2007 Chevy Cobalt Ls Coupe, 2.2l 4-cyl, Automatic, One Owner, Carfax Report on 2040-cars

Elizabeth, New Jersey, United States

Vehicle Title:Clear

Engine:2.2L 2198CC 134Cu. In. l4 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Coupe

Fuel Type:GAS

Make: Chevrolet

Warranty: Vehicle does NOT have an existing warranty

Model: Cobalt

Trim: LS Coupe 2-Door

Options: CD Player

Power Options: Air Conditioning

Drive Type: FWD

Mileage: 69,540

Number of Doors: 2

Sub Model: 2dr Cpe LS

Exterior Color: Orange

Number of Cylinders: 4

Interior Color: Gray

Chevrolet Cobalt for Sale

2006 chevrolet cobalt ss sedan 4-door 2.4l *beautiful car!!* low miles!!(US $10,000.00)

2006 chevrolet cobalt ss sedan 4-door 2.4l *beautiful car!!* low miles!!(US $10,000.00) Wholesale pricing to the public low reserve low gas mileage

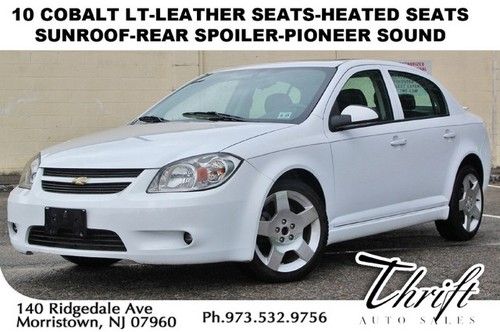

Wholesale pricing to the public low reserve low gas mileage 10 cobalt lt-leather seats-heated seats-sunroof-rear spoiler-pioneer sound(US $12,595.00)

10 cobalt lt-leather seats-heated seats-sunroof-rear spoiler-pioneer sound(US $12,595.00) 2006 chevrolet cobalt ss supercharged ~!~ recaro sport seats ~!~ sunroof ~!~ wow(US $10,950.00)

2006 chevrolet cobalt ss supercharged ~!~ recaro sport seats ~!~ sunroof ~!~ wow(US $10,950.00) 2007 chevrolet cobalt ls sedan 4-door 2.2l salvage wrecked repairable drives(US $5,000.00)

2007 chevrolet cobalt ls sedan 4-door 2.2l salvage wrecked repairable drives(US $5,000.00) 2005 chevrolet cobalt ls coupe 2-door 2.2l(US $5,000.00)

2005 chevrolet cobalt ls coupe 2-door 2.2l(US $5,000.00)

Auto Services in New Jersey

World Jeep Chrysler Dodge Ram ★★★★★

VIP HONDA ★★★★★

Vespia`s Goodyear Tire & Svc ★★★★★

Tropic Window Tinting ★★★★★

Tittermary Auto Sales ★★★★★

Sparta Tire Distributors ★★★★★

Auto blog

New auto loans could soon extend out to 84 months

Sun, Apr 22 2018Cars and trucks are more expensive than ever before. In order to boost sales and help consumers afford new vehicles, automakers are offering longer and longer terms for auto loans. This past week, Bloomberg reported that FCA's Ram Trucks division is currently offering the longest loans. Some stretch to 73 months. Jeep, Fiat and Chevy aren't far behind. More noteworthy is that we'll likely soon see lenders moving from 73-month to 84-month loans. That's seven years worth of interest. More than two-thirds of US auto sales come from light trucks like the Ford F-150, Chevy Silverado and Ram 1500. The average transaction price of a new vehicle is well over $30,000. It's not difficult to spec out a heavily-optioned truck up to $60,000. Vehicles depreciate from the moment they roll off a dealer lot, and these six or seven-year loans could hurt consumers and lenders both in the long run. The U.S. Senate voted last week to kill rules that would prevent discriminatory auto lending. These Obama-era guidelines were meant to curtail lenders who offered higher loans based on race, religion, sex or national origin. Related Video: News Source: Bloomberg Chevrolet Fiat RAM Car Buying car loan car values

Next Chevrolet Malibu to have 'groundbreaking,' 'passionate' design

Mon, Dec 29 2014In our First Drive of the Chevrolet Malibu after its redesign in 2013 we wrote, "Chevy has quickly worked up a host of changes for its ever-important midsize sedan, and will be launching this 'there, we fixed it' 2014 Malibu like it's an all-new product." Still, no one cared. The Malibu has been mentioned in eight posts this year, all but two of them dealt with recalls, and one of those two was about a 2011 Malibu university science project. It came up in precisely zero posts from November 2013 to March 2014. That's why, according to a report in Automotive News, Chevrolet honchos are "hustling" to have a new Malibu ready in a year. Mark Reuss, General Motors' head of global product development, said it will have "groundbreaking design" and "groundbreaking technology," and asked investors who were showed a picture of it, "When is the last time you saw a [midsize] car this distinctive and this dramatic from General Motors?" Doubling down on the bullishness, Reuss said, "We've got our act together here on the midsize-car segment." Then, throwing every last chip on the pile, global design head Ed Welburn said the next Malibu's design will "make a significant statement" with "a very passionate design." Based on the number of comments Malibu posts get, we figure a fair few number of you would love for this to be the case; yet this is a lot of braggadocio to slather on a car that probably hasn't made "a significant statement" since Elton John had a number one record with Honky Chateau. That was 1972, if you're trying to remember. No matter the looks, the AN report says the new 'Bu will make a profit statement, selling for more money while costing less to produce. Alongside the Cruze, GM figures the pair will bring in an extra $800 million in variable profit in 2016. Which, in case it ends up being another 'butterface,' isn't bad for a silver lining. Featured Gallery 2014 Chevrolet Malibu: First Drive View 36 Photos News Source: Automotive New - sub. req. Design/Style Chevrolet GM Sedan

2014 Chevrolet SS makes its live debut

Sat, 16 Feb 2013Chevrolet showed off the new 2014 SS in an airport hangar last night, its first rear-wheel-drive performance sedan in the US since the Impala SS from 1997. We'll have more to say about the SS later today, but this is the sedan that Chevrolet sees as the final piece in restoring its performance credentials. For those of you looking for a manual transmission, however, that wish will go unfulfilled - at least for now: the only two options buyers will have are the color and whether or not they want a sunroof.

We'll work on getting some more angles (in better light) today at Daytona International Speedway, but with fans seeing the car for the first time, we don't hold out much luck of getting a clear shot. So for now, enjoy the high-res gallery above.