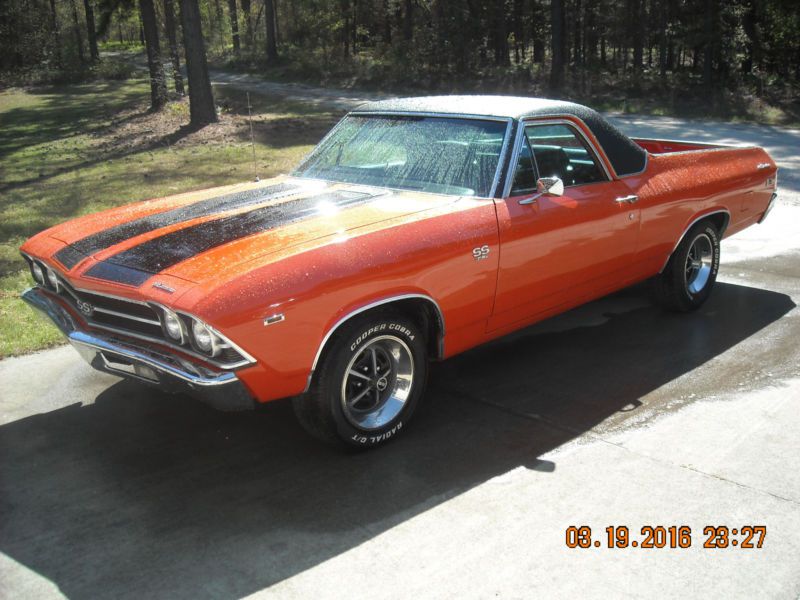

1969 Chevrolet El Camino Ss on 2040-cars

Donalds, South Carolina, United States

Please contact me at : dominiquedffernette@ukpeople.com .

1969 SS 396 El Camino. Factory Code 72 Hugger Orange with C08 Vinyl top. Factory Air ( Cold ) Tilt Wheel, Console

with Turbo 400 Automatic, Bucket Seats, new headrests, newTires, battery, . No cuts/tears in seats, or headliner or

dash, Kenwood Stereo , power steering, power brakes, stock rally wheels. 12 bolt rear end with 3.73 gears. Engine

rebuilt and a light cam installed. If you know your GM this is a rare color that was special order from dealers.

Hugger Orange and Daytona Yellow only were special order paints. Not many built and 47 yrs later not many left.

This truck drives straight down the road and stops fine. It does draw attention since most folks have never seen an

Orange El Camino.

Chevrolet El Camino for Sale

Chevrolet: el camino malibu(US $7,200.00)

Chevrolet: el camino malibu(US $7,200.00) Chevrolet: el camino ss396(US $15,800.00)

Chevrolet: el camino ss396(US $15,800.00) 1966 chevrolet el camino(US $2,900.00)

1966 chevrolet el camino(US $2,900.00) 1964 chevrolet el camino nice california elco(US $2,900.00)

1964 chevrolet el camino nice california elco(US $2,900.00) 1959 chevrolet el camino(US $7,500.00)

1959 chevrolet el camino(US $7,500.00) 1979 chevrolet el camino(US $2,900.00)

1979 chevrolet el camino(US $2,900.00)

Auto Services in South Carolina

West Specialty Products Used Cars ★★★★★

Tuffy Auto Service Centers ★★★★★

Star Automotive ★★★★★

Stack`s Wholesale Auto Parts ★★★★★

Scott`s Automotive ★★★★★

Reid`s Towing ★★★★★

Auto blog

Subprime financing on the rise in new car sales, leasing too

Fri, 07 Dec 2012We all remember the financial crisis that began several years back. At its core was a splurge of subprime lending for housing loans. The housing bubble burst, triggering a collapse of the mortgage-backed securities market. Apparently, those types of loans still exist in the automotive industry, and the market share for these types of "nonprime, subprime, and deep subprime," loans has grown 13.6 percent compared to the third quarter a year ago.

According to an Automotive News report, high-risk lending expanded to 24.8 percent of total loans in Q3, up from 21.9 percent for this time last year. As this level increased, average credit scores of borrowers dropped to 755, down from 763 a year ago. In that time, the average financing amount increased $90 per vehicle, to $25,963.

At 818, Volvo maintains the highest per-owner credit score, while Mitsubishi has the lowest, at 694. The highest rate of borrowers was at Toyota, with 14 percent of the market, followed by Ford with 13.1 percent and Chevrolet at 11.1.

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.

Chevy Crossvolt name kept alive in new trademark application

Fri, Dec 26 2014In April 2011 General Motors submitted a trademark application with the US Patent and Trademark Office for the word "Crossvolt." In November of this year, the application expired for lack of a statement of use. But in August of this year, GM applied again for the same trademark, leading some to believe that it intends to apply the name to a vehicle. That vehicle could explain the mule in sliced-and-diced Chevrolet Orlando bodywork caught in several spy shots this year, theorized to be some kind of Toyota Prius V or Ford C-Max Hybrid competitor; or it could be a production version of the Chevrolet Volt MP5 concept showed off at the Beijing Motor Show in 2010, which was about the same size as the Chevy Orlando. Or it could be none of those things – but the fact that Chevrolet is keeping it current makes us believe it will be... something. Featured Gallery Beijing 2010: Chevrolet Volt MPV5 concept View 13 Photos News Source: Fox News, Trademarkia Green Chevrolet GM Crossover Hybrid trademark uspto