1968 Chrysler 300 Convertible D-series 440 Engine on 2040-cars

Watertown, Connecticut, United States

|

1968 Chrysler 300 Convertible D-Series Convertible

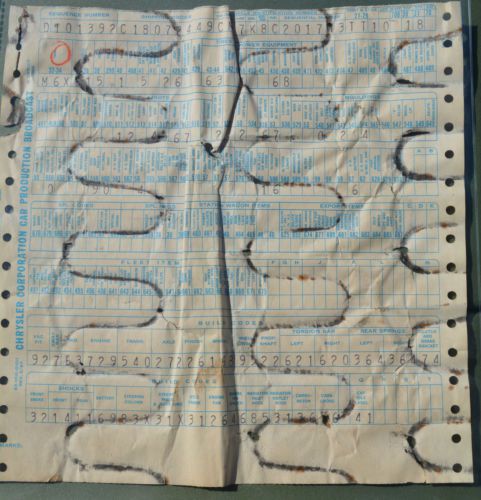

Powered by the 440 engine, its condition is exceptional for an all original car. It has a new fuel pump, new points, cap and rotor, and the carburetor was rebuilt. The engine compartment has not been touched or altered in any other way. Please note the "OK" paint stamp on the radiators support. The gas tank was totally cleaned and restored. The original build sheet was with the car, it has power windows and no air conditioning. This has been in the same private collection for over 20 years. You won't find cars original in this condition, especially convertibles. The exterior car color is green-( paint code TT1), interior is all black. There is a small ding in the front bumper that is shown in the photos. There is also a very small chip at the rear passenger side quarter panel that is also shown in a photo. Please let me know if you have any questions on this vehicle. Thank you for viewing the auction. |

Chrysler 300 Series for Sale

Clean carfax • one owner • sunroof!

Clean carfax • one owner • sunroof! Touring plus 3.5l cd high output rear wheel drive power steering aluminum wheels(US $14,000.00)

Touring plus 3.5l cd high output rear wheel drive power steering aluminum wheels(US $14,000.00) 2006 chrysler 300c srt8!(US $15,500.00)

2006 chrysler 300c srt8!(US $15,500.00) We finance!!! 2012 chrysler 300 limited heated leather u connect 45k texas auto(US $21,888.00)

We finance!!! 2012 chrysler 300 limited heated leather u connect 45k texas auto(US $21,888.00) Chrysler 300 -c(US $8,500.00)

Chrysler 300 -c(US $8,500.00) 2010 chrysler 300 touring leather alloy wheels only 74k texas direct auto(US $14,980.00)

2010 chrysler 300 touring leather alloy wheels only 74k texas direct auto(US $14,980.00)

Auto Services in Connecticut

Yankee Discount Muffler ★★★★★

Towne Body Shop Inc ★★★★★

Superior Transmission Inc ★★★★★

Speed Sport Tuning ★★★★★

Ron Johns Pit Stop ★★★★★

Middlesex Auto Center, Inc. ★★★★★

Auto blog

Fiat Chrysler posts record Q3 profit thanks to U.S. trucks and Jeep

Wed, Oct 28 2020MILAN — A rebound in car production in Fiat Chrysler on Wednesday reported record third-quarter earnings as production returned to nearly pre-pandemic levels. The Italian-American automaker, which is finalizing its full merger with French rival PSA Peugeot, reported a net profit in the three months ending Sept. 30 of $1.4 billion (1.2 billion euros). That compares with a loss of 179 million euros a year earlier. The carmaker reported adjusted earnings before tax and interest in North America of 2.5 billion euros. That offset deepening losses in Europe, Asia and at its Maserati luxury marquee. Latin America, the only other region to post a profit, saw it narrow by two-thirds to 46 million euros. “Our record results were driven by our teamÂ’s tremendous performance in North America,” CEO Mike Manley said in a statement. Overall, the carmaker said global earnings before tax and interest were a record 2.3 billion euros despite a 6% fall in revenues to 26 billion euros. Global shipments were down 3%, due largely to plant retooling in North American to produce the new Jeep Grand Wagoneer in the luxury SUV segment and the discontinuation of the Dodge Grand Caravan classic minivan. Fiat Chrysler announced earlier Wednesday that its merger with PSA Peugeot is on track to be finalized by the end of the first quarter of 2021, as planned. To meet regulatory concerns, the French carmaker is selling a small stake in a components maker to get below 40% ownership. The new automaker, to be called Stellantis, will be the fourth biggest producer in the world. Earnings/Financials Chrysler Dodge Fiat Jeep RAM Citroen Peugeot

