2004 Chrysler Crossfire Coupe 2-door 3.2l on 2040-cars

Stockbridge, Georgia, United States

|

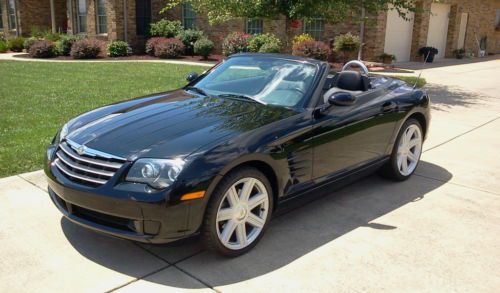

This is a 2004 Chrysler Crossfire Limited. It has been certified by our car service dept and It is also equipped with keyless entry, leather seats, leather wrapped steering wheel, cruise, fog lights, power driver seat, CD player, power rear spoiler, universal garage door opener and 19" aluminum wheels. The exterior looks great!! The interior like new. It comes with a 3 month/3,000 mile limited warranty provided by Preferred Warranties. Price and/or Payment do not include sales tax, you only have to pay sales tax in your home state.

Financing: We offer financing as well. Don't forget to ask about an extended warranty to give you years of worry-free service. We also offer credit rebuilding if your credit score is low and we offer great lease plans. Apply online at www.automazingautos.com or call us at 678-744-5972 with any questions. |

Chrysler Crossfire for Sale

Chrysler crossfire convertible limited 6 speed manual show condition(US $14,999.00)

Chrysler crossfire convertible limited 6 speed manual show condition(US $14,999.00) 2004 chrysler crossfire base coupe 2-door 3.2l(US $22,500.00)

2004 chrysler crossfire base coupe 2-door 3.2l(US $22,500.00) 2005 chrysler crossfire two-tone custom paint 50k miles!!!

2005 chrysler crossfire two-tone custom paint 50k miles!!! Warranty srt6 8k miles supercharged 330hp amg v6 htd alcantara seats we finance(US $20,900.00)

Warranty srt6 8k miles supercharged 330hp amg v6 htd alcantara seats we finance(US $20,900.00) 2004 chrysler crossfire in excellent condition. only 75k miles private seller(US $8,500.00)

2004 chrysler crossfire in excellent condition. only 75k miles private seller(US $8,500.00) 2005 chrysler crossfire base convertible 2-door 3.2l(US $14,500.00)

2005 chrysler crossfire base convertible 2-door 3.2l(US $14,500.00)

Auto Services in Georgia

Wright`s Car Care Inc ★★★★★

Top Quality Car Care ★★★★★

TNT Transmission ★★★★★

Tires & More Complete Car Care ★★★★★

Tims Auto Service ★★★★★

T-N-T Transmission Inc ★★★★★

Auto blog

Fiat Chrysler's Marchionne is done talking about alliances

Sat, Apr 15 2017AMSTERDAM (Reuters) - Fiat Chrysler Chief Executive Sergio Marchionne rowed back on his search for a merger on Friday, saying the car maker was not in a position to seek deals for now and would focus instead on following its business plan. Marchionne had repeatedly called for mergers in the car industry and a tie-up has long been seen as the ultimate aim of his relaunch of Fiat Chrysler, which he is due to leave in early 2019 after 15 years at the helm. He sought a merger with General Motors two years ago but was rebuffed. Only last month he said Volkswagen - the market leader in Europe - may agree to discuss a tie-up with FCA in reaction to rival PSA Group's acquisition of Opel. Marchionne told the annual general meeting in Amsterdam he still saw the need for car companies to merge to better shoulder the large investments needed, but said Fiat Chrysler was not talking to Volkswagen. "On the Volkswagen issue, on the question if there are ongoing discussions, the answer is no," he said. He added, without elaborating, that Fiat Chrysler was not at a stage where it could discuss any alliances. "The primary focus is the execution of the plan," he said. FCA has pledged to swing to a 5 billion euro net cash position by 2018, from net debt of 4.6 billion euros at the end of 2016 - an achievement that Marchionne has said would put it in a better position to strike a deal in the future. Volkswagen, which is still reeling from an emissions scandal that hurt its profits, initially spurned FCA's approach. However, CEO Matthias Mueller said last month the group had become more open on the issue of tie-ups and invited Marchionne to speak to him directly rather than with the press. Fiat Chrysler Chairman John Elkann underlined the message that finding a merger partner was not a priority. "I'm not interested in a big merger deal," he said. "Historically, deals are struck at times of difficulty ... we don't want to be in trouble." Elkann is the scion of Fiat's founder and top shareholder the Agnelli family. He has said in the past he was prepared to have the Agnelli's stake severely diluted in exchange for a minority holding in a larger auto group. "I believe the priority for FCA is to press ahead with this ambitious (business) plan despite the difficult environment," he said. FCA pledged in January to nearly halve net debt this year, as part of the 2018 plan. Doubts remain about its exposure to a peaking U.S.

