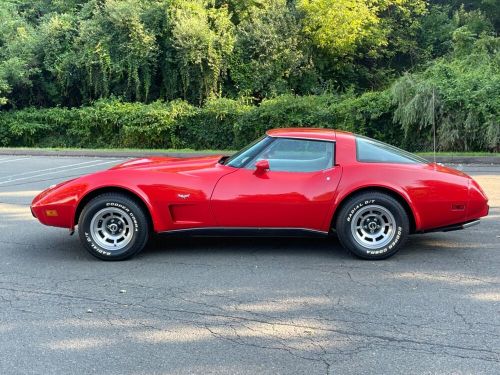

Transmission:Automatic

Vehicle Title:Clean

Mileage: 81012

Model: Corvette

Make: Chevrolet

Chevrolet Corvette for Sale

1974 chevrolet corvette 454(US $32,000.00)

1974 chevrolet corvette 454(US $32,000.00) 1979 chevrolet corvette(US $500.00)

1979 chevrolet corvette(US $500.00) 1975 chevrolet corvette(US $5,855.00)

1975 chevrolet corvette(US $5,855.00) 1958 chevrolet corvette(US $45,000.00)

1958 chevrolet corvette(US $45,000.00) 1984 chevrolet corvette(US $7,750.00)

1984 chevrolet corvette(US $7,750.00) 1970 chevrolet corvette lt-1 very hard to find lt-1 370hp(US $49,999.00)

1970 chevrolet corvette lt-1 very hard to find lt-1 370hp(US $49,999.00)

Auto blog

Chevy Colorado gets Midnight, Trail Boss editions

Mon, Aug 3 2015After introducing a gamut of special editions for the full-size Silverado, Chevrolet is offering a pair of new packages for its midsize Colorado. Following in the Silverado's footsteps, the Colorado Midnight Edition just blacks out all the things. There's a black grille, black Bowtie, and exclusive 18-inch wheels. They happen to be black, as well. In terms of functional changes, the Midnight Edition adds a spray-in bedliner, tonneau cover, and unique sill plates. Potential owners won't be limited on engine options and body styles here, as the blacked-out trim can be added to extended and crew cab bodies, in two- or four-wheel drive models, and with all of the pickup's available engines, including the upcoming Duramax diesel. The only limiting factor is the actual trim level – you'll need to settle for the mid-grade LT. Don't worry, though. The heftier, top-of-the-line Z71 will be offered with its own unique package, called the Trail Boss. As expected, it goes big on off-road character, with LED trail lighting and aggressive Goodyear Wrangler DuraTec tires. There are also black 17-inch wheels, newly flared fenders, side steps, and like the Midnight Edition, a blacked-out grille and spray-in bedliner. Also like the Midnight Edition, the only limit to adding the Trail Boss is that you opt for the Z71 trim. Engines, drivetrains, and body styles are not fixed. Look for both trucks at your local Chevrolet dealer this fall. Until then, scroll down for the official press release. 2016 Chevy Colorado Special Models Dressed to Impress Midnight Edition, Z71 Trail Boss complement capability with customized style 2015-08-03 DETROIT – On the street or on the trail, the 2016 Chevrolet Colorado's Midnight Edition and Z71 Trail Boss bring bolder choices to customers looking to make a visual statement with their truck. The special editions roll into Chevrolet dealerships this fall, with distinctly tailored appearances that blend custom design cues with Colorado's popular options and accessories. The Midnight Edition evokes the aesthetic of an urban tuner vehicle, while the Z71 Trail Boss is designed for terrain where the pavement ends. "These are aggressive editions of one of the country's hottest-selling truck, demonstrating the personalization that's possible with Chevrolet accessories, whether it's for the street, trail or both," said Tony Johnson, Colorado marketing manager.

GM recalls 8,500 Chevrolet Malibu models for rear suspension glitch

Mon, 04 Feb 2013According to a letter from General Motors to the National Highway Traffic Safety Administration, flaws in the build process of the 2013 Chevrolet Malibu have led to the recall of 8,519 cars. Units built between December 6, 2011 and January 15, 2013 may have been assembled with rear suspension cradles that had insufficient torque applied to certain bolts. That out-of-spec assembly could lead to issues ranging from slight noises to a loss of vehicle control.

The problem was first noticed in December of last year by a GM test fleet driver and eventually tracked back to the improperly torqued bolts on the suspension cradle assembled through July 2012 by a supplier located not too far from the Malibu's Detroit/Hamtramck Assembly Plant. Since an official NHTSA recall notice has not been issued yet, it isn't clear whether or not Detroit-built Malibus were the only ones affected (the 2013 Malibu is also built at GM's Fairfax Assembly Plant in Kansas City, Kansas). Dealers will fix the problem by inspecting vehicles for proper torque specs, retightening if not within specs and, in some cases, perform a rear-wheel alignment.

New 2016 Chevy Volt ad arrives in time for Tomorrowland

Tue, May 12 2015As summer approaches, so do the blockbusters. We've already seen Furious 7 and The Avengers: Age of Ultron, while Mad Max: Fury Road arrives this week. Next week's big debut is Disney's Tomorrowland, starring George Clooney, and not surprisingly, the advertising campaign is kicking into gear. Perhaps attempting to capitalize on the high-tech theme of the flick, Chevrolet has teamed up with Disney for the second-generation Volt's very first commercial appearance. As we reported previously, the Volt will star on the big screen when Tomorrowland hits theaters, and it will be accompanied by the EN-V Concept. Take a look at the Volt's Tomorrowland spot, up top. Related Video: