2005 04 03 02 Cadillac Deville 1own On Star Non Smoker Htd/cool Seats No Reserve on 2040-cars

Hollywood, Florida, United States

Engine:4.6L 281Cu. In. V8 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Sedan

Transmission:Automatic

Fuel Type:GAS

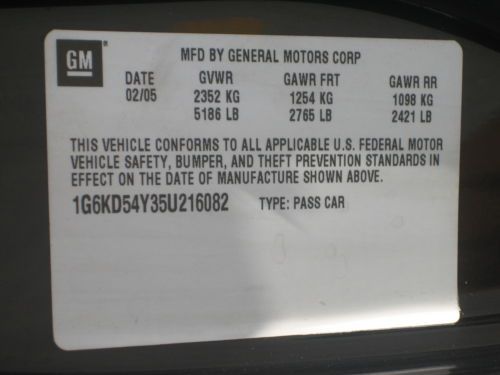

Year: 2005

Warranty: Vehicle does NOT have an existing warranty

Make: Cadillac

Model: DeVille

Options: Sunroof

Trim: Base Sedan 4-Door

Safety Features: Side Airbags

Power Options: Power Windows

Drive Type: FWD

Mileage: 78,825

Vehicle Inspection: Inspected (include details in your description)

Sub Model: 4dr Sdn

Number of Doors: 4

Exterior Color: Black

Interior Color: White

Number of Cylinders: 8

Cadillac DeVille for Sale

1969 cadillac coupe custom strret rod! 22k orig miles! california black plate!

1969 cadillac coupe custom strret rod! 22k orig miles! california black plate! 1990 cadillac sedan deville 4 door 4.5l v8 - 135k - black on black - very clean!(US $1,995.00)

1990 cadillac sedan deville 4 door 4.5l v8 - 135k - black on black - very clean!(US $1,995.00) 2003 04 05 02 01 00 cadillac deville hearse funeral 52k non smoker no reserve!

2003 04 05 02 01 00 cadillac deville hearse funeral 52k non smoker no reserve! 1969 cadillac deville. maroon w/ white interior 69k **must see** convertable(US $6,000.00)

1969 cadillac deville. maroon w/ white interior 69k **must see** convertable(US $6,000.00) Cadillac deville sedan 4 door 1986 with landau sunroof great condition!

Cadillac deville sedan 4 door 1986 with landau sunroof great condition! 2005 (no trim) 4.6l auto thunder gray

2005 (no trim) 4.6l auto thunder gray

Auto Services in Florida

Zephyrhills Auto Repair ★★★★★

Yimmy`s Body Shop & Auto Repair ★★★★★

WRD Auto Tints ★★★★★

Wray`s Auto Service Inc ★★★★★

Wheaton`s Service Center ★★★★★

Waltronics Auto Care ★★★★★

Auto blog

GM claims it's first to sell million 30+ mpg vehicles

Fri, 04 Jan 2013As we continue to put together all the data for the year-end edition of By The Numbers, General Motors has announced that it sold more than a million vehicles in the US last year that achieved at least 30 miles per gallon on the highway. More impressively, GM managed this feat using multiple strategies including small vehicle size, turbocharged engines and hybrid or plug-in technologies across four brands (Buick, Cadillac, Chevrolet and GMC) accounting for 13 separate models. This number will grow even more in 2013 thanks to cars like the all-electric Spark, the diesel Cruze, the range-extended Cadillac ELR and the Buick Encore compact CUV.

GM's small car sales were up 39 percent last year helping to attain this million-sales mark for 30-mpg models, and almost 40 percent of all GM sales consisted of cars with fuel-efficient I4 engines. In regards to more advanced means of improving fuel economy, GM says that it plans on having 500,000 vehicles with "some form of electrification" on the road by 2017.

Scroll down for the full list of GM's million 30+ mpg cars as well as an informative press release.

GM to idle car production at five factories as Americans continue CUV love affair

Mon, Dec 19 2016In case you needed another reminder that Americans have fallen out of love with sedans, General Motors today announced plans to idle five factories in January in a bid to cut its inventory to 70 days. Detroit-Hamtramck Assembly ( Buick LaCrosse, Cadillac CT6, Chevrolet Volt and Impala) and Fairfax Assembly in Kansas ( Chevy Malibu) will stop production for three weeks. Lansing Grand River ( Cadillac ATS and CTS, and Chevy Camaro) is going down for two weeks, while Lordstown, OH ( Chevy Cruze) and Bowling Green, KY ( Chevy Corvette) will go idle for a week each, Automotive News reports. GM's shutdown reflects a broader problem with the company's supply – at 847,000 vehicles, the company's supply increased unsteadily from a low of 629,000 units in January of 2016. That's more than a 25 percent increase in the past year. Citing information from Autodata, The Detroit News reports that at the end of November, GM had a 168-day supply of LaCrosses, 177 days' worth of Camaro, 170 days of Corvette, 121 days for Cruze, 119 days for ATS, 132 days for CTS, and 110 days of CT6. Meanwhile, inventory of the company's more popular vehicles is actually below the professionally accepted 60- to 70-day supply, The News reports. The Trax, Colorado pickup, and GM's full-size SUVs are sitting below 50 days and experiencing year-over-year sales increases. GM needs a rethink of its inventory levels, which is something that's apparently coming. "We're going to be responsible in managing our inventory levels," GM spokesman Jim Cain told The News. Another unnamed spokesman told Automotive News the company's day-to-day supplies would "fluctuate before moderating at year-end." But at least one analyst thinks this won't be the last time Detroit needs to stop production to level things out. "Incentives are elevated, residuals are declining, and rates are rising," Brian Johnson, an analyst with Barclays, told The News. "And while GM in particular may benefit in the months ahead from new product launches, it's important to recognize that GM's inventory is elevated at the moment, and it wouldn't surprise us if they need to announce another production cut – which could pressure the stock." Related Video: News Source: The Detroit News, Automotive News - sub. req.Image Credit: Paul Sancya / AP Plants/Manufacturing Buick Cadillac Chevrolet GM GMC Crossover SUV Sedan bowling green cadillac xt6 fairfax

Watch the 2019 Autoblog Technology of the Year presentation to Cadillac

Wed, Jan 16 2019Autoblog presented our 2019 Technology of the Year Award to Cadillac at the Detroit Auto Show. Autoblog conducted rigorous testing last fall on the latest automotive technologies, and Cadillac Super Cruise earned top honors, edging out Infiniti's Variable Compression Turbo and Mercedes' EQ technologies, the other two finalists. Super Cruise is a semi-autonomous system that allows for hands-free driving to reduce the driver's workload. Our editors found it easy to use and noted the system simply works as intended. We happily found Cadillac under-promised and over-delivered with Super Cruise, a clever system that truly helps the driver. Super Cruise launched on the CT6 sedan, and Cadillac plans to roll out the feature to other vehicles. Watch the video above as Cadillac President Steve Carlisle receives the 2019 Autoblog Technology of the Year Award from Editor-in-Chief Greg Migliore, with Autoblog GM Adam Morath and the editorial team on hand at the Detroit show. Related Video:

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.038 s, 7948 u