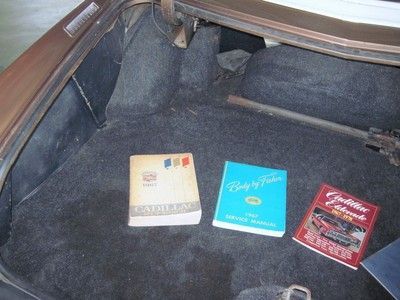

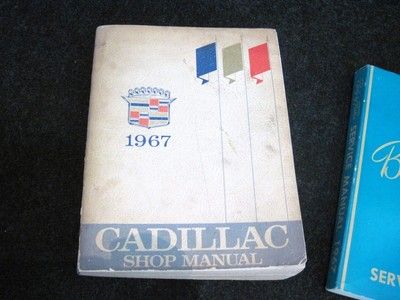

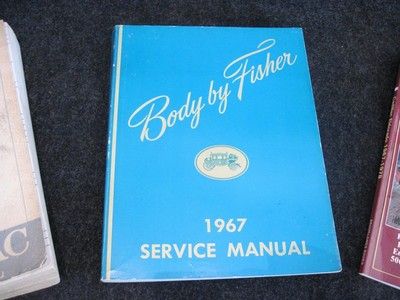

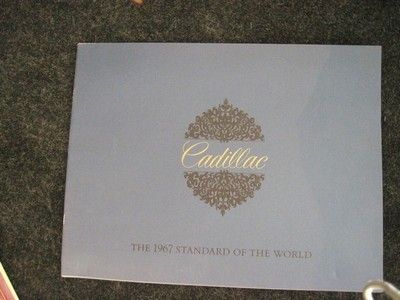

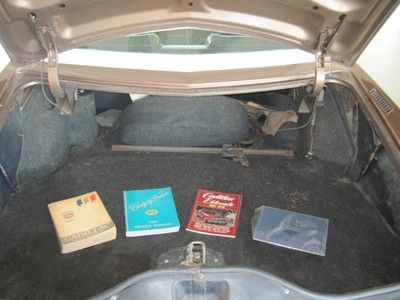

1967 Gold Cadillac Eldorado on 2040-cars

Bowling Green, Kentucky, United States

Body Type:Coupe

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Make: Cadillac

Model: Eldorado

Warranty: Vehicle does NOT have an existing warranty

Mileage: 30,000

Exterior Color: Gold

Interior Color: Brown

Number of Cylinders: 8

Cadillac Eldorado for Sale

Auto Services in Kentucky

Tire Discounters Inc ★★★★★

The Quick Lane Tire & Auto Center Of Winchester ★★★★★

T & T Transmission Service ★★★★★

Russell County Tire ★★★★★

ProTouch Quality Auto Cleaning Polishing & Window Tinting ★★★★★

Napa Auto Parts - Genuine Parts Company ★★★★★

Auto blog

Mercedes leads in US luxury car thefts

Wed, 31 Jul 2013Mercedes-Benz makes some fine automobiles. The Silver Arrow'd cars are so good, apparently, that thieves can't help but try to steal them. The German brand is at the top of the charts for luxury car thefts in the US, according to the National Insurance Crime Bureau, with New York City leading the way. (And those New Yorkers complain about Detroit being bad!)

The C-Class was the most stolen model, with 485 ganked between 2009 and 2012 in NYC alone, while the E-Class and S-Class (which also boasted the worst recovery rate, at 59 percent) both finished in the top ten. Following the C-Class was the BMW 3 Series and Infiniti G. Not surprisingly, each of these were the most common models in their respective lineups. Los Angeles and Miami are also prime hotspots for luxury car thefts, according to the Detroit News report.

While getting your car stolen is pretty awful, there was one inspiring statistic compiled by the NICB - the average recovery rate across the board was 84 percent, with the Cadillac CTS getting recovered 91 percent of the time.

