2013 Volkswagen Tiguan on 2040-cars

21154 U.S. Hwy. 19 N, Clearwater, Florida, United States

Engine:2.0L I4 16V GDI DOHC Turbo

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): WVGBV3AX7DW593345

Stock Num: 5306915

Make: Volkswagen

Model: Tiguan

Year: 2013

Exterior Color: Gold

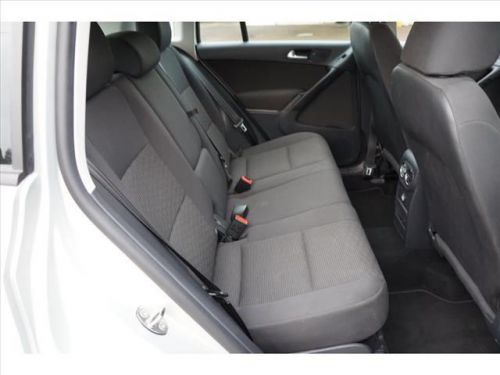

Interior Color: Black

Options: Drive Type: AWD

Number of Doors: 4 Doors

Mileage: 22571

Pricing and FinancingWe believe you shouldn't have to argue to get a fair price, which is why all of our prices are no-haggle. You'll get a great car at a great price, without all the stress and worry of traditional used-car sales. Hertz, buy from a brand you can trust. Thousands of vehicles already priced too low to haggle, often thousands below KBB. For your peace of mind, Hertz Certified vehicles come with a 12mo/12K mile Ltd warranty. Hertz offers a full range of financing solutions. Trade-ins are welcome. Become a Hertz Gold Member at no cost and earn FREE rentals with your purchase. Visit us at HertzCarSalesClearwater.com or call us at 877-516-5473

Volkswagen Tiguan for Sale

2009 volkswagen tiguan se(US $15,922.00)

2009 volkswagen tiguan se(US $15,922.00) 2014 volkswagen tiguan se(US $28,130.00)

2014 volkswagen tiguan se(US $28,130.00) 2011 volkswagen tiguan se(US $22,991.00)

2011 volkswagen tiguan se(US $22,991.00) 2014 volkswagen tiguan sel(US $36,085.00)

2014 volkswagen tiguan sel(US $36,085.00) 2012 volkswagen tiguan s(US $19,991.00)

2012 volkswagen tiguan s(US $19,991.00) 2014 volkswagen tiguan se(US $30,755.00)

2014 volkswagen tiguan se(US $30,755.00)

Auto Services in Florida

Zeigler Transmissions ★★★★★

Youngs Auto Rep Air ★★★★★

Wright Doug ★★★★★

Whitestone Auto Sales ★★★★★

Wales Garage Corp. ★★★★★

Valvoline Instant Oil Change ★★★★★

Auto blog

Next Volkswagen Golf R to get 286 horsepower?

Tue, 12 Feb 2013The seventh-generation Volkswagen Golf hasn't launched in the United States just yet, but we're already setting our sights on the range-topping R model. According to Autocar, the next Golf R will be more powerful than the current version, producing 268 horsepower and 280 pound-feet of torque, making it the most powerful production Golf ever.

Powering the new Golf R will be a further evolution of Volkswagen's well-liked 2.0-liter turbocharged inline-four, and when mated to a six-speed dual-clutch transmission, the hotter hatch will reportedly be able to sprint to 62 miles per hour in five seconds flat. That's over half a second quicker than the current US-spec model.

Other updates for the new Golf R include the addition of VW's Haldex 5 all-wheel-drive system found in the latest iteration of 4Motion. Furthermore, thanks to the use of lightweight materials, the new R is expected to weigh in around 2,650 pounds - that's a massive 675 pounds less than the current US-spec car. The exhaust has reportedly been reworked to provide more aural delight, as well.

Volkswagen Golf R wagon promises to be fast and functional [w/poll]

Tue, 25 Mar 2014Volkswagen's array of performance-oriented Golfs keeps getting bigger and bigger. What started with the GTI has since grown to include the diesel GTD, the hybrid GTE and the most powerful Golf R. But the additions haven't all come down to powertain. There's been cabrio versions of the GTI and Golf R as well, but before all is said and done, there will be one more bodystyle to join the lineup.

That, according to these latest spy shots, would be the Golf R Variant. For those unfamiliar, Variant is what Volkswagen calls the wagon version of the Golf (in some markets, anyway). It offers the Golf Variant with a variety of engines, but as the spy shots reveal, it is now working on bringing the Golf Variant and the Golf R together into one high-powered, long-roofed model.

The VW Golf R Variant would in all likelihood pack the same 2.0-liter turbo four as the hatchback, splitting 290 horsepower between all four wheels. Only in the wagon, it would offer that extra bit of utility. Of course there's no guarantee that Volkswagen would offer the Golf R Variant in the North American market, but considering that the Golf R hatchback will soon be joined in American showrooms by the Golf SpotWagen (as it's tipped to be called here) in place for the Jetta wagon, the possibility is definitely there.

Recharge Wrap-up: unofficial Tesla ad, VW will produce Budd-e

Fri, Jan 29 2016An unofficial Tesla commercial pays homage to the automaker's namesake. The video, which shows the Model S driving through a dusty, petroleum-addicted landscape reminiscent of a Mad Max film, features words from a speech by electricity-obsessed inventor Nikola Tesla. While Tesla (the man) talks about advancing technology into the future through electricity, the cars surroundings switch from the barren oil village to a green countryside dotted with wind turbines. See the video above, and read more at Treehugger. Famous rapper Akon is a Tesla fan who wants to power Africa with solar energy. Akon, who once boasted a collection of 28 exotic cars, traded them in for four Teslas, including a Model X. Also, his organization Akon Lighting Africa provides free solar electricity and lighting to communities that need it. Clean Technica talked to Akon about solar power, Tesla and EVs in a video. See the video and read more at Clean Technica, and get more perspective from Teslarati. The Volkswagen BUDD-e EV may be moving to production. The electric vehicle, built on the MEB modular platform with looks borrowed from the Microbus, made its debut as a concept vehicle at CES this year. Volkwagen's Dr. Volkmar Tanneberger tells Car magazine, "You will see a car that looks a lot like this, on the MEB platform, reach production. I can't say exactly when, but 2020 or thereabouts." He also says that the California camper van and Transporter van will continue production with internal combustion engines. Read more from Car. The 2017 Kia Soul EV will have more range. While it is scheduled for some minor updates, upping the electric Soul's driving range from its current EPA rating of 93 miles will hopefully attract more customers than a simple facelift. Autocar spied the next Soul EV testing in some heavy camouflage, but it offered no other details about the range beyond its reported expansion. Read more from Plugin Cars.