2004 Cadillac Cts on 2040-cars

Howard Beach, New York, United States

Body Type:Sedan

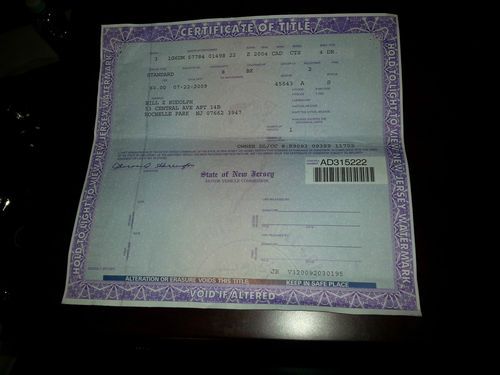

Vehicle Title:Clear

Engine:3.2L 197Cu. In. V6 GAS DOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Dealer

Make: Cadillac

Model: CTS

Warranty: Vehicle does NOT have an existing warranty

Trim: Base Sedan 4-Door

Options: Leather Seats, CD Player

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 85,000

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: CTS

Exterior Color: Black

Interior Color: Tan

Number of Doors: 4

Number of Cylinders: 6

Cadillac CTS for Sale

2005 tan!(US $10,777.00)

2005 tan!(US $10,777.00) One of a kind cts-v

One of a kind cts-v 2010 cadillac cts awd pano sunroof nav htd seats 33k mi texas direct auto(US $26,480.00)

2010 cadillac cts awd pano sunroof nav htd seats 33k mi texas direct auto(US $26,480.00) 2011 cadillac cts-v coupe *700 hp**show car**lingenfelter**cts v**d3**vossen*cpo

2011 cadillac cts-v coupe *700 hp**show car**lingenfelter**cts v**d3**vossen*cpo 2003 cadillac cts 5 speed - personal car for sale no reserve

2003 cadillac cts 5 speed - personal car for sale no reserve 2005 cadillac(US $9,800.00)

2005 cadillac(US $9,800.00)

Auto Services in New York

Tones Tunes ★★★★★

Tmf Transmissions ★★★★★

Sun Chevrolet Inc ★★★★★

Steinway Auto Repairs Inc ★★★★★

Southern Tier Auto Recycling ★★★★★

Solano Mobility ★★★★★

Auto blog

OnStar RemoteLink mobile app coming standard on all new GM vehicles

Thu, 06 Jun 2013As an evolution and improvement of its OnStar technology, General Motors has announced that it will be expanding the RemoteLink Mobile App on most 2014 model year Chevrolet, Buick, GMC and Cadillac vehicles. The new, aptly named RemoteLink Key Fob Services will allow users to remotely operate all of the same systems as the car's key fob, including locking and unlocking the doors and remote starting (on vehicles equipped with a factory remote starter) using a smartphone.

These Key Fob Services will be free for five years - starting from the vehicle's delivery date - but the full suite of RemoteLink features will continue to be offered only with a subscription (trial or paid). These premium features include contacting a live adviser, getting turn-by-turn directions and remotely monitoring the vehicle's diagnostic systems.

Scroll down below for the complete press release with all the details.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Junkyard Gem: 1981 Cadillac Eldorado with V8-6-4 engine

Sun, Aug 18 2019Skyrocketing fuel prices caused by geopolitical events in 1973 and 1979 led to gas lines, federal fuel economy requirements, and an increasing reluctance on the part of American car shoppers to buy big, thirsty Detroit luxury machines. General Motors had pulled off some amazing technological feats in the past — the small-block Chevrolet V8 engine and Hydramatic transmission being two extraordinarily successful ones — and so Cadillac's bosses figured that a combination of computer wizardry and clever mechanical engineering would give the 368-cubic-inch Cadillac V8 a cylinder-deactivation system and resulting superior fuel economy. Here's a very rare example of one of those 1981 Cadillacs, found in a California self-service wrecking yard. The idea behind the V8-6-4 was that computer-controlled solenoids would physically disengage the rocker arms for one or two cylinders on each engine bank under low-load conditions, converting the engine from a 368-cube V8 to a 276ci V6 or 184ci V4 (that's 6.0, 4.5 or 3.0 liters, respectively, for the metric-system aficionados among us). This sort of variable-displacement magic is commonplace today, but it was science-fiction stuff in 1981. An "MPG Sentinel" display on the dash would let the driver know how many cylinders were active at the moment, and the car would get Chevy Citation fuel economy with Cadillac luxury. The V8-6-4 was the standard engine in all 1981 Cadillacs (except for the Seville, which had the troubled Oldsmobile diesel engine as the base powerplant and the V8-6-4 as an option). Unfortunately, the V8-6-4 worked about as well as the Oldsmobile diesel: very poorly. Within a few years, most owners of these engines had disconnected the rocker-deactivation solenoids and just drove their cars as regular full-time V8s. This one has the snazzy "Cabriolet Roof Treatment" option, which boasted "textured elk grain" vinyl and could be had in one of 17 available colors. Front-wheel drive gave the early-1980s Eldorado plenty of interior space, despite its more proletarian Olds Toronado origins, and these velour-covered seats made for very comfortable road trips. The price tag started at $17,550, or about $51,650 in 2019 dollars. The 1981 Imperial went for $18,311, and that car was based on the same platform as the lowly Plymouth Volare. Meanwhile, A BMW 733i cost $28,945 and a new Toyota Cressida a mere $11,599. The 1981 Cadillacs were just a little too much ahead of their time, it turned out.