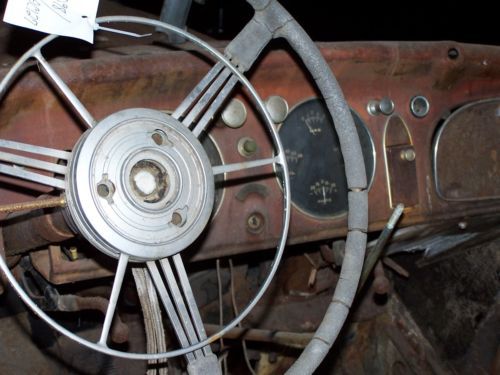

1935 Chrysler Airflow C3 Four Door Sedan on 2040-cars

Glencoe, Missouri, United States

Powered by eBay Turbo Lister The free listing tool. List your items fast and easy and manage your active items. |

Chrysler Cirrus for Sale

2006 chrysler 300 touring 4 door(US $9,400.00)

2006 chrysler 300 touring 4 door(US $9,400.00) 1935 chrysler airflow c1 coupe

1935 chrysler airflow c1 coupe 1998 chrysler cirrus lxi sedan 4-door 2.5l

1998 chrysler cirrus lxi sedan 4-door 2.5l 2004 chrysler crossfire(US $4,000.00)

2004 chrysler crossfire(US $4,000.00) 2007 chrysler sebring touring(US $9,500.00)

2007 chrysler sebring touring(US $9,500.00) 2012 chrysler town & country touring rear cam 67k miles texas direct auto(US $17,980.00)

2012 chrysler town & country touring rear cam 67k miles texas direct auto(US $17,980.00)

Auto Services in Missouri

Weber Auto Service ★★★★★

Shuler`s Service Station ★★★★★

Schaefer Autobody Centers ★★★★★

OK Tire Store ★★★★★

Mr. Transmission ★★★★★

M & L Auto Inc ★★★★★

Auto blog

What will the next Presidential limo look like?

Thu, 25 Jul 2013With recent news that the Secret Service has begun soliciting proposals for a new armored limousine, we've been wondering what the next presidential limo might look like. The current machine, nicknamed "The Beast", has a design based on a car that's no longer sold: the Cadillac DTS. If General Motors gets the job again, which wouldn't be a surprise considering the government still owns a chunk of the company, the next limo's shape would likely resemble the new XTS (below, left). But Cadillac hasn't always been the go-to car company for presidential whips.

Lincoln has actually provided far more presidential limousines throughout history than Cadillac. In fact, the first car modified for Commander-in-Chief-carrying duty was a 1939 Lincoln K-Series called "Sunshine Special" used by Franklin D. Roosevelt, and the last Lincoln used by a president was a 1989 Town Car ordered for George H.W. Bush. If President Obama wanted a Lincoln today, it would likely be an amalgam of the MKS sedan and MKT crossover, as illustrated above.

And what about Chrysler? The only record we could find of a President favoring the Pentastar is Nixon, who reportedly ordered two limos from the company during his administration in the '70s, and then another one, known today as the "K-Car limo," in the '80s after he left office. Obama, however, has a personal - if modest - connection to Chryslers, having owned a 300 himself before he took office. A 300-based Beast (above, right) would certainly earn the U.S. some style points.

CES 2022 was huge for EVs | Autoblog Podcast #711

Fri, Jan 7 2022In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder. CES took place this week, and there were some nice electric surprises from automakers, especially General Motors. John has been driving the Ram 1500 Power Wagon, as well as what seems to be its polar opposite, the electric Mini Cooper SE. Greg talks about the differences between the Acura TLX A-Spec long-termer (which is back in the shop) and the Type S loaner that's filling in for it. John's also got some interesting thoughts on leather interiors. Finally, the editors reach into the mailbag and help a repeat customer decide on a suitable replacement for a 2008 Lexus GX 470 in this week's Spend My Money segment. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #711 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown CES 2022 2024 Chevy Silverado EV revealed: 664 hp — and Midgate's back 2024 Chevy Silverado EV vs. 2022 Ford F-150 Lightning | How do they compare? Chevy Equinox EV and Blazer EV confirmed for production in 2023 Chrysler Airflow concept previews the brand's all-electric future Mercedes-Benz Vision EQXX shoots for 620-mile range Cadillac InnerSpace reimagines the personal luxury coupe What we're driving: 2022 Ram 1500 Power Wagon 2021 Acura TLX A-Spec and Type S long-termers 2022 Mini Cooper SE John's unpopular opinion: Let's do away with leather for good Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related Video:

FCA recalling Chrysler and Dodge minivans, Dodge Nitro SUVs for faulty airbag covers

Fri, Jul 10 2020Fiat Chrysler Automobiles said on Friday it would recall about 925,239 of its older model vehicles in the United States to replace airbag covers on their steering wheels after 14 potentially related injuries. The recall is limited to 2007-2011 Dodge Nitro SUVs, 2008-2010 Chrysler Town & Country and Dodge Grand Caravan minivans, the Italian-American automaker said. The move follows an FCA investigation that found these vehicles were equipped with certain clips that may loosen and disengage over time, and in case of a driver-side airbag deployment the clips could act as projectiles. Fiat Chrysler said none of the potential injuries involved occupants of front-passenger or rear seats and that the airbags were not supplied by Takata. Reporting by Sanjana Shivdas in Bengaluru; Editing by Amy Caren Daniel. Related Video: Â Recalls Chrysler Dodge Minivan/Van SUV