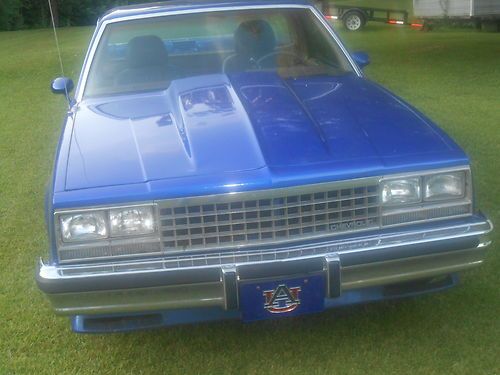

1985 Elcamino on 2040-cars

Guin, Alabama, United States

Vehicle Title:Clear

Engine:350

For Sale By:Private Seller

Exterior Color: Blue

Make: Chevrolet

Number of Cylinders: 8

Model: El Camino

Trim: ss

Power Options: Power Locks, Power Windows, Power Seats

Drive Type: automatic

Mileage: 117,000

Warranty: Vehicle has an existing warranty

Sub Model: ss

1985 elcamino runs drives good 350 engine r200 tran new exhust bluid motor tran 1 year ago gm cal hood small com cam daly driver

Chevrolet El Camino for Sale

1979 chevrolet el camino ss standard cab pickup 2-door 5.7l(US $7,500.00)

1979 chevrolet el camino ss standard cab pickup 2-door 5.7l(US $7,500.00) 1969 chevelle concours station wagon; , all original 350 / 300 hp, very rare

1969 chevelle concours station wagon; , all original 350 / 300 hp, very rare 1981 silver blue/blue,38kmiles,fuel-injected vettev-8,computer,auto,,pdb,ac,exc.

1981 silver blue/blue,38kmiles,fuel-injected vettev-8,computer,auto,,pdb,ac,exc. 1983 chevrolet el camino base standard cab pickup 2-door 5.0l no reserve

1983 chevrolet el camino base standard cab pickup 2-door 5.0l no reserve 1979 chevrolet el camino base standard cab pickup 2-door 5.7l(US $10,000.00)

1979 chevrolet el camino base standard cab pickup 2-door 5.7l(US $10,000.00) Seafoam green 1966 el camino(US $13,000.00)

Seafoam green 1966 el camino(US $13,000.00)

Auto Services in Alabama

Y-Bi-Nu-Karz ★★★★★

Wright Tire And Service ★★★★★

Weeks Tire ★★★★★

Tuscaloosa Chevrolet ★★★★★

Transtech ★★★★★

Townsend Roadside Assistance ★★★★★

Auto blog

Ranking full-size pickup trucks by the size of their discounts

Tue, Oct 20 2020Each and every month, full-size pickup trucks dominate the new-car sales reports in America. It's been that way for years — the Ford F-Series has been America's best-selling vehicle for 38 consecutive years — and it's not going to change any time soon. With that in mind, we've compiled this list of discounts on brand-new full-size pickup trucks using data provided by Truecar, including their average retail prices, average transaction prices and discounts in dollars and percentage off list price. We've also created a visualization of the best deals Americans are scoring on the three best-selling models in America. If you're looking for the absolute biggest discount you can find on a new truck, look no further than your nearest Ram dealership, then scour the lot for a leftover 2019 1500 model. Buyers are averaging nearly 13% off the cost of the 2019 Ram, paying an average transaction cost of $41,667. That's $6,071 off the average retail price, which equals the best truck deal in October. The 2020 edition isn't discounted nearly as far, averaging $2,852 off for an average transaction price of $48,904. The next best deal is on the 2019 Ford F-150; its average transaction price of $43,064 equals $3,843 off its sticker price. The 2020 F-150's $2,810 discount means buyers are paying around $47,300. They should know, though, that a brand-new model is coming for 2021, so we'd expect bigger discounts on remaining 2020 inventory in the coming months. Moving to General Motors, the best deal you'll find is on leftover 2019 Chevy Silverado 1500s, which are selling for an average of $47,043. That's $2,852 off the sticker price. Interestingly, 2020 Silverados are seeing slightly lower transaction prices at $46,009, but with a smaller average discount of $1,693. The 2020 GMC Sierra is mechanically similar to the Chevy, but aimed at buyers who want a bit more luxury. That's reflected in the 2020 Sierra 1500's average transaction price of $54,491, which is $2,131 off its sticker. If pickup trucks aren't your thing, take a look at this list of the best new car deals in America based on the percentage discount off their suggested asking prices here. And when you're ready to buy, click here for the Autoblog Smart Buy program, which brings you a hassle-free buying experience with over 9,000 Certified Dealers nationwide.

2014 Chevy Silverado priced from *$24,585, V8 gets better economy than Ford EcoBoost V6

Mon, 01 Apr 2013Chevrolet has thrown down the next hand in the pickup truck poker wars and revealed at least a couple of potential aces - depending on which numbers matter most to you. The 2014 2014 Silverado 1500 with its 5.3-liter EcoTec3 V8 gets 335 horsepower and 383 pound-feet of torque, is mated to a six-speed automatic, can tow 11,500 pounds with the optional Max Trailer Package and costs the same as the outgoing Silverado, $24,585 (*including $995 destination fee). Chevy says the Silverado also stands atop the fuel economy charts when comparing any competitor with a V8 engine - and some competitors with V6 engines. The two-wheel drive model returns 16 miles per gallon city, 23 mpg highway, 19 mpg combined in two-wheel drive guise and 16 mpg city, 22 mpg highway and 18 mpg combined as a four-wheel drive.

For context around those numbers, the most fuel efficient V8-powered 2013 Ford F-150 pickups lose about two mpg in every metric compared to the Silverado, the 3.5-liter V6 EcoBoost returning 16 city, 18 highway and 22 combined in two-wheel drive. However, that EcoBoost does have 365 hp and 420 lb-ft of torque. You can get a Ram 1500 with a 3.6-liter V6 that gets 25 mpg highway, but it has 305 hp and 269 lb-ft of torque. The 2013 Ram with the 5.7-liter Hemi V8 and its 395 hp and 407 lb-ft drops one mpg in every category to the Silverado. Its tow rating is 200 pounds beyond its nearest competitor, the F-150 with the Max Trailer Tow Package.

Elsewhere, the new Silverado gets a quieter cab with a redesigned interior, a new bed with improved load-management possibilities, disc brakes all around, tweaked steering and suspension, along with free standard scheduled maintenance for two years or 24,000 miles.

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.