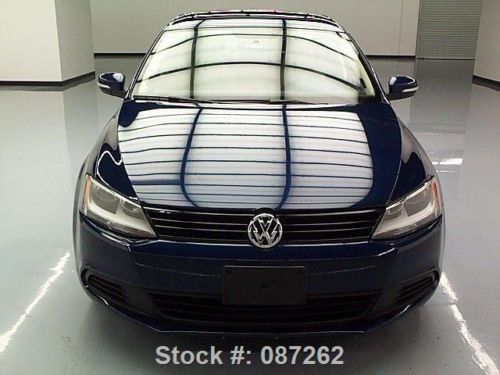

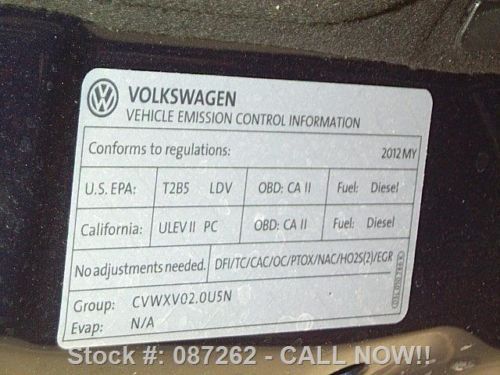

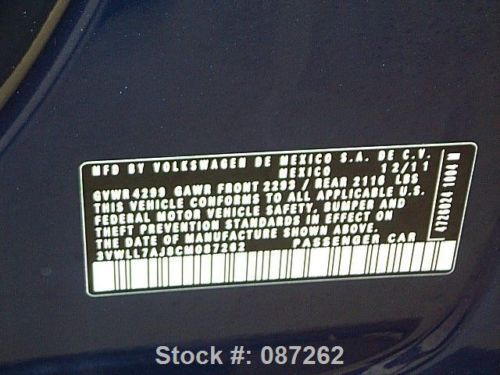

2012 Volkswagen Jetta Tdi Diesel Sunroof Htd Seats 40k Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Volkswagen Jetta for Sale

* * * 2003 volkswagen jetta gls wolfsburg edition sedan 4-door 1.8l(US $7,500.00)

* * * 2003 volkswagen jetta gls wolfsburg edition sedan 4-door 1.8l(US $7,500.00) 2011 jetta sedan se,2.5l,automatic,heated leather,b/t,16in whls,67k,we finance!!(US $13,900.00)

2011 jetta sedan se,2.5l,automatic,heated leather,b/t,16in whls,67k,we finance!!(US $13,900.00) 2011 vw jetta tdi wagon panoramic diesel 2.0l 45mpg bluetooth clean l@@k!! push

2011 vw jetta tdi wagon panoramic diesel 2.0l 45mpg bluetooth clean l@@k!! push 09 vw 2.0l turbo diesel mk5 automatic 40 mpg alloy 2.0 used cars knoxville tn(US $11,950.00)

09 vw 2.0l turbo diesel mk5 automatic 40 mpg alloy 2.0 used cars knoxville tn(US $11,950.00) 2013(13)jetta se silver/black fact w-ty only 16k miles keyless cruise save!!!(US $14,893.00)

2013(13)jetta se silver/black fact w-ty only 16k miles keyless cruise save!!!(US $14,893.00) 2011 volkswagen jetta tdi sedan(US $10,100.00)

2011 volkswagen jetta tdi sedan(US $10,100.00)

Auto Services in Texas

Yang`s Auto Repair ★★★★★

Wilson Mobile Mechanic Service ★★★★★

Wichita Falls Ford ★★★★★

WHO BUYS JUNK CARS IN TEXOMALAND ★★★★★

Wash Me Down Mobile Detailing ★★★★★

Vara Chevrolet ★★★★★

Auto blog

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.

Volkswagen profit jumps as it warns of a cooling auto market

Wed, Oct 30 2019FRANKFURT, Germany — Volkswagen says its profits jumped 44% in the third quarter thanks to a more profitable mix of vehicles in its lineup but warned that global car markets are slowing more than expected and lowered its forecast for annual sales. After-tax profit rose to $4.42 billion (3.98 billion euros) as revenues rose 11% to $68.27 billion (61.42 billion euros). The sales margin of 7.8% exceeded the goal of 6.5-7.5% as vehicles bringing higher profits took a larger share of sales. The Wolfsburg-based automaker pointed to the headwinds facing the industry by saying that it expects "vehicle markets will contract faster than previously anticipated in many regions of the world." It said sales would be "on a level" with last year's record of 10.8 million vehicles. Previously it had expected a slight increase. The company said its profits would be in the lower end of its forecast range. Global automakers are facing a slowdown in sales amid disputes over trade and from pressure in the European Union and China to develop and sell low-emission vehicles that require heavy investment in new technology. Ford and Renault have issued profit warnings in recent days, while Daimler, maker of Mercedes-Benz luxury cars, lost money in the second quarter and is expected to outline a cost-cutting strategy for investors on Nov. 14. Volkswagen is leading the push into electric vehicles in Europe by launching its ID.3 battery-powered compact car at prices it says will make zero local emission vehicles a mass phenomenon. The company was able to increase earnings in the quarter despite an 18% rise in spending on research and development.

Automakers suspend some business in Russia following invasion

Mon, Feb 28 2022These Russian GAZ Tigr infantry mobility vehicles were destroyed by Ukrainian fighters in Kharkiv on Monday. (Getty Images) Â Global auto and truck makers, including Sweden's Volvo Cars and Germany's Daimler Truck, on Monday suspended some business in Russia following that country's invasion of Ukraine. Russian forces invaded Ukraine last week, marking the biggest attack by one state against another in Europe since World War II. Many firms have idled operations in Russia following Western sanctions against Russia. Energy giant BP Plc, Russia's biggest foreign investor, abruptly announced over the weekend it was abandoning its 20% stake in state-controlled Rosneft at a cost of up to $25 billion. On Monday, Swedish automaker Volvo Cars said it would suspend car shipments to the Russian market until further notice, becoming the first international automaker to do so as sanctions over the invasion continue to bite. In a statement, the company said it had made the decision because of "potential risks associated with trading material with Russia, including the sanctions imposed by the EU and US." "Volvo Cars will not deliver any cars to the Russian market until further notice," it said. A Volvo spokesman said the carmaker exports vehicles to Russia from plants in Sweden, China and the United States. This came as Russia warned Sweden and Finland not to join NATO or risk facing “serious military-political consequences." Volvo sold around 9,000 cars in Russia in 2021, based on industry data. Earlier on Monday, RIA news agency reported Volkswagen had temporarily suspended deliveries of cars already in Russia to local dealerships, citing a company statement. VW had no immediate comment when contacted by Reuters. VW previously said it would halt production for a few days this week at two German factories after a delay in getting parts made in Ukraine. Daimler Truck said on Monday it would freeze its business activities in Russia with immediate effect, including its cooperation with Russian truck maker Kamaz. Mercedes-Benz Group is also looking into legal options to divest its 15% stake in Kamaz as quickly as possible, the Handelsblatt newspaper reported. A Mercedes spokesperson told Reuters business activities would have to be re-evaluated in light of the current events. Mercedes-Benz Group, formerly Daimler AG, was the parent company of Daimler Truck before the truck maker was spun off.