May 2016: FCA wins, Ford and GM stumble on weak car volumes

Wed, Jun 1 2016The May 2016 sales numbers are in, and it looks as though FCA is getting some vindication for boldly cancelling two slow-selling car models. Meanwhile, Ford saw overall sales dip and GM's May volume took a big dive versus the same month in 2015. While Marchionne's decision to axe the Chrysler 200 and Dodge Dart has drawn criticism as being short-sighted, it's working for FCA so far. Although the Dart and 200 aren't out of production yet and no capacity has been shifted to crossover or trucks, May's numbers show that the emphasis on Jeep and Ram models makes sense right now. FCA's US sales rose 1 percent last month compared to May 2015, putting the year-to-date total at 955,186 vehicles, an increase of 6 percent compared to the same period last year. Standouts included the Jeep Renegade, Compass, and Patriot, and the Fiat 500X. Ram pickup sales were down 3 percent. And your fun fact is that Alfa Romeo sales were up precisely 10 percent, for a total of 44 4Cs sold versus 40 in the same month last year. At FoMoCo, the Ford brand took a hit to the tune of 6.4 percent from May 2015 to 2016, registering 226,190 sales last month. Lincoln showed improvement on its modest numbers, going from 9,174 to 9,807, a 6.9 percent increase. Overall, Ford was down 5.9 percent for the month to 235,997; despite the slump, year-to-date total Ford sales are up 4.2 percent to 1,112,939. Strong sellers included Escape, Expedition, F-Series, and Transit - big stuff. Most small and/or efficient models (Fiesta, Focus, Fusion, C-Max) saw sales slides. Fusion sales were also down, likely due to effects of model changeover to the freshened 2017 model. Ford has promised four new crossovers and SUVs by 2020 and if things keep trending this way the company will be able to sell them, but things could change in the next four years. GM saw the worst of it for domestic brands. Retail and fleet sales were down for each of the four divisions, with the May 2016 total dropping 18 percent to 240,450 vehicles. GM's year-to-date sales are down 5.0 percent in 2016 to 1,183,705. Both the Sierra and Silverado were down significantly, and the majority of Chevy, Buick, GMC, and Cadillac nameplates saw sales decreases, with both small cars and larger utilities included. Not even big stuff could help GM this month, it seems. We'll have more on the rest of the industry's May sales as those figures trickle in.

Driving Civic and Elantra Hybrids, and big Ford Maverick updates | Autoblog Podcast #842

Fri, Aug 2 2024In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Road Test Editor Zac Palmer. They discuss the week in car news first, leading off with the updated 2025 Ford Maverick that adds a Lobo sport truck variant and an AWD hybrid. Next, they chat some Cadillac news with the reveal of the stunning Sollei convertible concept and the refreshed 2025 Escalade. After the news, the two focus on what they've been driving over the past couple of weeks. They start with the Fiat 500e, then move along to a comparison between the refreshed Hyundai Elantra Hybrid and totally-new Honda Civic Hybrid. Lastly, there's a discussion of the new Infiniti QX80 and the STI mods applied to our long-term Subaru WRX. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #842 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown News 2025 Ford Maverick Lobo 2025 Ford Maverick adds AWD hybrid version Cadillac Sollei revealed 2025 Cadillac Escalade refresh What we're driving 2024 Fiat 500e 2025 Honda Civic Hybrid 2024 Hyundai Elantra Hybrid 2025 Infiniti QX80 Long-Term 2023 Subaru WRX Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related Video:  Cadillac Sollei is an electric convertible concept This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

1975 cadillac eldorado base coupe 2-door 8.2l

1975 cadillac eldorado base coupe 2-door 8.2l 1976 cadillac eldorado biarritz coupe 2-door 8.2l silver

1976 cadillac eldorado biarritz coupe 2-door 8.2l silver Original 1975 eldorado convertible

Original 1975 eldorado convertible 1978 cadillac eldorado

1978 cadillac eldorado 1957 cadillac eldorado

1957 cadillac eldorado 1993 red cadillac eldorado touring coupe 2-door 4.6l northstar engine low miles

1993 red cadillac eldorado touring coupe 2-door 4.6l northstar engine low miles