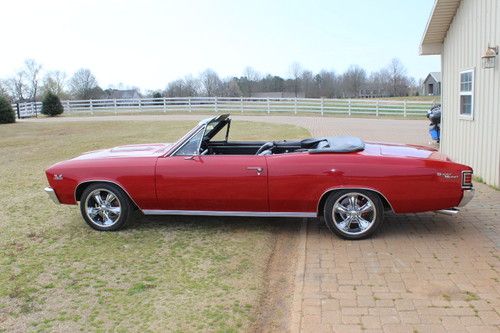

1966 Chevelle Ss Convertible 4 Speed 396 Ci Frame Off Rotisserie on 2040-cars

Buffalo, New York, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:396

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Chevrolet

Model: Chevelle

Trim: SS Convertible

Options: Convertible

Drive Type: 4 speed 12 bolt

Mileage: 30

Sub Model: SS

Disability Equipped: No

Exterior Color: Marina Blue

Number of Doors: 2

Interior Color: Bright Blue

Warranty: Vehicle does NOT have an existing warranty

Chevrolet Chevelle for Sale

1965 chevelle immaculate new restoration! no reserve

1965 chevelle immaculate new restoration! no reserve 1967chevelle convertible-big block(US $33,500.00)

1967chevelle convertible-big block(US $33,500.00) 2 door, 4 speed, standard trans.(US $8,000.00)

2 door, 4 speed, standard trans.(US $8,000.00) 1971 ls3 396 chevelle ss 4 speed original oem numbers matching super sport bbc

1971 ls3 396 chevelle ss 4 speed original oem numbers matching super sport bbc 1967 chevelle malibu

1967 chevelle malibu Fully documented just 14,286 miles 1971 chevrolet chevelle malibu all original.

Fully documented just 14,286 miles 1971 chevrolet chevelle malibu all original.

Auto Services in New York

Zona Automotive ★★★★★

Zima Tire Supply ★★★★★

Worlds Best Auto, Inc ★★★★★

Vip Honda ★★★★★

VIP Auto Group ★★★★★

Village Line Auto Body ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Submit your questions for Autoblog Podcast #323 LIVE!

Mon, 04 Mar 2013We're set to record Autoblog Podcast #323 tonight, and you can drop us your questions and comments regarding the rest of the week's news via our Q&A module below. Subscribe to the Autoblog Podcast in iTunes if you haven't already done so, and if you want to take it all in live, tune in to our UStream (audio only) channel at 10:00 PM Eastern tonight.

Discussion Topics for Autoblog Podcast Episode #323

Lamborghini Veneno

GM Halts Sale Of Most Chevy Cruze Models

Fri, Mar 28 2014General Motors has told dealers to stop selling some 2013 and 2014 Chevrolet Cruze compact cars. But the company won't say why. Dealers say stop-sale orders are routine and almost always made to fix a safety problem. They received the order in an e-mail Thursday, but no reason was given. The move comes as GM deals with fallout from a delayed recall of 1.6 million older small cars to fix an ignition switch problem. The company says the switches can slip out of the run position and shut down the engine. That causes loss of power steering and brakes and disables air bags. GM says the problem has been linked to 31 crashes and at least a dozen deaths. Spokesman Greg Martin says he has no details on the Cruze. Related Gallery Chevy Impala Earns Highest Accolades From Consumer Reports Recalls Chevrolet GM Cruze