Very Clean 2005 Chrysler Crossfire Srt-6 Coupe 2-door 3.2l on 2040-cars

Carbondale, Illinois, United States

Body Type:Coupe

Engine:3.2L 3199CC V6 GAS SOHC Supercharged

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Year: 2005

Number of Cylinders: 6

Make: Chrysler

Model: Crossfire

Trim: SRT-6 Coupe 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: RWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 89,150

Sub Model: SRT-6

Disability Equipped: No

Exterior Color: Gray

Interior Color: Black

Number of Doors: 2

|

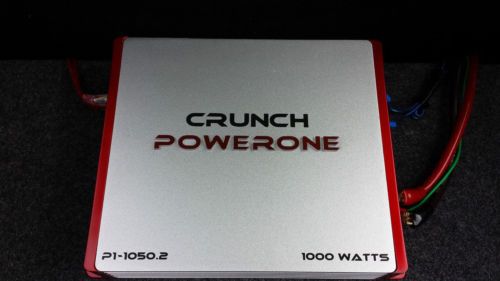

Up for sale a very nice 2005 Chrysler Crossfire SRT-6 that has supercharged 3.2l engine. It has an upgraded sound system that I paid about $1,000 for. The car is in very good condition mechanically and cosmetically. Clean title and clean carfax with no accidents. Please, let me know if you have any question.

|

Chrysler Crossfire for Sale

2005 chrysler crossfire limited coupe 2-door 3.2l no reserve

2005 chrysler crossfire limited coupe 2-door 3.2l no reserve 2004 chrysler crossfire coupe 2-door(US $11,500.00)

2004 chrysler crossfire coupe 2-door(US $11,500.00) 2dr roadster convertible 3.2l 4-wheel abs 4-wheel disc brakes 6-speed m/t a/c

2dr roadster convertible 3.2l 4-wheel abs 4-wheel disc brakes 6-speed m/t a/c No reserve! clean sporty coupe rare southern no rust! just serviced nice & fun!

No reserve! clean sporty coupe rare southern no rust! just serviced nice & fun! 2004 chrysler crossfire

2004 chrysler crossfire 2008 crysler crossfire coupe 30k miles cd/gps nav 3.2l v6 excellent condition

2008 crysler crossfire coupe 30k miles cd/gps nav 3.2l v6 excellent condition

Auto Services in Illinois

USA Muffler & Brakes ★★★★★

The Auto Shop ★★★★★

Super Low Foods ★★★★★

Spirit West Motor Carriage Body Repair ★★★★★

South West Auto Repair & Mufflers ★★★★★

Sierra Auto Group ★★★★★

Auto blog

Strains between France and Italy risk Renault-FCA merger

Thu, May 30 2019PARIS/ROME — Fiat Chrysler's proposed $35 billion merger with Renault has cheered investors, won conditional support from Paris and Rome and even earned cautious backing from trade unions. Beneath this veneer, however, the bold attempt to create the world's third-largest carmaker risks becoming rapidly embroiled in the fraught relationship between France's europhile President Emmanuel Macron and Italy's euroskeptic leaders. For while Deputy Prime Minister Matteo Salvini hailed the proposal as a "brilliant operation," Italy's creaking, state-subsidized Fiat factories are likely to bear the brunt of any production-related cost savings. FCA and Renault said this week that more than 5 billion euros ($5.6 billion) of annual savings would come mainly from combining platforms, consolidating powertrain and electrification investments and the benefits of increased scale. Salvini and France's Finance Minister Bruno Le Maire, who called the deal a "good opportunity" to build a European industrial champion able to compete with China and the United States, have both said they want guarantees on local jobs. "It's not every day that I agree with Salvini," said Le Maire, whose government appears to hold the trump cards. When it comes to where any job cuts fall, France will be helped by its existing 15 percent holding in Renault, whose superior efficiency at its five French plants makes it better placed to handle a supply glut, the demise of the petrol engine and the investments needed for electric and autonomous vehicles. "It will take many, many years to find real savings, and ugly political and operational realities can often swamp the potential of such new entities," Bernstein analyst Max Warburton said of the FCA-Renault plan to rival Japan's Toyota and Germany's Volkswagen. Advantage France? As well as Italy's government having to cope with the aftermath of European elections, which coincided with news of the FCA-Renault plans, political leaders in Rome were only informed shortly before the deal was made public, an FCA source said. This contrasted with the way the French government was treated, with Fiat Chrysler Chairman John Elkann, a fluent French speaker, letting it know of his merger proposal to Renault weeks ago, a French government official said.

Chrysler earns $1.7B in 2012, revises product plans for US

Wed, 30 Jan 2013Hot on the heels of Ford's earnings announcement for the year that was, Chrysler today reported a 2012 net income of $1.7 billion, up substantially from the comparatively minuscule $183 million profit earned in 2011 when it repaid its US government loans.

Chrysler's good year ended with an excellent fourth quarter that saw net income rise 68 percent from $225 million in 2011 to $378 million. Where are all those extra earnings coming from? Market share, which Chrysler saw increase to 11.4% last year on sales of 1.65 million vehicles. In fact, the Auburn Hills, MI-based automaker out-paced the industry's market growth of 13 percent last year with sales up 21 percent for the year.

The company also revealed an updated product plan for its Chrysler Group and Fiat brands that looks all the way out to 2016. It's an updated version of the plan introduced in 2009 shortly after Fiat took control of the American automaker, and includes such new additions as an Alfa Romeo model, likely the 4C, to be introduced in the US this year, as well five more Alfa models by 2016. Likewise, Fiat will be growing by an additional seven models in the coming few years.

China's Great Wall confirms its interest — in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI — Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.028 s, 7928 u