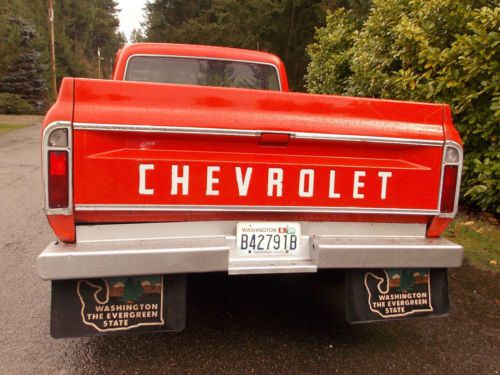

1969 Chevy 3/4 350 Auto No Reserve Sell Worldwide Excellent Condition Turn Key on 2040-cars

Tacoma, Washington, United States

| |||||

Chevrolet Other Pickups for Sale

1955 chevy pick up, first series , big block .street rod!! woody!!!!(US $21,500.00)

1955 chevy pick up, first series , big block .street rod!! woody!!!!(US $21,500.00) 1947 1948 1949 1950 1951 1952 1953 chevrolet pickup five window restored(US $28,000.00)

1947 1948 1949 1950 1951 1952 1953 chevrolet pickup five window restored(US $28,000.00) 1953 chevy 3100 pickup truck(US $14,444.44)

1953 chevy 3100 pickup truck(US $14,444.44) 1958 chevrolet 3100 pickup cool truck look!

1958 chevrolet 3100 pickup cool truck look! Daily driver on c-10 frame! watch video!(US $7,900.00)

Daily driver on c-10 frame! watch video!(US $7,900.00) 1982 chevrolet k10 silverado regular cab pickup lq9 6.0l swap ls1 lsx 4x4 4l80e(US $7,495.00)

1982 chevrolet k10 silverado regular cab pickup lq9 6.0l swap ls1 lsx 4x4 4l80e(US $7,495.00)

Auto Services in Washington

West Richland Auto Repair ★★★★★

We Fix IT Auto Repair ★★★★★

Trucks Plus Inc ★★★★★

Tru Autobody & Collision Repair LLC ★★★★★

Toyota of Renton ★★★★★

Toby`s Battery & Auto Electric ★★★★★

Auto blog

GM promises to add 20 EVs and fuel-cell cars to lineup, paid for by SUVs

Mon, Oct 2 2017DETROIT — General Motors outlined plans on Monday to add 20 new battery electric and fuel-cell vehicles to its global product lineup by 2023, financed by robust profits from sales of gasoline-fueled trucks and sport utility vehicles in the United States and China. "General Motors believes in an all-electric future," GM global product development chief Mark Reuss said on Monday during a briefing at the company's suburban Detroit technical center. Future generations of GM electric vehicles "will be profitable," Reuss said, but added it was not clear when GM could make all its new vehicle offerings zero-emission electric cars. Regulators in China and some European countries have floated proposals to ban internal combustion engines by 2030 or 2040. "We will continue to make sure our internal combustion engines will get more and more efficient," Reuss said. GM shares were up more than 4 percent in midday New York trading on positive comments from Rod Lache, auto analyst at Deutsche Bank. Automakers, including electric vehicle market leader Tesla, lose money on electric cars because battery costs are still higher than comparable internal combustion engines. The company offered sneak peeks of three EV prototypes: a Buick SUV, a sporty Cadillac wagon and a futuristic pod car wearing a Bolt badge. GM funds its forays into new technology using a river of cash generated by old-technology vehicles popular with its core customer base in the United States heartland. In comparison, Tesla has burned through an estimated $10 billion in cash and has yet to show a full year profit. GM earned more than 90 percent of its $12.5 billion in pretax profits last year in North America, amid robust demand for its lineup of large sport utility vehicles and pickup trucks. The company's profitable operations in China rely on consumer demand for an expanding lineup of gasoline powered SUVs. GM has previously announced plans to make some of its future electric vehicles capable of driving themselves in robot taxi fleets. The company offered sneak peeks of three electric vehicle prototypes: a Buick brand sport utility vehicle, a sporty Cadillac wagon and a futuristic pod car wearing a Bolt badge. GM collaborated with Korean battery maker LG Chem to build the Bolt battery system. Company officials did not say what companies would supply batteries for the larger fleet of vehicles promised by 2023. Fuel-cell vehicles will also play a role in GM's future, the company said.

The story of the 2014 Chevrolet SS: "Luxury, power, refinement, handling"

Thu, 07 Mar 2013Not including the women and men who built it, the 2014 Chevrolet SS has only been seen in person by a piddling number of people - fewer humans than would fill the gymnasium at a high school volleyball game. Not including the men and women who built it, no one has driven it. Even so, it is already saddled with two controversies: the way it looks and the way it shifts.

First to that shifting. Did we love the last Americanized Holden, the awesomely sportsome Pontiac G8 GXP, and its six-speed manual? Of course. Do we wish the SS came with a six-speed manual? Of course. But we'd like a toboggan to come with a manual transmission. We'd put a manual transmission on a weasel if we could because we're just wired that way; if it moves, it should come with a stick and a clutch. Or at least the option.

Let's climb down off the ledge, though. We haven't driven the SS and we have no idea how good (or not) the automatic is. And the Hobson's Choice in transmissions when it comes to sport sedans like the BMW M5, Mercedes-Benz E63 AMG and Jaguar XFR-S and, oh yeah, cars-that-really-should-have-manuals like the Audi R8 and Nissan GT-R and Porsche 918 and every single Lamborghini and Ferrari, for instance, hasn't stopped us from enjoying what is clearly the gruesome, dual-clutched demise of Western automotive civilization. Because in spite of our ululations at the dying of the six-speed light, we understand.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.