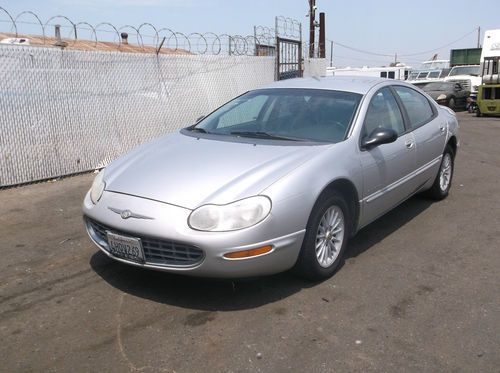

2000 Chrysler Concorde Lxi Sedan 4-door 3.2l on 2040-cars

Hardy, Virginia, United States

Engine:3.2L 3200CC 197Cu. In. V6 GAS SOHC Naturally Aspirated

Vehicle Title:Clear

Body Type:Sedan

Fuel Type:GAS

For Sale By:Private Seller

Sub Model: LXI

Make: Chrysler

Exterior Color: Silver

Model: Concorde

Interior Color: Gray

Trim: LXi Sedan 4-Door

Drive Type: FWD

Options: Sunroof, Cassette Player, Leather Seats, CD Player, Infinity Sound system, Automatic heating/AC system

Number of Cylinders: 6

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 161,253

Car was my leased company car and purchased by me from Chrysler Credit. The car has only used synthetic oil. The car was scratched on the top of the right back fender near the trunk lid, there is a dent on the left rear quarter panel. This car is ideal as a second car or for a student. Car is located in Hardy, Virginia 24101 and can be seen by appointment. 540-537-8970.

Chrysler Concorde for Sale

Auto Services in Virginia

West Broad Hyundai ★★★★★

Virginia Tire & Auto Of Falls Church ★★★★★

Virginia Auto Inc ★★★★★

Total Auto Service ★★★★★

Shorty`s Garage ★★★★★

Rosner Volvo Of Fredericksburg ★★★★★

Auto blog

Dodge to resurrect Scat Pack?

Fri, 27 Sep 2013Before social media ever existed, if automotive enthusiasts wanted to be noticed or recognize other fans, they joined a car club. For Dodge muscle car lovers from 1968 through 1971, that group was known as the Scat Pack. Just like the Charger, Challenger and Dart nameplates, it looks like the Scat Pack could be getting a resurrection by Chrysler.

Automotive News is reporting that Chrysler recently renewed its trademark on the Scat Pack name, and while this is in no way a guarantee that the name will return, AN talked to Tim Kuniskis, Dodge President and CEO, who stoked the fire a little more. In the article, Kuniskis said that the name is "a very important part of our history" and added that "we like the whole idea of having a Scat Pack of cars." Scat Pack models were identified by their bumblebee stripes and helmet-wearing bumblebee logo, and the idea of a modern Scat Pack doesn't seem all that outlandish in light of recent vehicles like the Charger SRT Super Bee and the Ram 1500 Rumble Bee Concept.

What do you think, is this a cool idea, or is it just an unwelcome bit of nostalgia? Have you say in Comments.

Marchionne says the Chrysler 200 and Dodge Dart were terrible investments for FCA

Mon, Jan 9 2017In a press conference during the Detroit Auto Show, Sergio Marchionne was quite candid about why the Chrysler 200 and Dodge Dart were discontinued altogether without replacement. He essentially said they weren't worth the trouble. "I can tell you right now that both the Chrysler 200 and the Dodge Dart, as great products as they were, were the least financially rewarding enterprises that we've carried out inside FCA in the last eight years," Marchionne said. "I don't know one investment that was as bad as these two were." Marchionne was responding to a question about whether he felt the company's shift toward trucks and SUVs and sacrifice in sedan development was shortsighted. Marchionne said he felt that the market would likely continue to be strong for trucks and SUVs, and that the sedan market requires enormous investment that might not pay off. He used the 200 and Dart as examples. When we tried out the 200 and the Dart, we had mixed feelings. We enjoyed the 200's potent V6, pleasant interior, and solid handling. However, it was lacking in space (especially in the rear seat area), and doesn't drive any better than the top vehicles in the midsize sedan class. As for the Dart, it was fairly roomy, and had great infotainment thanks to Uconnect, but lackluster handling and a surprising amount of weight left it only average. With that in mind, it's probably not a bad idea to get rid of the 200 and Dart. The sedan segment is shrinking, and FCA can only afford to invest in areas where it can be a class-leader. Related Video:

EIB ups financing for Fiat Chrysler's electric vehicles to $949 million

Sat, Sep 19 2020MILAN — The European Investment Bank (EIB) has increased to almost 800 million euros ($949 million) its funding to Fiat Chrysler Automobiles (FCA) to support production of electric and hybrid vehicles, they said in a joint statement. Investments to manufacture battery electric vehicles and plug-in hybrid electric vehicles will be mainly directed at FCA plants located in southern Italy, supporting employment and compliance with the strictest environmental criteria. To improve capacity utilization at FCA's Italian plants, the group has announced a 5 billion euro investment plan for the country through 2021 which envisages the launch of new electric and hybrid models. EIB and FCA had sealed 300 million euros in financing before the summer to fund investments for plug-in hybrid electric vehicle production lines at plants in Melfi, in the southern Basilicata region, and battery electric vehicles at Fiat's historic Turin plant of Mirafiori over the 2019-2021 period. FCA has now finalized a 485 million euro deal with EIB to support both an innovative line of plug-in hybrid electric vehicles at the Pomigliano plant in the southern Campania region as well as R&D activities at FCA laboratories in Turin. The EIB credit line covers 75% of the total value of FCA's investment in the project for the 2020-2023 period. Earnings/Financials Green Plants/Manufacturing Chrysler Fiat

2000 chrysler concorde, no reserve

2000 chrysler concorde, no reserve 2000 chrysler concorde lxi 1 owner

2000 chrysler concorde lxi 1 owner 2004 chrysler concorde lxi sedan 4-door 3.5l

2004 chrysler concorde lxi sedan 4-door 3.5l 1996 chrysler concorde lx sedan 4-door 3.3l

1996 chrysler concorde lx sedan 4-door 3.3l 1998 chrysler concorde lx sedan 4-door 3.2l

1998 chrysler concorde lx sedan 4-door 3.2l 2000 chrysler concorde lx "one owner"

2000 chrysler concorde lx "one owner"