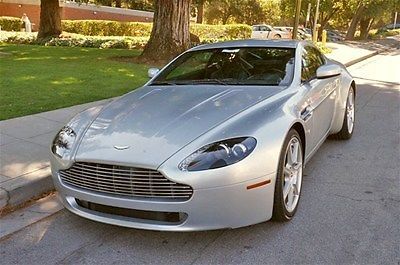

2008 Aston Martin Vantage *pearl White *1 Owner *pristi on 2040-cars

Costa Mesa, California, United States

Body Type:Coupe

Engine:4.3L 380.0hp

Vehicle Title:Clear

Year: 2008

Interior Color: Black

Make: Aston Martin

Model: Vantage

Warranty: Vehicle does NOT have an existing warranty

Mileage: 37,181

Sub Model: Vantage

Number of doors: 2

Exterior Color: White

Drivetrain: RWD

Aston Martin Vantage for Sale

2014 aston martin v8 vantage s/r coupe- # 1 of 1!!!!(US $169,350.00)

2014 aston martin v8 vantage s/r coupe- # 1 of 1!!!!(US $169,350.00) 2012 aston martin vantage,toro red/blk,serviced,clean(US $109,999.00)

2012 aston martin vantage,toro red/blk,serviced,clean(US $109,999.00) 2009 vantage,blk/blk,sport pkg,srvcd,newtires,newbrakes(US $78,888.00)

2009 vantage,blk/blk,sport pkg,srvcd,newtires,newbrakes(US $78,888.00) 2006 aston martin vantage,silver/blk,serviced new tires(US $56,000.00)

2006 aston martin vantage,silver/blk,serviced new tires(US $56,000.00) 2007 aston martin v8 vantage roadster, just serviced, loaded

2007 aston martin v8 vantage roadster, just serviced, loaded 2008 aston martin vantage v8 convertible w/ nav/ blk top/ iron ore red interior(US $65,991.00)

2008 aston martin vantage v8 convertible w/ nav/ blk top/ iron ore red interior(US $65,991.00)

Auto Services in California

Your Car Valet ★★★★★

Xpert Auto Repair ★★★★★

Woodcrest Auto Service ★★★★★

Witt Lincoln ★★★★★

Winton Autotech Inc. ★★★★★

Winchester Auto ★★★★★

Auto blog

Bond, junk bond? Aston Martin financial ratings go south as it awaits DBX

Sat, Sep 28 2019Ratings agencies Standard & Poor's and Moody's have taken a dim view of Aston Martin Lagonda. S&P cut its credit rating on the storied carmaker deeper into junk territory this week, and Moody's revised its credit outlook to "negative" after the company raised $150 million in debt from a bond issue at 12% interest, with the option to raise another $100 million at 15%. The Standard & Poor's rating was trimmed by one notch to 'CCC+', which reflects substantial risks and takes it close to default territory after a faster-than-expected cash burn this year. The outlook is negative. The negative outlook reflects ongoing pressure on profits, a high cash burn, and very high leverage in the face of heightened risks linked to a potential no-deal Brexit and new tariffs on car imports threatened by the United States. The potential salvation for the company is its new DBX luxury SUV, the success of which is critical to its ambitious growth strategy and ongoing creditworthiness, S&P said. But Moody's noted that it's burning cash at a high rate as it nears the launch of the DBX. The British carmaker, known as James Bond's favorite marque, has been hit by falling demand in Europe, the Middle East and Africa. It slumped to a first-half loss in July. Chief Executive Andy Palmer said concerns around Brexit and U.S.-China trade relations were skewing the outlook to the downside, so it was prudent to address investor concerns about its balance sheet. "Taking this debt on — short-term debt — is we think the correct tool to completely remove that thesis that we don't have sufficient liquidity," he told Reuters. "In every substantial and material way, this ensures that we can get through to DBX in spite of what all of those global uncertainties might throw at us." The main tranche comprises notes with an interest rate of 12% due in 2022, while the additional notes could be issued under the same terms if permitted, or could be issued as unsecured notes with an interest rate of 15%, Aston Martin said. Shares of stock in the company, which have had a precipitous fall since they listed in London in October 2018 at 19 pounds, were trading down 5% at 545 pence in early deals. Broker AJ Bell said Aston Martin was known for its high end prices and that situation now also applied to its debt. "These rates are very high and are a major red flag that investors consider the car company to be a high risk entity," it said.

