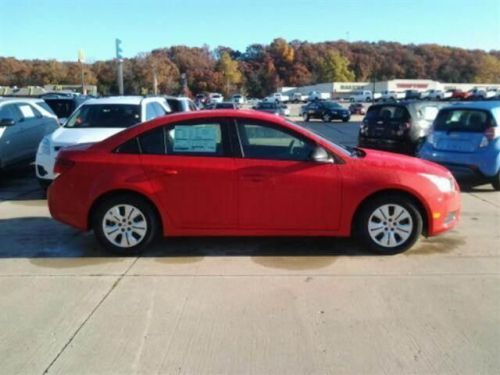

2014 Chevrolet Cruze Ls on 2040-cars

317 W Main St, Linn, Missouri, United States

Engine:1.8L I4 16V MPFI DOHC

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1G1PA5SH2E7204351

Stock Num: N168

Make: Chevrolet

Model: Cruze LS

Year: 2014

Exterior Color: Red

Interior Color: Red

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 3

Best buy a country mile! At Carroll-Rehma, we invite you to visit our 6 acre lot on Hwy 50 in Linn. If you are sure of the model you are interested in, just let us know and we'll put together a deal that you will be thrilled about! - No paperwork fees! - Less expensive from the start. - Free pickup, delivery, wash and vac with service - Family owned and operated

Chevrolet Cruze for Sale

2014 chevrolet cruze ls(US $19,530.00)

2014 chevrolet cruze ls(US $19,530.00) 2014 chevrolet cruze 2lt(US $21,950.00)

2014 chevrolet cruze 2lt(US $21,950.00) 2012 chevrolet cruze eco(US $15,950.00)

2012 chevrolet cruze eco(US $15,950.00) 2014 chevrolet cruze ls(US $19,280.00)

2014 chevrolet cruze ls(US $19,280.00) 2014 chevrolet cruze ls(US $19,280.00)

2014 chevrolet cruze ls(US $19,280.00) 2014 chevrolet cruze 1lt(US $22,830.00)

2014 chevrolet cruze 1lt(US $22,830.00)

Auto Services in Missouri

Wodohodsky Auto Body ★★★★★

West County Nissan ★★★★★

Wayne`s Auto Body ★★★★★

Superior Collision Repair ★★★★★

Superior Auto Service ★★★★★

Springfield Transmission Inc ★★★★★

Auto blog

First 2016 Chevy Volt commercial rocks us to sleep

Fri, Jan 30 2015The 2016 Chevrolet Volt, with its thorough restyling and increased all-electric range, is an exciting evolution of Chevy's groundbreaking plug-in hybrid, so it's only fitting that the commercial campaign to sell it to the masses also be engaging and vibrant. Well, the first ad has just been officially released and it rocks... us to sleep. Now, we get that General Motors didn't want to repeat past Volt-commercial mistakes. No one wants to see dogs licking feet or dumb (and weirdly horny) aliens again. Nor would it be smart to slam all-electric vehicles, since it now sells the Spark EV and has just revealed its 200-mile Bolt concept. So, what does that leave? How about a mostly computer-generated spot that relies on cliche images and an upbeat synthetic soundtrack to communicate that the Volt is now as boring as other four-door appliances? An intro, featuring a lightly-bearded gentleman peering at his tablet through designer glasses launches us into the action as the Volt makes its way across a city bridge, then a curvaceous country road. Chevrolet doesn't include voiceover to inform you that the new Volt has a 50-mile battery-only range. There's no mention of its gas mileage once its electric charge is depleted – items that just might be of importance to hybrid buyers. The ad also makes no attempt at establishing an emotional connection, either through drama or comedy. There are, however, lots of fast cuts of the new, normalized interior, including a two-second detail shot featuring the windshield wiper switch. We imagine that this is only the first in a series of spots that will tell the Volt story and motivate potential buyers to run down to their local dealer, hopefully the next spots will be more interesting and informative. View 16 Photos

2022 Chevrolet Silverado and GMC Sierra now cost more, again

Thu, May 26 2022GM Authority put Chevrolet and GMC pickup truck prices under the microscope, spying the same macroscopic issues none of us can avoid seeing: Price increases. The 2022 Chevy Silverado 1500 and 2022 GMC Sierra 1500 have been hit with their third price increases this year. The Heavy Duty versions of those same trucks have been given their fourth price increases this year. Starting with the light-duty options, they've been rung up for another $900 across the board, which breaks down to $800 added to the MSRP and $100 added to the destination charge. The mandatory cost for shipping a truck from the factory to the dealer is now $1,795. That destination fee is now more than 5% of the purchase price of the least expensive 2022 Silverado, the Regular Cab Work Truck trim with a Standard Bed and 2.7-liter turbocharged four-cylinder retailing for $36,395 after destination. And that price is $3,200 more than the initial list price from last December. At the other end, the Silverado ZR2 is up $3,400. Average that out, and the Silverado's MSRP has gone up by nearly $700 every month since initial pricing came out. On the GMC side, the bidding starts at $37,195 for the Regular Cab Pro trim with a Standard Bed, a $4,700 increase over pricing announced last October. Stepping up a tow rating or two, the Silverado HD is now $1,100 more expensive — $1,000 tacked onto the MSRP, the destination charge plumped another $100 to $1,795. The Silvy 2500 HD now starts at $41,295. The Sierra HD turns the screw a few more degrees, going up by $2,100 after the $100 increase for destination. The low bar for the Sierra 2500 HD is $41,995, a $4,100 rise over the price when it hit dealer lots last summer. Whew. Anyone know where the exit is for this "new normal?" Related video:

C7 Corvette makes inaugural ad appearance in Chevy's first spot with new slogan

Mon, 11 Feb 2013Chevrolet's "Runs Deep" tagline has finally been run into the ground, replaced with the Bowtie brand's "Find New Roads" slogan that's part of parent General Motors' plan to unify its everyday brand's marketing efforts worldwide. The new Chevrolet campaign was ushered in on prime time last night during the Grammy Awards on CBS, and the first spot, a 90-second full-line ad, also marks the first appearance of the 2014 Corvette Stingray in a commercial.

Being a full-line ad, the commercial is composed of vignettes centered on different vehicles in the brand's lineup. The all-new 2014 Impala also makes its first commercial appearance in dapper fashion, and time is spent on a skateboarding Sonic and a bouquet of brightly colored Spark hatchbacks driven by fashionable women. The ad starts and ends with Chevy's green halo car, the Volt, along with a young girl with her robotic dog (yes, really).

Chevrolet's "Runs Deep" campaign got off to a rocky start in the fall of 2010, but it did last for a couple of years with some tweaks. This new one, "Find New Roads" seems more intent on drawing new customers into the fold than the outgoing tagline, which seemed to play more toward the brand faithful. It admittedly reminds us more than a little the short-lived "Find Your Own Road" Saab motto (which, we note, was conceived while the Swedish brand was under GM's control), but no matter, we still think it's got more long-term potential than "Runs Deep."