Borman's order," it added. In its motion, GM asked the appeals court to throw out Borman's order and reassign the case to a different district court judge. It called Borman's order "unprecedented" and "a profound abuse" of judicial power. GM sued Fiat Chrysler last year, accusing the Italian-American company's executives of bribing United Auto Workers union officials to secure labor agreements that put GM at a disadvantage. Fiat Chrysler is under investigation by the U.S. Justice Department as part of a wide-ranging probe of UAW corruption. GM's accusations came as Fiat Chrysler and French automaker Peugeot were in the early stages of preparing for a merger. Fiat Chrysler has said the suit was aimed at disrupting that deal. GM has said the suit has nothing to do with the merger. In a statement, GM rejected Borman's characterization of the suit as a "distraction" and defended its decision to press the case. "We filed a lawsuit against FCA for the same reason the U.S. Department of Justice continues to investigate the company: former FCA executives admitted they conspired to use bribes to gain labor benefits, concessions and advantages. Based on the direct harm to GM these actions caused, we believe FCA must be held accountable." Related Video: Government/Legal UAW/Unions Chrysler Fiat GM

Fiat Chrysler, GM are trying 7-year 0% loans, online buying to lift plunging sales

Thu, Apr 2 2020With auto showrooms shut during the coronavirus pandemic, Fiat Chrysler and General Motors moved to reboot demand with seven-year, no-interest loans and programs allowing customers to buy vehicles online. Fiat Chrysler Automobiles' new "Drive Forward" marketing program includes online shopping tools that will for the first time allow U.S. customers to complete the purchase of a vehicle through an FCA dealer without setting foot in a dealership, a company spokesman said. The move toward online sales and home delivery breaks with a long U.S. auto sector tradition of manufacturers giving franchised dealers control of sales to consumers. Dealers have fought Tesla 's efforts to sell vehicles directly to consumers through its website. GM and Fiat Chrysler's promotions of extended, no-interest loans — made less costly by the Federal Reserve's recent interest rate cuts — echo the "Keep America Rolling" sales push GM launched to jump start a paralyzed consumer market after the Sept. 11, 2001, attacks. But the pandemic has been pulling auto retailing into the digital age, with dealerships shuttered across the country and sales likely to take a further beating in April as social distancing guidelines remain in place.  Related: Auto sales drop in March as coronavirus hits demand, output  FCA shares were down 4.9% to $6.84 in afternoon trading in New York after the company posted a 10% drop in first-quarter U.S. auto sales, as the pandemic hurt demand and halted production from mid-March. The company, however, did not break out sales by month. General Motors reported its first-quarter sales fell 7% because of significant declines in March, and said customers can use its existing "Shop.Click.Drive." program to find, purchase and arrange for home delivery of a vehicle. A GM spokeswoman said across the Chevrolet, Buick, GMC and Cadillac brands the automaker has seen two to four times greater online site visits and sales leads than before the pandemic. Hyundai said earlier that its U.S. sales fell 43% in March due to the pandemic. "It goes without saying that the entire world is facing a tremendous challenge that is having a significant impact on business and our normal way of life," Randy Parker, vice president for sales at Hyundai Motor America, said in a statement. Toyota said its sales were down nearly 37% in March and 8.8% for the quarter. Nissan reported a 27% drop in first-quarter sales.

Marchionne ready to get tough with GM over merger

Mon, Aug 31 2015FCA CEO Sergio Marchionne absolutely refuses to let go of his dream of a merger with General Motors. With official discussions not happening, Marchionne now hints that a hostile takeover attempt of The General could be under consideration as a future strategy. In a massive interview with Automotive News, the boss explains why a tie-up with GM might be such a windfall for both automakers. By Marchionne's numbers, a merged GM-FCA would produce $30 billion a year in global earnings and 17 million vehicles annually. He claims these huge figures are based on analyzing plants around the world to find growth opportunities. So far, GM is refusing to sit down and look at the numbers, let alone even begin to negotiate. For now, Marchionne just wants to talk, but he's not against aggressive action, if necessary. He uses a bizarre metaphor in the interview to explain his feelings. "There are varying degrees of hugs. I can hug you nicely, I can hug you tightly, I can hug you like a bear, I can really hug you. Everything starts with physical contact," he said to Automotive News. "An attack on GM, properly structured, properly financed, it cannot be refused," he said in the interview. Marchionne is looking for partners, too. The UAW's significant stake in GM could be a strong ally, and he's reportedly recruiting activist investors for more help. Selling Magneti Marelli and spinning off Ferrari would put even more cash in the war chest. Both sides also have banks at their aid. While Marchionne received positive replies from some of his "Plan B" partners, he apparently lost interest in working with them. "Are they the people I wanted to get the response from? The answer is probably not. There are people who are interested in doing deals," he said in the interview. News Source: Automotive News - sub. req.Image Credit: Paul Sancya / AP Photo Earnings/Financials Chrysler Fiat GM Sergio Marchionne FCA merger