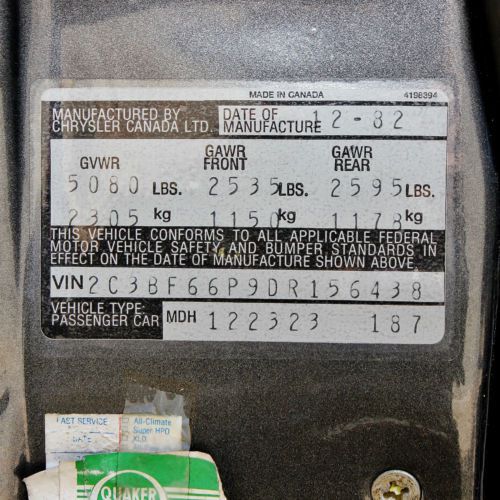

1983 Chrysler New Yorker 5th Ave Ed. Original Paperwork/owners Manual 22.9k Mi on 2040-cars

Fort Worth, Texas, United States

Chrysler Cirrus for Sale

Auto Services in Texas

Zeke`s Inspections Plus ★★★★★

Value Import ★★★★★

USA Car Care ★★★★★

USA Auto ★★★★★

Uresti Jesse Camper Sales ★★★★★

Universal Village Auto Inc ★★★★★

Auto blog

FCA's profit rises ahead of Peugeot merger

Thu, Feb 6 2020MILAN — Fiat Chrysler (FCA) posted a 7% rise in fourth-quarter profit on Thursday, boosted by strong business in North America and better results in Latin America as it heads into a merger with France's PSA. The Italian-American carmaker said adjusted earnings before interest and tax (EBIT) rose to 2.12 billion euros ($2.3 billion), in line with a 2.11 billion forecast in Reuters poll of analysts. That left its adjusted operating profit for the year at 6.67 billion euros ($7.34 billion), just shy of its target of over 6.7 billion euros. Its adjusted EBITDA margin came in at 6.2%, in line with its target of more than 6.1%. A trader said Fiat Chrysler results were "a touch above" expectations and the carmaker's shares in Milan were up 3.4% at 1300 GMT following the results. Fiat Chrysler and Peugeot maker PSA agreed in December to combine forces in a $50 billion deal to create the world's No. 4 carmaker, in response to slower global demand and the mounting cost of making cleaner cars amid tighter emissions rules. Chief Executive Mike Manley said last month that talks with PSA were progressing well and that he hoped to complete the deal by early 2021. FCA reiterated its plan to boost adjusted EBIT to above 7 billion euros ($7.7 billion) this year. In slides prepared for an analyst call, FCA said it was monitoring the global impact of coronavirus in China. FCA operates in the country through a loss-making joint venture with Guangzhou Automobile Group (GAC) and has a 0.35% share of the Chinese passenger car market. Reporting by Giulio Piovaccari; Additional reporting by Danilo Masoni; Editing by Stephen Jewkes, Jason Neely and David Clarke. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Federal judge orders Barra and Manley to try to resolve GM racketeering lawsuit

Tue, Jun 23 2020DETROIT — A federal judge in Detroit on Tuesday ordered the chief executives of automakers General Motors and Fiat Chrysler Automobiles to meet by July 1 to try to resolve GM's racketeering lawsuit. U.S. District Court Judge Paul Borman called on GM CEO Mary Barra and FCA CEO Mike Manley to meet in person to try to resolve a case that could drag on for years. "What a waste of time and resources now and for the years to come in this mega-litigation if these automotive leaders and their large teams of lawyers are required to focus significant time-consuming efforts to pursue this nuclear-option lawsuit if it goes forward," Borman said at the end of a hearing during which FCA asked the judge to dismiss GM's lawsuit. Borman said instead, the companies need to focus on building cars and keeping people employed at a time when the coronavirus has hurt the U.S. economy and the country is also dealing with issues of racial injustice after the death of George Floyd, a Black man whose death in police custody in Minneapolis triggered worldwide protests. GM filed the racketeering lawsuit against FCA last November, alleging its rival bribed United Auto Workers (UAW) union officials over many years to corrupt the bargaining process and gain advantages, costing GM billions of dollars. GM is seeking "substantial damages" that one analyst said could total at least $6 billion. Barra and Manley should meet, taking into account social distancing to keep them safe, to "explore and indeed reach a sensible resolution," Borman said in the hearing, which was broadcast online. It is common for judges to order parties to try to resolve disputes out of court. But it is unusual that the chief executives of two big companies be instructed to meet face-to-face, not just to settle their differences but also to serve a greater good. A GM spokesman said the No. 1 U.S. automaker has a strong case and "we look forward to constructive dialogue with FCA consistent with the courtÂ’s order.” FCA had no immediate comment. Borman said he wanted to hear from Barra and Manley personally at noon on July 1 to provide him with results from their discussion. FCA shares were up 6.1% at $10.24 in New York and GM shares were down 0.5% at $26.25 on Tuesday afternoon. Government/Legal Chrysler Fiat GM

Chrysler banks $507 million in Q2, trims 2013 earnings forecast

Tue, 30 Jul 2013Chrysler has some good news and some bad news. First, profits were up 16 percent over the second quarter of 2012, bringing the Auburn Hills, Michigan-based manufacturer $507 million on the back of strong demand for trucks and SUVs (a recurring theme this quarter, particularly in the US). Q2 revenue was up as well, from $16.8 billion in 2012 to $18 billion in 2013. The bad news is that the Pentastar's overall earnings forecast for net income in 2013 has been trimmed from $2.2 billion to between $1.7 and $2.2 billion, according to Automotive News.

In addition to the adjusted net income forecast, Chrysler tweaked its operating profit from $3.8 billion to between $3.3 and $3.8 billion. This has gone largely unexplained by Chrysler, perhaps hoping the news of a three-percent increase in its transaction prices for Q2 will allow it to sweep this adjustment under the rug.

The star of the show for Chrysler has been its US sales, which saw a 10-percent jump, both bettering the industry average of eight percent and improving over the same stretch of 2012. As with the increase in transaction prices, Chrysler has the new Ram pickup and Jeep Grand Cherokee to thank. Perhaps most worrying from this report, though, is that every brand in the automaker's stable saw an increase in sales... except for the Chrysler brand itself.

1935 chrysler airflow c3 four door sedan

1935 chrysler airflow c3 four door sedan 2006 chrysler 300 touring 4 door

2006 chrysler 300 touring 4 door 1935 chrysler airflow c1 coupe

1935 chrysler airflow c1 coupe 1998 chrysler cirrus lxi sedan 4-door 2.5l

1998 chrysler cirrus lxi sedan 4-door 2.5l 2004 chrysler crossfire

2004 chrysler crossfire 2007 chrysler sebring touring

2007 chrysler sebring touring