Stellantis moves to set up its own lending unit

Sat, Sep 4 2021Stellantis is buying Houston-based auto lender First Investors Financial Services Group to set up its own finance arm in the U.S., a move that should support sales and eventually boost profit. The only major traditional automaker in the U.S. without its own finance company agreed to pay $285 million to a group of investors led by Gallatin Point Capital and Jacobs Asset Management, according to a statement. The transaction is expected to close by year-end. Stellantis was formed via the merger between Fiat Chrysler and PSA Group early this year. Carlos Tavares, the PSA boss who became the combined company’s chief executive officer, called the deal to acquire First Investors a milestone that will increase earnings and enhance customer loyalty. “Direct ownership of a finance company in the U.S. is a white-space opportunity which will allow Stellantis to provide our customers and dealers a complete range of financing options,” Tavares said Wednesday in the statement. Having an in-house finance company has helped rivals General Motors Co. and Ford Motor Co. pad profits, especially during the global semiconductor shortage that has limited production and crimped sales. GM bought subprime lender AmeriCredit Corp. in 2010 and renamed it GM Financial. The operation generated a $2.76 billion profit in the first half -- roughly a third of the companyÂ’s adjusted earnings before interest and taxes. Trouble for Santander? The First Investors acquisition could spell trouble for Chrysler Capital, the operation that Santander Consumer USA Holdings Inc. and Chrysler set up in 2013 before the U.S. automaker completed its merger with Fiat. In a statement, Santander Consumer said itÂ’s committed to supporting Stellantis through the term of their existing agreement and its transition. Santander Consumer will also have “ongoing conversations with Stellantis about long-term mutually beneficial opportunities beyond 2023,” the company said, adding that its consumer business remains strong and has “delivered solid results for our shareholders.” This, along with support from its parent company, will allow the lender to “pursue additional opportunities as they arise.” The lenderÂ’s U.S.-listed stock fell 1.5% in New York trading Wednesday after Bloomberg reported Stellantis was preparing to announce a new finance partner. Stellantis shares rose as much as 1.3% in Paris trading Thursday.

FCA workers get raises, health care co-op in new UAW deal

Mon, Sep 21 2015The pending labor agreement between FCA US and the United Auto Workers is now in the hands of union members to confirm. It's expected to be accepted, but a final decision could take weeks, The Detroit News reports. Employees didn't get everything they were hoping for, and contrary to earlier reports, the two-tier wage system remains in place. However, there are attempts to lessen the difference between the levels in this four-year deal. Assuming FCA US workers agree to this offer, the starting pay for tier-two workers would go up around a dollar to $17 an hour. The other level would now begin at $25.35, about a $6 increase, and they would receive 3 percent raises in the first and third year of the deal. Both groups also get $800 in profit sharing for each percent the automaker's profit margin rises above two percent. Extra money kicks in for the second tier above eight percent. Union members get a $3,000 bonus for accepting this contract, as well. The other major change under the pending agreement is the previously rumored switch to a healthcare co-op. The goal is to collect members from the Big Three together to create a huge member base for leverage to negotiate better rates with insurance companies. The UAW is promising no increase in cost to workers, according to The Detroit News. The idea was inspired by the similar structure for the Voluntary Employee Beneficiary Association for union retirees. UAW boss Dennis Williams expects the agreement to be approved. "Once the membership looks at it, hears the explanation for it, I think they'll ratify it," he said, according to The Detroit News. The next step is to craft similar deals with General Motors and Ford. Related Video: