1995 Buick Roadmaster Station Wagon Lt1 5.7 Engine on 2040-cars

|

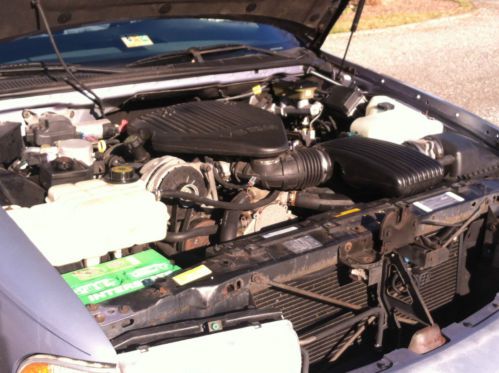

Vehicle Owner: Charlie Daniels Contact Phone: (757) 871-3623 1995 Buick Roadmaster Wagon Excellent running vehicle! Mechanically sound. Interior is very nice. Original paint with normal small scratches/door dings. Grill has small piece broken. Little or no rust. A/C and heat work very well. Very clean and nice appearing vehicle! (Great street rod engine and transmission package). Current VA State Inspection Sticker Shipping and payment: Buyer must take delivery of vehicle within 7 days of close of auction. $500 deposit within 24 hours of the close of the auction (preferred method of PayPal). Remaining balance to be paid within 7 days of the close of the auction via cash (in person) or through PayPal. |

Buick Roadmaster for Sale

1996 buick roadmaster wagon low miles 1-owner(US $6,999.00)

1996 buick roadmaster wagon low miles 1-owner(US $6,999.00) 1996 roadmaster sedan - collectors edition

1996 roadmaster sedan - collectors edition Two owner~1st owner for 17 yrs~3rd row~vista roof~ all recent service~clean~rare(US $14,995.00)

Two owner~1st owner for 17 yrs~3rd row~vista roof~ all recent service~clean~rare(US $14,995.00) 1996 buick roadmaster estate wagon collector's edition wagon 4-door 5.7l

1996 buick roadmaster estate wagon collector's edition wagon 4-door 5.7l 1995 buick roadmaster *super low miles* low reserve!

1995 buick roadmaster *super low miles* low reserve! 1948 buick roadmaster 4-door sedan with v-8 engine project car parts(US $2,500.00)

1948 buick roadmaster 4-door sedan with v-8 engine project car parts(US $2,500.00)

Auto blog

Next-gen LaCrosse, Cascada convertible coming to Buick showrooms in 2016

Thu, Jul 24 2014It's difficult to overstate how significant the post-bankruptcy years have been for General Motors' Buick brand. Arguably the most improved American automaker, Buick has rounded out its range with an excellent compact in the Verano, a well-balanced midsizer in the Regal and a segment-busting mini-CUV, with the Encore. Seeking to keep that momentum going, the next several years will see the brand address a trio of its most obvious issues. First and foremost will be a replacement for the aging LaCrosse, a vehicle whose only bit of attention since its 2009 debut was a very light refresh in 2013. According to Automotive News, we should expect the next-generation LaCrosse to arrive late next year or early in 2016, as a 2016 model. AN expects big design changes, as Buick attempts to further the LaCrosse from its popular platform-mate, the Chevrolet Impala. The changes won't be so radical, though, as to do away with its front-drive architecture, as the latest version of the Epsilon platform will underpin the next LaCrosse. The 3.6-liter V6 is likely to carry on, although a smaller, budget-minded offering is also extremely likely (we'll eat our hat if it's not the 2.0-liter, turbocharged four-cylinder from the Regal, Verano and Cadillac CTS et al.). The other issue plaguing Buick's lineup is a lack of a midsize crossover. This is particularly damning for the brand as most of its showrooms are shared with GMC, which boasts its own midsizer in the form of the Terrain. With the upcoming Envision (see here for teasers), that problem should be addressed. Like the LaCrosse, the Envision will likely be a 2016 model. It will debut and launch in China early next year, while we can expect it to arrive stateside later next year, or even early in 2016. For American consumers, both a 2.5-liter four-cylinder and the aforementioned 2.0T could see action in the Envision. Finally, while Buick can boast a pair of vehicles available with manual transmissions, it's still far from what we'd call a brand for fun driving experiences. Of course, one way of solving that problem is with a two-door convertible. Yes, it's extremely likely that the Euro-market Opel Cascada convertible will be sold in the US early in 2016. Whether it keeps the Cascada name is unclear (all in favor of Skylark, say "aye"). Regardless, adding a reasonably priced, relaxed, two-door droptop to the Buick range to fill the space left by the not-so-dearly departed Chrysler 200 Convertible seems like a no brainer.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Why Buick's Encore wasn't a Chevy

Wed, 31 Oct 2012Buick is taking a gamble with its 2013 Encore. General Motors' near-luxury brand has enjoyed great success attracting conquest buyers to its larger Enclave crossover, but it has never offered something quite like this small CUV.

Very early signs suggest that the gamble might be working. According to Mark Reuss, President of General Motors, the automaker expected about 1,500 initial orders from its dealers for the Encore, but it's tracking closer to 9,000 units. Alluding to the fact that historically, Buick has shared similar products with GM's other brands, Reuss says that Buick dealers are "thrilled to have an exclusive." The automaker already markets almost identical models in other markets as the Opel/Vauxhall Mokka and Chevrolet Trax, but The General's other brands won't offer a twin to the new baby Buick.

The new Encore is based on the Gamma architecture that underpins the Chevrolet Sonic, and it shares the economy car's available turbocharged 1.4-liter four-cylinder engine. With standard front-wheel drive and available all-wheel drive, GM says its Encore will be pitted against competitors like the BMW X1 and Audi Q3, both of which are much more expensive but also much more powerful.