Aston Martin working on mid-engine Valkyrie ‘brother’ to rival McLaren P1

Mon, Mar 12 2018We know about the Aston Martin Valkyrie and the Valkyrie AMR Pro (pictured). And we know Aston Martin is planning a mid-engine rival for the Ferrari 488 and McLaren 720S. Now Autocar reports that the English luxury maker is working on yet another mid-engine model, a hypercar to outdo the McLaren P1 and Ferrari LaFerrari and stand up to the coming McLaren BP23. The newest addition to the small carmaker's grand plans is said to be known internally as "brother of the Valkyrie," and came about because of the sellout success of both the Valkyrie and Valkyrie AMR Pro. Both "brother of Valkyrie" and the 488 competitor are expected to use a carbon monococque with aluminum subframes. Both will use lessons from Aston Martin's tie-up with the Red Bull Formula 1 team, especially in packaging. Both are due to hit the market around 2021. And both will be products of the carmaker's Performance Design and Engineering Centre, a base of 130 engineers set up at Red Bull F1's Milton Keyes headquarters. However, the former car will fight in the GBP1M-plus price bracket ($1.4M-plus) where various manufacturers have made amazing hay with warp-speed daily drivers, and will be a limited edition "in order to add to its desirability." We remain in the dark on powertrains for both cars, but outsiders expect both to use a V8. When it comes to the "brother" car, Aston Martin's working relationship with Mercedes-AMG means it could tap the 4.0-liter V8 used by the DB11 and the Vantage. Apparently that engine can be wrung out to 800 horsepower with help from an ultimate EQ Boost setup. That still wouldn't be enough to compete in the segment, though, so the "brother" could become a demonstrator for Aston Martin's electric know-how — a rolling showcase that could turn its halo light on a potential electric sports car. Or perhaps there's another option that turns to Cosworth, the company helping develop the 1,000-hp 6.5-liter V12 in the Valkyrie. Aston Martin boss Andy Palmer wouldn't say much more about the junior supercar powertrain than, "In our portfolio today, we don't have an engine capable of giving us the output we require.

Aston Martin plots more specific models for China, Middle East

Wed, Apr 1 2015Aston Martin is a thoroughly British automaker. Given its independence from any foreign automaker and its production that takes place entirely in the UK – particularly since Rapide assembly was moved back to Gaydon and the Toyota-based iQ was discontinued – you might argue that it's the most British automaker of them all. But like any other, it thrives on exports, and that only stands to increase with its latest announcement. With support from the British government, Aston Martin has revealed that it plans to develop new models specifically for export outside of the UK and continental Europe – especially for developing but wealthy markets in China and the Middle East. It wouldn't be the first time Aston would launch a new model targeted at a specific market, after all. When the company relaunched the Lagonda marque with the new Taraf luxury sedan late last year, it initially planned to make it available only in the Middle East. And by Middle East, we don't mean war-torn Yemen or Syria – we mean the oil-rich emirates of the Persian Gulf, like Bahrain, Qatar, Dubai and Abu Dhabi. Popular demand later prompted Aston to switch tracks, however, expanding availability to Europe and other markets. At this point, Aston isn't saying just what it has in mind for these lucrative markets, but the possibilities seem limited only by what local buyers would be interested in ponying up for. We could easily see the company offering a long-wheelbase Taraf limousine for China, a partial convertible sedan (like the Maybach Landaulet) for the Emirates or that long-rumored crossover that would be sure to attract buyers from both markets. ASTON MARTIN SET TO EXPAND MODEL RANGE FOR EXPORT MARKETS UK Government confirms support for new projects 29 March 2015, Gaydon: Aston Martin today confirmed it will widen its product offering for markets outside of Europe. Based on a conditional offer of an exceptional regional growth fund from the UK Government, Aston Martin will commence work this year on new models intended to broaden its customer reach in export markets such as China and the Middle East. The UK Government has committed support of up to the value of GBP6.9 million, conditional on investments in new products from Aston Martin. Commenting on this news, Aston Martin CEO, Dr Andy Palmer said: "Expanding our product range to enable a greater reach into export markets is an essential part of our Second Century business plan.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.03 s, 7940 u