2015 Chrysler 300 First Drive [w/video]

Mon, Dec 22 2014When Chrysler last updated its 300 in 2011, the fullsize sedan market was a very different place than it is today. Ford's redesigned Taurus was in showrooms, sure, but segment stalwarts like the Toyota Avalon and Chevrolet Impala were languishing at the tail end of their model cycles. And still, the second-generation 300 (not counting the "letter series" cars from the 1950s and '60s, of course) failed to recapitulate the booming success of the model reboot in 2004. Something in the combination of the down economy, higher gas prices and great product from front-wheel-drive entries in the class kept the 300 from the six-digit sales numbers it saw in the early 2000s. For the 2015 model year, Chrysler hopes that a more clearly defined purpose for its big sedan, combined with liberal dipping into the corporate tech toy box, will rekindle buyer interest. Considering the mild characters and front-driver dynamics of its mainstream competition, the promise of V8 power and rear-wheel drive should at least turn the heads of those looking for a car with a little edge. I grabbed the keys of the edgiest of the bunch, the sport-intended 300S, and found a big sedan that gives away some practicality to the rest of its segment mates. The trade-off for the dip in pragmatism is an uptick and driving fun and attitude that should make all the difference for the right buyer. Even though the hard-to-miss face of the 300 has come in for another nip and tuck, that attitude is still clearly on display, too. The grille of the 300 is some 33-percent larger than the outgoing model, though it's still far less brutal than the throwback styling of the 2005 "Baby Bentley" car, at least to my eyes. The cheese grater insert is metallic in most trims of the 300, though the 300S you see in my photo set gets the meaner blacked-out treatment. A quick scroll through our gallery will show you that the rest of the 300 has been similarly changed but not reinvented. Light clusters front and rear are revised, the rear clip has been re-forged with less busy styling, and the whole car has been de-chromed to a large extent (this 300S is wearing the least blingy outfit of the bunch). That rear spoiler is S-model specific. I held the existing 300 interior in fairly high regard, and this new car improves on that base.

Ford delays North American production restart from coronavirus lockdown

Tue, Mar 31 2020Ford said on Tuesday it was postponing its plan to restart production at its North American plants due to safety concerns for its workers amid the coronavirus pandemic. To generate cash, the No. 2 U.S. automaker had said last week it was poised to restart production at some plants in North America as early as April 6, bringing back such profitable vehicles as its top-selling F-150 full-sized pickup, the Transit commercial van and SUVs. But on Tuesday, Ford said it had been aiming to resume production at several key U.S. plants on April 14, but would now instead do so at dates it would announce later on. "The health and safety of our workforce, dealers, customers, partners and communities remains our highest priority," Kumar Galhotra, president of Ford's North American operations, said in a statement. Still, the automaker will open a plant in Ypsilanti, Michigan, during the week of April 20, that will make ventilators to treat patients afflicted by the coronavirus. Rival Fiat Chrysler Automobiles said last week it plans to resume production in North America on April 13. General Motors has shuttered its plants indefinitely and has not provided a date for vehicle production to restart. It is facing a delay in the production launch of its redesigned large SUVs and is delaying work on other SUVs. "Once it is safe to resume production, we will do so," a GM spokesman said. As of Monday, Volkswagen was shooting for an April 5 reopening at its Tennessee plant. Honda, Nissan and Subaru facilities in North America will remain closed through April 6, and Hyundai through April 10. Toyota was planning to reopen its North American plants April 17. Plants/Manufacturing Chrysler Fiat Ford GM coronavirus