2014 Buick Lacrosse Base on 2040-cars

6000 S 36th St, Fort Smith, Arkansas, United States

Engine:2.4L I4 16V GDI DOHC Hybrid

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1G4GA5GR2EF178117

Stock Num: 14287

Make: Buick

Model: LaCrosse Base

Year: 2014

Exterior Color: Summit White

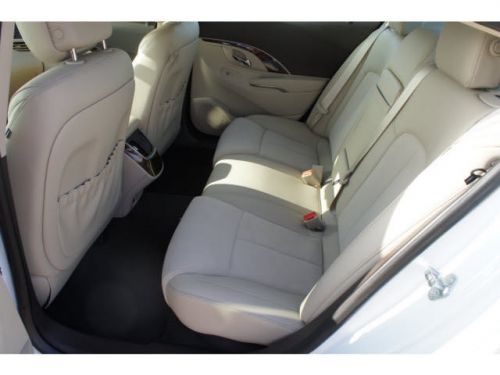

Interior Color: Light Neutral

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 11

Lots of options. Drive coast to coast without ever changing the radio station. You can hook your ipod up to this baby! No need to bring the garage door opener, you have one built in. Shopping with the VIP department gives you VIP Pricing! Haggle-free pricing means a pleasant experience for all of us. Call/text 877-565-5736 to speak with Jackie, Alyssa, James or Jon. We price low and fair, allowing us to focus on your needs. June Rebates: $1500 off Acadia and Enclave, $1000 off 14 Lacrosse and 14 Regal. Huge discounts on all trucks! 2015 Yukons and 2500's in stock.

Buick Lacrosse for Sale

2014 buick lacrosse base(US $33,000.00)

2014 buick lacrosse base(US $33,000.00) 2014 buick lacrosse leather group(US $35,875.00)

2014 buick lacrosse leather group(US $35,875.00) 2014 buick lacrosse leather group(US $37,330.00)

2014 buick lacrosse leather group(US $37,330.00) 2014 buick lacrosse leather group(US $38,300.00)

2014 buick lacrosse leather group(US $38,300.00) 2014 buick lacrosse leather group(US $38,795.00)

2014 buick lacrosse leather group(US $38,795.00) 2014 buick lacrosse leather group(US $38,895.00)

2014 buick lacrosse leather group(US $38,895.00)

Auto Services in Arkansas

Weber Automotive Repair ★★★★★

Riverdale Automotive Ltd ★★★★★

Pro Care Tire & Auto ★★★★★

Mustard Seed Mobile Auto Repair & Towing ★★★★★

Larry`s Mobile ★★★★★

Larry Hice Custom & Collision ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Opel to be shuttered in China, but will restart Buick production in Germany

Fri, 28 Mar 2014Opel, General Motors' troubled German brand continues its quest to reinvent itself and find solid profitability. In the course of that metamorphosis, the company has a bit of good news/bad news today. The good news is, it will once again begin screwing together Buick models for the American market. The bad news, though, is that it's being shut down in yet another country, China.

Let's start with the good news. The last vehicle Opel's Ruesselsheim factory built for the North American market was the early run of the then-new Regal, which is based heavily on the Opel Insignia. Production ran for just over two years, from 2009 to 2011, before moving production to Oshawa, Ontario.

Now, thanks to a 245-million-euro investment (just over $336 million), Opel will kick off production of a unspecified model for the US in the "second half of the decade," according to Automotive News. According to Opel, the new model will be announced before the end of 2014. You can begin your speculation about this new model down in Comments (we're wagering it'll be the Cascada convertible, sold here under the Buick umbrella).

Submit your questions for Autoblog Podcast #310 LIVE!

Mon, 26 Nov 2012We record Autoblog Podcast #310 tonight, and you can drop us your questions and comments regarding the rest of the week's news via our Q&A module below. Subscribe to the Autoblog Podcast in iTunes if you haven't already done so, and if you want to take it all in live, tune in to our UStream (audio only) channel at 10:00 PM Eastern tonight.

Discussion Topics for Autoblog Podcast Episode #310

Buick GN and GNX will return